SUI faces resistance while ETF possibilities loom. We break down the trends, potential breakouts, and what NYC traders are watching.

SUI's Resistance Test and ETF Bets: A NYC Perspective

SUI is currently navigating a challenging landscape, with its price struggling against key resistance levels while the potential for a spot ETF approval adds a layer of intrigue. Let's dive into what's happening with SUI, resistance levels, and the ETF buzz, all with a New York state of mind.

SUI Stuck Below Resistance

As of early July, SUI was trading around $2.74, having gained a bit of ground but still stuck in a downtrend since May. The token tested its falling trendline near $2.80–$3.00 but couldn't break through. Key moving averages, like the 20-day EMA ($2.84) and 50-day EMA ($3.03), are acting as barriers. The relative strength index (RSI) is below 50, suggesting that buyers haven't taken back control. In the meantime, big shots like Bitcoin and Ethereum haven't made any big moves to help SUI break through.

TVL Holding Steady

While the price is under pressure, SUI's total value locked (TVL) is holding relatively steady near $1.743 billion. This indicates real usage and interest in the SUI ecosystem. A big chunk of this TVL comes from stablecoins, providing liquidity for lending and trading. Daily chain fees and app revenue numbers also reflect this ongoing activity, showing that people are actively using the SUI network.

ETF Hopes on the Horizon

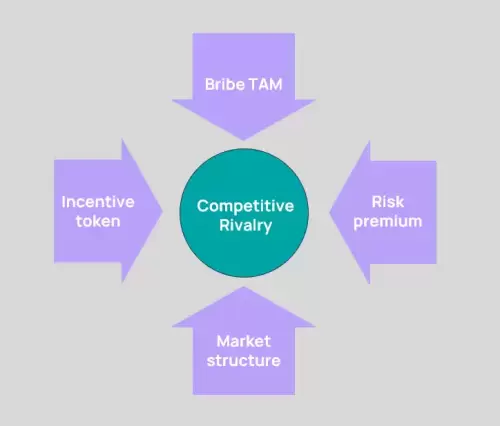

Looking ahead, a spot ETF could be a game-changer for SUI, injecting fresh liquidity into the market. Canary filed for a dedicated spot SUI ETF with a final SEC decision expected in late 2025. Analysts give it a decent chance of approval, given the current regulatory climate for commodity-like digital assets. Futures open interest for SUI shows steady trader participation, but nobody's making any major moves just yet. Traders are waiting for a clear breakout or breakdown before placing bigger bets.

The Big Picture

SUI is at a crossroads. It's facing resistance in the short term, but its underlying ecosystem is showing signs of life. The potential for a spot ETF adds a bullish narrative that could play out in the medium term. For New York traders, it's all about watching those resistance levels and keeping an eye on the ETF developments.

So, is SUI the next big thing? Maybe. Is it worth keeping an eye on? Absolutely. After all, in the fast-paced world of crypto, you never know what's just around the corner. Keep stacking sats and stay tuned!

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.