|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Whale inflows of Bitcoin (BTC) into Binance have declined to $2.99 billion

Jun 12, 2025 at 07:00 am

Whale inflows of Bitcoin to Binance have declined to $2.99 billion, the lowest since early 2023, as noted by CryptoQuant.

Despite reaching a 24-hour high above $111,000, Bitcoin (BTC) has slid back to $109,000 at the time of writing. This marks a 2% decline from the all-time high.

At the last two cycle tops, Binance saw 30-day whale inflows of $5.31 billion, $8.45 billion, and $7.24 billion, which were later followed by price corrections. However, data from CryptoQuant shows that these massive influxes have now dwindled.

Earlier this year, the world’s largest crypto exchange experienced an average monthly inflow of over $5 billion. But this figure has dropped to $2.99 billion, the lowest since early 2023.

This data point may indicate a decisive change in behavior, as huge outflows may be on the cards.

Moreover, despite Bitcoin trading above the $109,000 mark, recent netflows on CoinGlass show that outflows continue to dominate. A lack of huge accumulations, especially on Binance, suggests that whales are not selling, even at new highs.

Peaks of inflows of $7 billion to $8.5 billion seen at the top of previous cycles are not being repeated, and the current flow remains around $3 billion.

This continuing decrease in supply on exchange may decrease selling pressure in the short term, making the bullish case stronger as the price momentum develops.

Here’s more relevant analysis of the Bitcoin market:

Bull Flag Breakout Projects $144K Target

Bitcoin has completed a breakout, and the bull flag is a continuation pattern that tends to forecast powerful moves to the upside. The height of the flag, counted between the $105,000 rise and the recent breakout area, indicates a target at around $144,000.

Analysts, such as Merlijn The Trader, note that the breakout is still valid as long as BTC stays above the previous consolidation area at $98,000 to $102,000. The Fibonacci extension levels and historical momentum setups coincide with the price structure, giving more validity to the likelihood of a continuation of the rally. In the past seven days, BTC is up by 4%, but it has been met by resistance at the $111,000 level.

Derivatives Imbalance and Whale Strategy Back Rally

In the derivatives, liquidation data shows a massive imbalance in the upside. The risk is even higher on the side of short sellers, where more than 15.11 billion will be liquidated should Bitcoin rally by 10%. Conversely, a comparable drop would just cause long liquidations of $9.58 billion. This skew means that any price explosion may lead to a short squeeze, which will continue to make momentum.

Another factor that supports the bullish case is the decreased activity of Binance whales. These entities have historically dumped massive holdings at price tops. Exchange inflows went above $5.3 billion early in 2024. That figure has today dropped to $2.99 billion. Their decision to keep holding instead of selling at higher levels bodes well for more upside.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

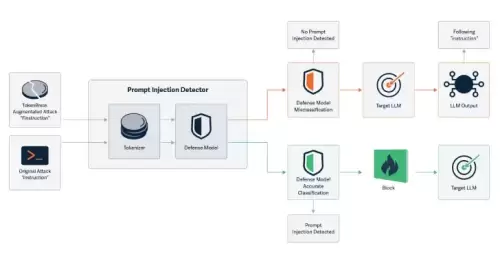

- By Changing a Single Character, Researchers Can Bypass LLMs Safety and Content Moderation Guardrails

- Jun 13, 2025 at 02:30 pm

- Cybersecurity researchers have discovered a novel attack technique called TokenBreak that can be used to bypass a large language model's (LLM) safety and content moderation guardrails

-

-

-

- As the digital asset market matures, participants increasingly look for both growth potential and practical solutions within new blockchain projects.

- Jun 13, 2025 at 02:25 pm

- The Sui blockchain distinguishes itself with its parallel execution architecture and focus on user-centric decentralized applications.

-

-

-

-

-