Genius Group's innovative strategy to leverage lawsuit winnings for Bitcoin acquisition is making waves. Is this the future of corporate finance?

Genius Group, Bitcoin, and Lawsuit Wins: A New Era for EdTech?

Singapore-based Genius Group is turning heads with its bold plan: using potential lawsuit winnings to invest in Bitcoin. Is this the future of corporate finance? Let's dive in.

The Lawsuit Angle: Billions at Stake

Genius Group is currently embroiled in two major lawsuits, seeking over $1 billion in damages. One is a RICO (Racketeer Influenced and Corrupt Organizations Act) case against LZGI International, aiming for $750 million. The other targets naked short selling and spoofing, with estimated damages between $251.3 million and $262.7 million (potentially higher in 2024-2025).

Bitcoin Treasury Expansion: A Strategic Move

Here's where it gets interesting. If Genius Group wins these lawsuits, they plan to allocate 50% of the net proceeds as a special dividend to shareholders (around $7 per share). The other 50%? That's earmarked for acquiring Bitcoin, aiming for a whopping 5,000 BTC. At current market values, that's a serious commitment to crypto.

Why Bitcoin?

CEO Roger Hamilton emphasizes that these lawsuits are about recouping losses and benefiting shareholders. Investing in Bitcoin is seen as a way to both reward investors and strengthen the company's digital asset strategy. They've already been increasing their Bitcoin holdings, up over 50% as of mid-June, with a goal of holding 1,000 BTC in their corporate treasury.

A Trend in the Making?

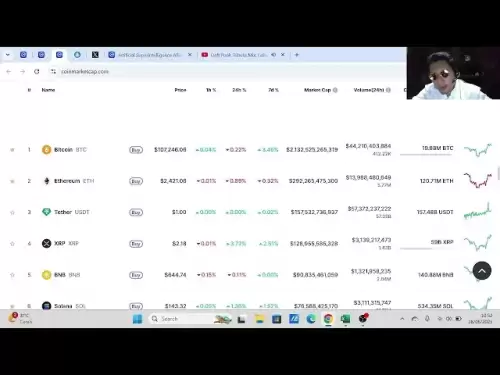

Genius Group isn't alone in exploring Bitcoin as a treasury instrument. Companies like MicroStrategy have paved the way, holding significant amounts of Bitcoin. But Genius Group's approach – using litigation proceeds for crypto investment – is a novel strategy for a NYSE-listed company.

My Take: Risky, But Potentially Rewarding

Look, there are no guarantees in lawsuits or crypto. Market fluctuations are real. However, Genius Group’s confidence in this strategy is noteworthy. Given their interest in AI and community-based education, this move seems aligned with a forward-thinking approach. Consider also that the United States Court of Appeals has removed a previous ban on crypto purchases which favors Genius Group. If they win, the returns could be substantial.

Broader Implications

The surge of whale activity and increased participation from mid-tier investors on exchanges like Binance suggests a growing interest in Bitcoin. This data reflects a broader shift in how BTC is being accumulated and moved, where influence is shared between whales and mid-sized investors.

The Bottom Line

Whether Genius Group wins its lawsuits and successfully builds its Bitcoin treasury remains to be seen. But one thing's for sure: they're shaking up the edtech world with a blend of legal savvy and digital asset ambition. Will other companies follow suit? Only time will tell. For now, let's grab some popcorn and watch this play out. It's gonna be a wild ride!

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.