|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

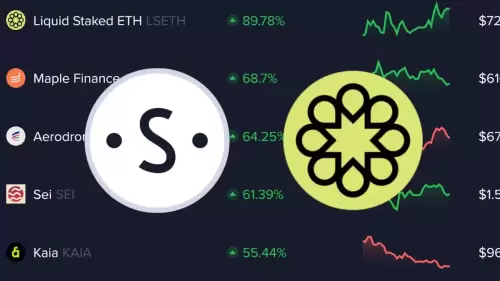

Interoperability between blockchain networks. Restaking. EVMs. Some major trends giving digital assets markets a lift in the new cycle

The crypto market has had a strong start to 2024, with several trends emerging that are shaping the altcoin landscape and contributing to the growth of digital assets.

One key vertical that has emerged in this new cycle is re-staking, which involves continuously staking the rewards earned from staking tokens, essentially compounding the returns over time. Several projects are implementing mechanisms that encourage users to restake their staking rewards, increasing their stake in the network and contributing to its security and stability. EigenLayer (EIGEN), EtherFi (ETHFI), and Renzo (REZ) are among the projects facilitating this practice.

Another notable trend is the increasing adoption of Layer2 scaling solutions such as Optimistic Rollups, zkRollups and side-chains by altcoins to improve transaction speeds and reduce fees. Some of the projects in this category that are attracting attention include Arbitrum (ARB), Optimism (OP), Polygon (MATIC), and Starknet (STRK). These projects aim to enhance user experience and attract more users to their platforms.

Interoperability between blockchain networks is also emerging as a significant trend, with projects collaborating and building bridges to enable asset transfers and communication across disparate blockchains. This trend aims to create a more interconnected and efficient blockchain ecosystem instead of many different siloed blockchains. Some of the projects facilitating this interoperability include Axelar (AXL), Across (ACX) and Stargate (STG).

With the rise of Layer 2 solutions and interoperability, modular blockchains represent the next phase of digital assets’ evolution. These blockchains are designed to be adaptable and customizable, offering a flexible framework where developers can plug-and-play modules such as consensus mechanisms, token standards and governance models. Some blockchains that are using this modularity to enhance scalability, interoperability and security include Celestia (TIA) and Dymension (DYM).

Finally, parallelized Ethereum Virtual Machines (EVMs) are breaking down smart contract execution into parallel tasks, harnessing the power of multiple nodes simultaneously. The most popular parallelized EVMs, such as Sei (SEI), Canto (CANTO), Nomad, and NeonEVM (NEON), are attempting to do this by processing transactions off-chain, then aggregating them back onto the Ethereum mainnet. This approach drastically improves transaction throughput and reduces latency, addressing Ethereum's historic limitations in these areas.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.