|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

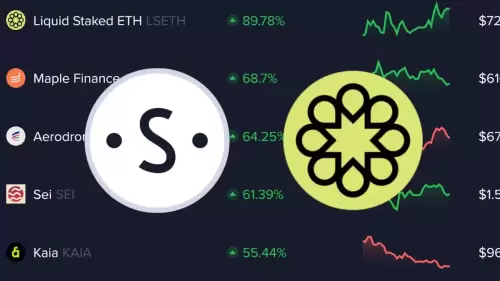

JUP token price surges 18% as Jupiter Exchange launches new lending product

May 27, 2025 at 05:16 pm

Jupiter's native token JUP experienced sharp price movements on Monday, initially jumping 18% before settling at 4% daily gains.

Jupiter's native token JUP experienced a sharp rise on Monday, adding 18% at one point before settling with 4% daily gains.

Among major altcoins, the move was among the day's top performers. The token also hit a new 2023 high of $0.62 during the session.

The sudden spike followed Jupiter's recent announcement of a new lending product set to launch this summer. Called Jupiter Lend, the platform promises loan-to-value ratios of up to 90%.

This is far higher than the 75% average offered by existing crypto lending platforms. The service will offer fees as low as 0.1%.

This presents a competitive advantage in the DeFi lending space, where lower fees attract more users.

"The most advanced money market on Solana. Coming Summer, 2025. Be early: https://jupiter.money/"

Announcing: Jupiter Lend. Powered by @0xfluid.

The most advanced money market on @Solana.

Coming Summer, 2025. Be early: https://t.co/VRD1DRcCSf pic.twitter.com/v6c8TM2Htv

— Jupiter (🐱, 🐐) (@JupiterExchange) May 22, 2025

The new lending service will offer loan-to-value ratios of up to 90%, far higher than the 75% average for existing crypto lending platforms.

Jupiter currently holds the position as the second-largest DEX aggregator in the crypto industry. The platform processes more than $1 billion in daily trading volume according to DeFiLlama data.

The protocol accounts for over a third of the DEX aggregator market share, with only 1inch surpassing Jupiter in this category.

Multiple Factors Drive Price Movement

Analyst Min Jung of Presto Research noted that the spike was less about any single catalyst and reflects converging developments driving bullish sentiment across the market.

The analyst pointed to the Huma Finance token sale where Jupiter staking is rewarded and signs of life returning to the meme coin space as contributing to the positive momentum.

Bitcoin's rally also played a crucial role in the broader market uplift. The leading cryptocurrency reached a new all-time high of $111,814 last week before pulling back to current levels around $109,003.

"We're seeing follow-through buying in altcoins as Bitcoin continues to push higher," said Kadan Stadelmann, CTO of Komodo Platform.

"As Bitcoin breaks out, the altcoin market is responding accordingly, with tokens like LINK, CHESS, and JUP showing strong gains."

Indeed, several mid-cap tokens have benefited from renewed risk appetite, with AVAL gaining over 60% this past week and CHESS surging over 150%.

Technical Analysis Points to Potential Upside

Technically, JUP is approaching its 200-day exponential moving average at around $0.67, which could confirm a bullish outlook for the token if breached.

Technical analysts suggest the most powerful buy signal would come from a golden cross formation, which occurs when the 21-day EMA crosses above the 200-day EMA.

This signal has mixed results, with one previous occurrence in 2021 resulting in short-term gains of 40.5%, which could push JUP toward $1 per token.

The daily price chart indicates JUP's bullish structure has held well during recent pullbacks, and momentum remains strong as the Relative Strength Index has crossed above its 14-day moving average.

However, shorter timeframes show potential resistance, with the hourly chart revealing strong selling pressure at the $0.62 area, where price has retreated multiple times in recent weeks.

Solana Ecosystem Growth Supports Fundamentals

Arjun Vijay, founder of Indian crypto exchange Giottus, highlighted Solana's total value locked nearly doubling since April.

TVL increased from $11 billion to $20 billion during this period, showcasing the growth in Solana's DeFi ecosystem.

This growth in Solana's DeFi ecosystem corresponds with a surge in Jupiter's trade volume, benefiting the platform directly.

Jupiter operates exclusively on the Solana blockchain, and expansion to multiple chains could potentially increase trading volumes and market share against competitors like 1inch.

DEX aggregators, like Jupiter and 1inch, collect price data from several exchanges to provide traders with optimal trading routes, guaranteeing access to the lowest possible prices for each transaction.

The project's positioning in Solana's DeFi stack continues to strengthen as the ecosystem grows, presenting a validation of Jupiter's market position rather than short-term speculation.

Announcing: Jupiter will be revealing a new milestone reached by its decentralized exchange within hours. For the latest updates and exclusive insights, subscribe to Benzinga's Benzinga Pro

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.