Toronto welcomes its first XRP ETF, marking a significant step for crypto investment in Canada and globally. Dive into the implications of this debut.

The financial landscape in Toronto is buzzing with the arrival of a groundbreaking development: the Purpose XRP ETF (TSX: XRPP). This marks Canada's first XRP spot ETF and the third globally, opening new doors for investors seeking exposure to XRP, the native token of the XRP Ledger.

Canada's First XRP Spot ETF Launches in Toronto

Purpose Investments officially launched the Purpose XRP ETF on June 18, following regulatory approval on June 16. This ETF provides direct spot exposure to XRP, a move praised by many crypto enthusiasts. It’s a significant leap forward, especially for Canadian investors eager to tap into the digital asset market through regulated and transparent channels.

What This Means for Investors

The Purpose XRP ETF is available in CAD-hedged (XRPP), CAD non-hedged (XRPP.B), and USD units (XRPP.U), offering flexibility based on currency preference and market strategy. This variety allows investors to tailor their investments to their specific needs.

Vlad Tasevski, Chief Innovation Officer at Purpose Investments, highlighted the demand for XRP ETFs, emphasizing XRP's design for fast, low-cost global payments. This ETF simplifies access to XRP, removing complexities associated with crypto custody and trading.

A Global Trend: Spot XRP ETFs

The Purpose XRP ETF joins similar offerings in Switzerland (21Shares XRP ETP) and Brazil (Hashdex’s ETF), signaling a growing global trend. These ETFs provide spot market exposure, reflecting increasing interest from asset managers to meet the demand for regulated altcoin investment vehicles.

The Bigger Picture: Crypto ETFs and Memecoins

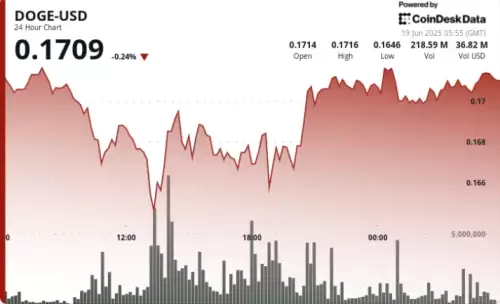

While the XRP ETF is making waves, the broader crypto ETF landscape is also evolving. There's even talk of active memecoin-focused ETFs on the horizon. Bloomberg ETF analyst Eric Balchunas suggests that an ETF actively trading memecoins could emerge by 2026. The success, or lack thereof, of Dogecoin ETF applications could be very telling.

Final Thoughts

The debut of the Purpose XRP ETF in Toronto is more than just a new investment product; it's a sign of the times. It reflects the increasing acceptance and integration of cryptocurrencies into traditional financial markets. As the crypto landscape continues to evolve, expect more innovative products to emerge, giving investors even more ways to participate in the digital economy. So, buckle up and enjoy the ride – the future of crypto investing looks bright, eh?

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.