|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The technical summary data tells us to buy COIN near 240.56 with an upside target of 306.5. This data also tells us to set a stop loss @ 239.87

Technical Summary

Last Close: 249.0

Support 1: 240.56

Support 2: 250.19

Resistance 1: 260.12

Resistance 2: 251.4

Deviations: 0.65

Volume: 162,667

Real Time Updates Available: True

Coinbase Global Inc (NASDAQ:COIN) has been a hot topic in the investing world, and for good reason. The company is a leading player in the cryptocurrency space, and its stock has seen significant gains in recent months. However, with the stock now showing signs of fatigue, some investors may be wondering if it’s time to take some profits.

Coinbase Global Inc (NASDAQ:COIN) is a company that operates a cryptocurrency exchange platform. The company allows users to buy, sell, and trade various cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH). Coinbase also provides institutional investors with custody solutions for their digital assets.

Coinbase was founded in 2012 by Ben Armstrong, Brian Armstrong, and Jed McCaleb. The company is headquartered in San Francisco, California, and has offices in several other countries around the world.

Coinbase’s stock began trading publicly in April 2021, following a direct listing. The stock had a strong start, rising sharply from its listing price of $38. A year later, in April 2022, the stock hit a high of over $500 before trending lower throughout 2022.

Coinbase stock is now down over 80% from its all-time high, having been battered by the bear market in cryptocurrencies and broader macroeconomic headwinds. However, the technical summary data suggests that the stock could be due for a rebound.

Coinbase stock is currently testing the first level of support, which is at $240.56. If this level of support holds, then the next upside target is $306.5. To protect against excessive loss, we recommend setting a stop loss at $239.87.

If support breaks, then the next level of support is at $250.19. If support is broken, it is best to exit any long positions and wait for a new buy signal.

In the case of a short trade, the technical summary data suggests that COIN should be shorted as it gets near $306.5 with a downside target of $240.56. We should have a stop loss in place at $307.39.

The first level of resistance is at $251.4, and by rule, any test of resistance is a short signal. In this case, if resistance $251.4 is being tested, a short signal would exist.

If resistance breaks, then the next level of resistance is at $260.12. If resistance is broken, it is best to exit any short positions and wait for a new sell signal.

Longer Term Trading Plans for COIN

The technical summary data tells us to buy COIN near $240.56 with an upside target of $306.5. This data also tells us to set a stop loss at $239.87 to protect against excessive loss in case the stock begins to move against the trade. $240.56 is the first level of support below $250.19 , and by rule, any test of support is a buy signal. In this case, support $240.56 is being tested, a buy signal would exist.

The technical summary data is suggesting a short of COIN as it gets near $306.5 with a downside target of $240.56. We should have a stop loss in place at $307.39. 306.5 is the first level of resistance above 250.19, and by rule, any test of resistance is a short signal. In this case, if resistance, 306.5, is being tested a short signal would exist.

Swing Trading Plans for COIN

If 260.12 begins to break higher, the technical summary data tells us to buy COIN just slightly over 260.12, with an upside target of 306.5. The data also tells us to set a stop loss at 259.37 in case the stock turns against the trade. 260.12 is the first level of resistance above 250.19, and by rule, any break above resistance is a buy signal. In this case, 260.12, initial resistance, would be breaking higher,

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

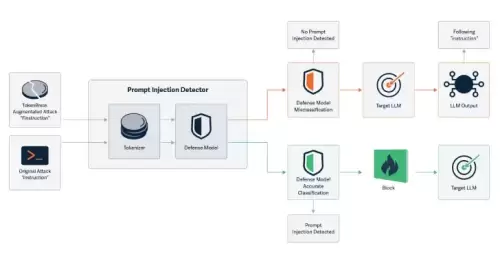

- By Changing a Single Character, Researchers Can Bypass LLMs Safety and Content Moderation Guardrails

- Jun 13, 2025 at 02:30 pm

- Cybersecurity researchers have discovered a novel attack technique called TokenBreak that can be used to bypass a large language model's (LLM) safety and content moderation guardrails

-

-

-

- As the digital asset market matures, participants increasingly look for both growth potential and practical solutions within new blockchain projects.

- Jun 13, 2025 at 02:25 pm

- The Sui blockchain distinguishes itself with its parallel execution architecture and focus on user-centric decentralized applications.

-

-

-

-

-