|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Navigating the Crypto Seas: Charting a Course Through Bull Runs and Bear Markets

Jun 23, 2025 at 03:23 pm

Is the crypto bull run over? Dive into the current bear market, analyze market trends, and discover potential investment strategies for navigating these turbulent times.

Navigating the Crypto Seas: Charting a Course Through Bull Runs and Bear Markets

The crypto market is at a pivotal point. After a period of highs, we're now facing a potential bear market. This article examines key factors influencing this shift and suggests strategies for investors.

The War Factor and Its Impact

Geopolitical tensions, particularly the conflict between Iran and Israel, have significantly impacted the crypto market. As missiles fly, crypto prices tend to crash. The initial price spikes were short-lived, followed by widespread liquidation as the conflict escalated. Prudent investors are hedging their bets amid these uncertainties.

Technical Indicators Pointing South

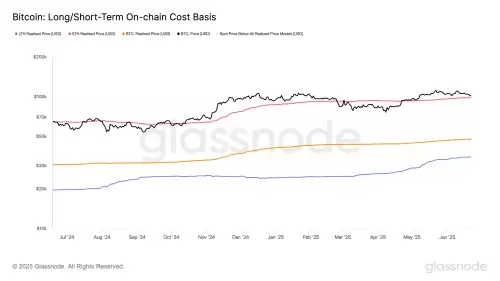

Technical analysis also suggests a bearish trend. Bitcoin's price chart recently showed a bearish shark harmonic pattern, which has historically proven accurate most of the time. A double top formation further confirms that the bull run might be over, potentially leading to new lows.

Institutional Investors and Market Dynamics

The rise of institutional investors is another critical factor. Some analysts believe that the increased involvement of large firms using leverage could lead to a market collapse, similar to the 2008 crisis. The performance of the S&P 500 also indicates that new interest rate cuts are needed to stimulate market flow.

Best Crypto to Buy Now in a Bear Market

Given the bearish conditions, investors should consider alternative assets available in presales. These assets often offer long-term perks, such as staking, and are less subject to market volatility. Here are a few options:

SUBBD

SUBBD is a platform centered around spicy content, offering AI tools for creators and fans. It features stable staking rewards for presale investors and aims to provide utility that can weather market downturns.

Bitcoin Hyper

Bitcoin Hyper focuses on L2 scaling solutions to add utility to the Bitcoin ecosystem. It could emerge as a strong Bitcoin alternative, especially if the market bottoms out, and offers staking perks for additional gains.

Snorter

Snorter is a Solana-based meme coin ecosystem featuring a trading bot designed to find and invest in emerging Solana meme coins. It offers protection tools and staking perks, making it a unique option during the bearish phase.

Pi Network: A Potential Reversal?

Amidst market hesitation, Pi Network has captured attention. Despite a recent drop, technical signals suggest a potential reversal. The PI token is at the heart of speculation about a possible rebound.

Technical Signals

The Pi Network price has recorded a sharp drop since May. However, technical signals suggest a possible reversal. On-chain indicators paint the picture of an asset in consolidation, potentially ready to rebound, but still dependent on the reaction of its market and community.

Key Events

Several events could give new momentum to Pi Network, including Pi Day 2 and the closing of auctions for .pi domains, which have seen unexpected success.

Final Thoughts: Staying Positive in a Bear Market

The crypto market is indeed struggling, but opportunities still exist. Focusing on alternative assets in presales and projects with strong utility could be a safer bet during these uncertain times. As the saying goes, "When life gives you lemons, make lemonade!" And in the crypto world, when the market turns bearish, find those hidden gems that can shine even in the dark.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.