Despite US-Iran escalations, crypto investors show resilience. Bitcoin defies fear, mirroring traditional markets. Is panic selling a trap?

Crypto Investors Navigate US-Iran Tensions: Market Reaction and Resilience

In the ever-volatile world of crypto, geopolitical tensions often send ripples through the market. The recent escalations between the US and Iran are no exception, triggering widespread discussion about market stability and investor behavior.

Bitcoin's Unpredictable Resilience

Despite escalating tensions in the Middle East, the crypto market has once again shown its unpredictability and resilience. When the U.S. launched airstrikes on Iranian nuclear sites and Iran responded with missiles, global investors braced for the worst. But instead of spiraling downward, Bitcoin reversed course and rallied, nearing its all-time high.

This pattern isn't new. Similar to past geopolitical crises like the Russia-Ukraine war and the 2024 Israel-Palestine conflict, cryptocurrencies initially dipped on panic but quickly rebounded as institutional players stepped in. Analysts suggest this volatility often traps retail investors who sell early, only to see prices bounce back once the initial uncertainty fades.

Markets Follow Macro Signals

As tensions ease, traders are noticing Bitcoin's alignment with traditional markets. Analysts observe continued correlation with major U.S. stock indices like the S&P 500. This linkage is crucial; while war headlines trigger emotional reactions, the crypto market's deeper signals often come from inflation data, rate cut expectations, and equity performance—not just conflict zones. With U.S. stocks climbing and rate cuts on the horizon, liquidity is returning to risk markets, including crypto.

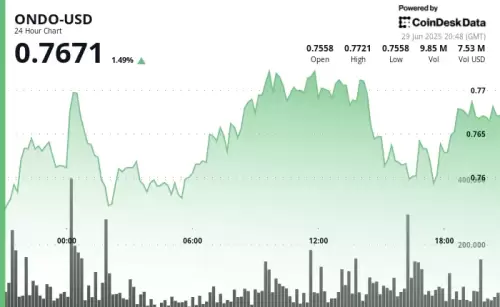

Alternative Cryptocurrencies Emerge

Amidst the geopolitical drama, some investors are exploring alternative cryptocurrencies like Neo Pepe Coin ($NEOP). These coins, built on transparency and community, offer a fresh narrative in uncertain times.

The Investor's Dilemma

In a space where sentiment shifts by the hour, the lesson remains clear: panic rarely pays. As whales accumulate in fear and unload in greed, the market tends to reward patience over emotion. Traders are once again faced with a familiar question—follow the headlines, or follow the price?

So, what's the takeaway? Don't let the headlines scare you into selling your crypto! Remember, patience is a virtue, especially in the wild west of crypto. And who knows, maybe this dip is just the perfect opportunity to snag some more Bitcoin before it hits that all-time high. Happy investing, folks!

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.