|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

After Dipping to $74k Due to Economic Turmoil, Bitcoin Has Jumped 25%

May 02, 2025 at 05:29 pm

Bitcoin has jumped 25% since dipping to $74k due to economic turmoil, but that might just be the beginning.

Bitcoin (BTC) has seen a 25% surge following its dip to $74k amid economic turmoil. However, this might just be the beginning, according to Robert Breedlove, a renowned crypto expert.

He highlights three major signs that could indicate a huge breakout for Bitcoin is closely approaching.

Miners Are Reaching Their Limits

The first chart, created by Blockware, showcases the “Average Miner Cost of Production.” This chart tracks the average cost to mine 1 Bitcoin. Observing the pattern, it’s evident that Bitcoin’s price doesn’t remain below the cost of mining for extended periods.

Each time Bitcoin fell below this level before, it marked the lowest point prior to a substantial price increase. This occurrence has taken place six times before, most recently in September 2024, and now, it’s reappearing.

Long-Term Holders Are Accumulating More Bitcoin

Another crucial statistic reveals that long-term holders, defined as those who haven’t touched their BTC for at least 155 days, are accumulating more coins. Over the past 30 days, they have added around 150,000 Bitcoin to their holdings.

This statistic underscores a strong belief in Bitcoin’s future and implies that less supply is being sold. With fewer sellers and persistent demand, prices tend to rise.

More Money Is Entering the Market

Finally, perhaps the most potent signal is the increasing fiat liquidity, particularly U.S. dollars. As more dollars enter the financial system, there are greater funds available to purchase Bitcoin.

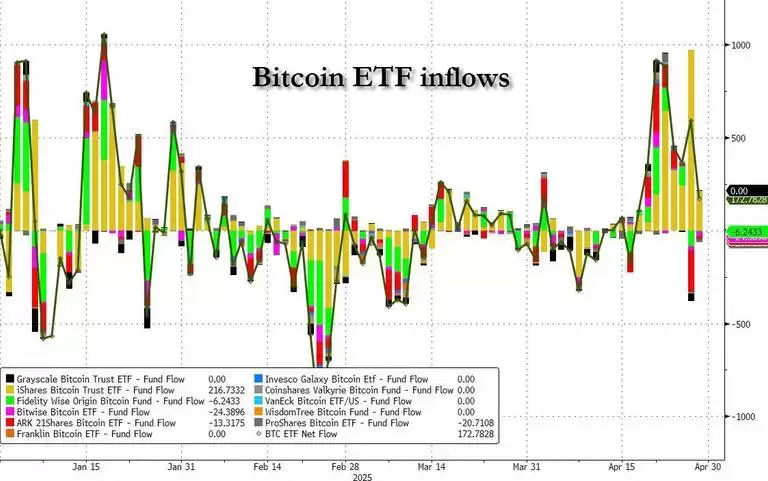

The introduction of ETFs, Bitcoin bonds, and major companies investing in BTC facilitates the influx of liquidity.

Although things appear calm on the surface, this quiet observation suggests that a larger Bitcoin rally could be closely approaching.

At present, Bitcoin is trading at $96,676, indicating a 1.5% increase observed over the past 24 hours, pushing the market cap to $1.92 trillion.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- Movement Labs Suspends Co-founder Rushi Manche Amidst Controversial MOVE Token Dump

- May 03, 2025 at 07:30 am

- Movement Labs made a significant decision to suspend its co-founder, Rushi Manche, following allegations that he was involved in the controversial dumping of MOVE tokens. This decision was made amid growing concerns about market manipulation and the resulting 27% drop in the price of MOVE.

-

-

- Ruvi AI (RUV) Continues to Hold Investor Attention, Trading Steadily Around $600 Despite Recent Market Volatility

- May 03, 2025 at 07:25 am

- RUV has shown resilience, rising above recent lows of $522.72 in April. However, the cryptocurrency remains stuck below $700, reflecting the struggle to achieve a significant breakout.

-

-

![Bitcoin [BTC] Surges Past $97,000, Reclaiming a Critical Level and Reinforcing Bullish Momentum Across the Market. Bitcoin [BTC] Surges Past $97,000, Reclaiming a Critical Level and Reinforcing Bullish Momentum Across the Market.](/assets/pc/images/moren/280_160.png)

-

- Ethereum's dominance among layer-1 (L1) blockchain networks has declined, resulting in an "open race"

- May 03, 2025 at 07:20 am

- Ethereum's relative dominance among layer-1 (L1) blockchain networks has declined, resulting in an "open race" to become the leading Web3 platform, according to Alex Svanevik, CEO of data service Nansen.

-

![Bitcoin [BTC] Surges Past $97,000, Reclaiming a Critical Level and Reinforcing Bullish Momentum Across the Market. Bitcoin [BTC] Surges Past $97,000, Reclaiming a Critical Level and Reinforcing Bullish Momentum Across the Market.](/uploads/2025/05/03/cryptocurrencies-news/articles/bitcoin-btc-surges-reclaiming-critical-level-reinforcing-bullish-momentum-market/middle_800_480.webp)