|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

The U.S. Securities and Exchange Commission (SEC) has begun to outline a new

Jun 12, 2025 at 03:30 am

The U.S. Securities and Exchange Commission (SEC) has begun to outline a new, more constructive

The U.S. Securities and Exchange Commission (SEC) is rolling out a new, more constructive regulatory direction for decentralized finance (DeFi), signaling a major policy shift toward greater alignment between crypto protocols and federal law.

At a recent SEC roundtable, Chair Paul Atkins highlighted DeFi’s compatibility with core American values, including freedom, property rights, and technological innovation.

These comments come amid broader structural changes at the SEC that include a reduced reliance on litigation and an increased focus on formal rulemaking to provide clarity to the industry.

A Departure from ‘Regulation-by-Enforcement’

The SEC’s approach to crypto oversight has shifted dramatically since the departure of former Chair Gary Gensler on January 20. Under Gensler, the Commission faced criticism for pursuing its regulatory objectives primarily through enforcement actions and costly litigation.

According to Atkins, that strategy is no longer the default. Speaking before a Senate Appropriations Subcommittee on June 3, Atkins stated that the SEC’s rulemaking will now follow a formal “notice and comment” process.

This procedural change is a core mandate of the SEC’s new Crypto Task Force, which was established on January 21 and is expected to issue its first formal report in the coming months.

What the SEC’s New Stance Means for the DeFi Market

Monday’s SEC roundtable marked a turning point in how regulators are characterizing DeFi platforms. Atkins described DeFi as a reflection of American economic values, signalling institutional openness to decentralized financial systems.

Despite the absence of a fully finalized regulatory framework, recent actions by the SEC suggest that developers and investors may soon operate with greater legal clarity.

For example, SEC staff recently provided guidance clarifying that several common staking mechanisms do not violate existing securities laws. Additionally, the Commission has dropped certain long-standing enforcement cases involving crypto firms, indicating a less adversarial stance toward the sector.

While comprehensive regulation is still in progress, the SEC’s expanding posture has sparked discussion of potential impacts on the market. As the agency continues to adjust its approach, investors and developers are anticipating changes that could create better compliance pathways and reduce legal uncertainty for DeFi protocols operating in the U.S.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

-

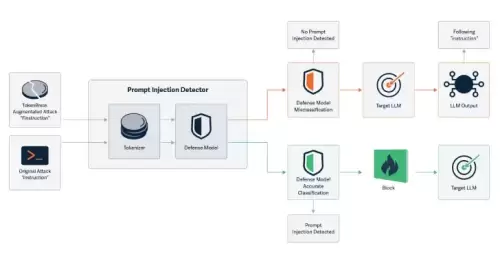

- By Changing a Single Character, Researchers Can Bypass LLMs Safety and Content Moderation Guardrails

- Jun 13, 2025 at 02:30 pm

- Cybersecurity researchers have discovered a novel attack technique called TokenBreak that can be used to bypass a large language model's (LLM) safety and content moderation guardrails

-