Metaplanet aggressively expands its Bitcoin treasury, aiming for 210,000 BTC by 2027, while Sequans Communications joins the trend with a new Bitcoin treasury initiative.

Metaplanet's aggressive move into Bitcoin highlights a growing trend of companies viewing Bitcoin as a key treasury asset. Let's dive into the details.

Metaplanet's Ambitious Bitcoin Acquisition

Metaplanet, a Japanese firm, is making waves with its ambitious plan to build a massive Bitcoin treasury. Recently, the company's Board of Directors approved an additional $5 billion in capital allocation to its US subsidiary, aiming to acquire 30,000 BTC by the end of the year. Their ultimate goal? A whopping 210,000 Bitcoin by 2027, representing 1% of the total BTC supply. This move follows an earlier announcement of a $5.4 billion fundraising plan specifically for Bitcoin purchases. Metaplanet's strategy is part of its "555 Million Plan," first announced in June 2025, with the company aiming to become a global leader in Bitcoin treasury management.

Aggressive Expansion and Capital Allocation

Metaplanet's expansion includes strategic capital allocation across key jurisdictions. The company believes this approach will enhance treasury yield efficiency and reinforce its position at the forefront of Bitcoin-based capital market innovation. This strategy is not without risk, as evidenced by recent stock fluctuations. After the launch of its US subsidiary, the MTPLF share price initially rose but later faced selling pressure. However, institutional interest remains strong, with firms like Citigroup and Capital Group purchasing significant shares.

The Numbers Behind the Bitcoin Push

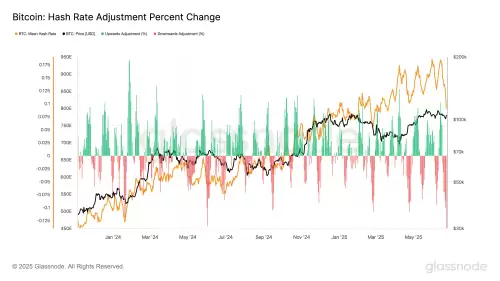

Recent reports indicate that Metaplanet acquired 1,111 Bitcoin for approximately ¥17.2 billion ($118.2 million), bringing their total holdings to 11,111 BTC. These acquisitions occurred even during periods of market volatility, demonstrating Metaplanet's commitment to its Bitcoin strategy. Their Bitcoin-to-equity yield has fluctuated, showcasing the dynamic nature of this investment.

Sequans Communications Joins the Fray

Adding another player to the mix, Sequans Communications, a France-based tech company, announced its own Bitcoin treasury initiative, backed by a $384 million private placement. Partnering with Swan Bitcoin, Sequans aims to build a Bitcoin position alongside its core IoT operations. CEO Georges Karam believes Bitcoin will enhance the company's financial resilience and deliver value to shareholders. This move aligns Sequans with a growing trend of companies leveraging Bitcoin as a treasury asset.

My Two Satoshis

While Metaplanet's aggressive approach and Sequans' strategic move highlight the growing corporate interest in Bitcoin, it's essential to remember that this is a relatively new trend. For example, the stock price of Metaplanet(MTPLF) has seen strong institutional backing by Citigroup and Capital Group purchasing 1 million and 2 million shares respectively, however, after a massive rally, there's been a pullback. As more companies explore Bitcoin treasury strategies, it will be interesting to see how these strategies evolve and impact the broader market.

Final Thoughts

So, are we witnessing the dawn of a new era in corporate finance? Only time will tell, but one thing is clear: the world of Bitcoin is full of surprises, and it's always good to keep an eye on the trends.