Cathie Wood's ARK Invest trims its Circle holdings as CRCL stock experiences a meteoric rise. Is this a strategic move or a sign of things to come? Let's dive in.

Cathie Wood's ARK Dumps Circle as CRCL Stock Skyrockets: What's the Deal?

Cathie Wood's ARK Invest is making headlines again, this time for strategically offloading Circle shares as the stablecoin leader's stock CRCL experiences a massive surge. Is this savvy portfolio management or something else entirely?

ARK's Circle Selling Spree

ARK Invest has been on a Circle (CRCL) selling spree, capitalizing on the stock's impressive climb since its public debut. CRCL stock has surged nearly 250% since its IPO. According to a Cointelegraph report, ARK dumped another 609,175 Circle shares on Friday alone, raking in a cool $146.2 million. This move came as Circle's shares jumped over 20%, closing at a whopping $240.30.

This isn't a one-off thing. In the past week, ARK has sold a total of 1.25 million CRCL shares, pocketing approximately $243 million. That's some serious cash!

Behind the Numbers

The sales were executed across three of ARK's key funds: the ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF). ARKK, the largest fund, accounted for the lion's share of the sales, offloading 490,549 CRCL shares. ARKW and ARKF followed suit, selling 75,018 and 43,608 shares, respectively.

Still a Major Player

Despite the selling frenzy, ARK remains a significant player in Circle. They're still the eighth-largest holder of CRCL, owning $750.4 million worth of shares. In fact, CRCL has become the top holding in the ARKW fund, representing a hefty 7.8% of the fund's portfolio. It seems like a strategic profit taking while remaining invested.

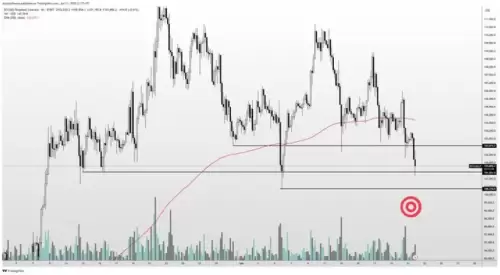

Market Context: Crypto Volatility

It's worth noting that this activity comes amid broader volatility in the crypto market. Recent price drops in Bitcoin and Ethereum have triggered significant liquidations. While Circle's business is not directly tied to the price action of other cryptocurrencies, the general market sentiment could be influencing investment decisions.

So, What's the Takeaway?

Cathie Wood's ARK Invest is known for its bold bets on disruptive technologies. The decision to trim its Circle holdings, even as the stock soars, suggests a strategic approach to portfolio management. ARK is likely rebalancing its portfolio and taking profits on a highly successful investment. While reducing their position, ARK still holds a substantial stake in Circle, signaling continued confidence in the company's long-term prospects.

As a thought, Wood might see the nearly 250% surge as overbought and due for a correction. Cashing out now, while maintaining a large position, hedges against potential future downturns, securing profits while not abandoning a promising investment.

Final Thoughts

The world of finance never sleeps, does it? One thing's for sure: Cathie Wood and ARK Invest are always worth watching. Their moves often provide valuable insights into the evolving landscape of innovation and investment. And who knows, maybe they'll buy back in later. Only time will tell!