HBAR experiences volatile trading, hinting at a bearish reversal. Institutional sentiment shifts, and key price levels dictate its next move. Is a turnaround coming?

HBAR's Bearish Reversal and Volatile Trading: What's Next?

HBAR has been on a wild ride, marked by bearish reversals and volatile trading. Institutional sentiment is shifting, creating uncertainty. Is this a temporary dip or the start of a longer downturn? Let's dive in.

Institutional Sentiment and the HBAR Rollercoaster

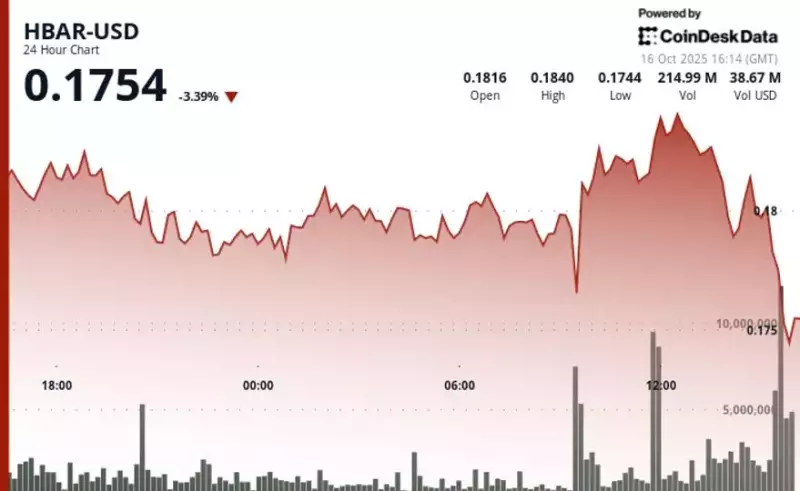

Recently, HBAR experienced a volatile 24-hour period, bouncing between $0.176 and $0.185. An initial dip driven by corporate profit-taking was followed by a strong rebound, with enterprise trading volumes surging. However, this momentum was short-lived, with a sharp reversal occurring as corporate sell pressure overwhelmed support zones. This highlights a potential shift in institutional sentiment toward enterprise blockchain assets. While HBAR found resilience around $0.176–$0.178, resistance at $0.183–$0.185 suggests growing caution among institutional investors.

Technical Indicators Point to a Potential Reversal

Despite the recent struggles, technical indicators offer a glimmer of hope. HBAR's price has been sliding for weeks, but a bullish divergence on the Relative Strength Index (RSI) suggests that sellers might be losing steam. The Chaikin Money Flow (CMF) also remains positive, indicating that money is still flowing into HBAR. However, traders should watch the $0.14 level on the CMF, as a drop below this could signal a drying up of funds.

The Critical $0.19 Level

For HBAR to confirm a bullish reversal, it needs to break above the $0.19 resistance level. This level has repeatedly stopped upward movement since October 11. A breakout above $0.19 would signal that buyers have absorbed the sell pressure and are ready to push higher. If successful, the next resistance zones appear near $0.23 and $0.25. However, if HBAR loses ground below $0.16, it could slide back towards $0.15, negating the bullish setup.

A Word on Memecoins and Market Sentiment

It's worth noting the broader market context, particularly the memecoin sector. While not directly related to HBAR, the volatility in memecoins like Pump.fun reflects the overall risk-on/risk-off sentiment in the crypto market. Factors like Federal Reserve policies and rate cut anticipation can significantly impact market fluctuations. This indirectly influences HBAR's trading dynamics as well, showing a possible correlation in trading behaviors across different crypto assets.

My Take: Proceed with Caution

While the technical indicators offer some hope for a reversal, the shifting institutional sentiment and the broader market volatility suggest caution. Breaking the $0.19 resistance is crucial, but it's not a guaranteed path to recovery. Keep a close eye on the CMF and be prepared for potential downside risks if HBAR fails to hold above $0.16.

Wrapping Up

So, is HBAR headed for a comeback, or is this just a blip on the radar? Only time will tell. But one thing's for sure: the crypto market never fails to keep us on our toes. Until next time, keep your eyes on those charts and your wits about you. Happy trading, y'all!

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.