|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin's Price Resistance: Understanding the Cohort Force at Play

Oct 20, 2025 at 07:34 pm

Bitcoin faces price resistance from existing holders taking profits, even amid positive market signals. Understanding this 'cohort force' is crucial for navigating Bitcoin's trends.

Bitcoin's Price Resistance: Understanding the Cohort Force at Play

Bitcoin's journey is never a straight shot to the moon. Right now, it's wrestling with price resistance, not from some shadowy manipulation, but from a good ol' cohort force: existing holders taking profits. Let's break down what's happening.

The Profit-Taking Pressure Cooker

Bitcoin recently bottomed around $103,500, an 18% dip from its October 6th high. Classic bull market behavior, you might say. But dig deeper, and you'll find existing Bitcoin holders are the primary source of sell-side pressure. Analyst Checkmate calls it a resistance stemming from “good old fashioned sellers.”

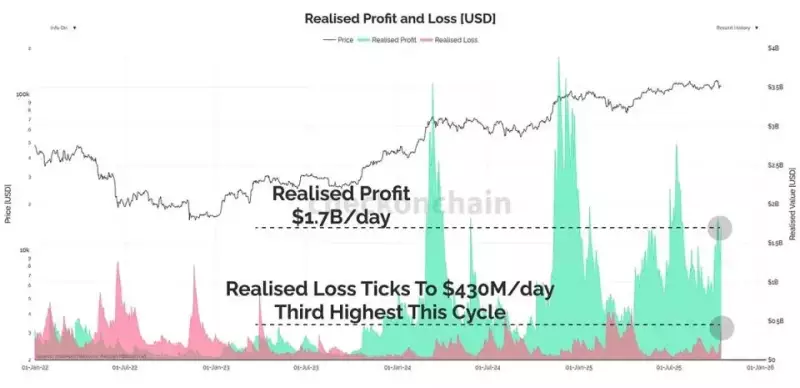

We're seeing revived supply, meaning coins dormant for a while are hitting the market. A whopping 47% of the selling pressure comes from coins held for six months to a year. Translation? Those who bought Bitcoin in late 2024, especially during that dip to $76,000, are cashing in.

The average age of spent coins is up, too, signaling older coins are changing hands. Realized profits are surging, showing people are locking in those gains. Even realized losses are up, hinting at some capitulation. Bottom line: profit-taking is the name of the game, and it's weighing on Bitcoin's price.

Geopolitical Winds: A Crypto Price Boost?

It's not all about internal dynamics, though. Remember when Trump announced a potential meeting with Xi Jinping? That news sent crypto markets soaring. A major whale even threw down $255 million in long positions on Bitcoin and Ethereum. Why? The market's sensitive to US-China relations; any hint of stability sends prices up.

Of course, this same whale also opened a $76.1 million Bitcoin short position, suggesting they anticipate volatility around the meeting. Crypto's a wild ride, folks.

BNB's Cautionary Tale

Look at BNB. It hit an all-time high, fueled by general bullish sentiment, but on-chain data revealed a decline in user activity. It was a warning sign. The price increase wasn't supported by new demand. This disconnect put BNB at risk of a pullback, and it serves as a reminder to look beyond just the price.

Navigating the Waves

So, what does this all mean? Bitcoin's facing headwinds from profit-taking. Geopolitical news can trigger short-term pumps, and on-chain data is key to assessing the sustainability of any rally. Keep an eye on who's selling, what's driving the market, and whether the fundamentals support the hype.

Understanding the cohort force – those holders deciding when to buy and sell – is crucial for navigating Bitcoin's ever-changing tides. Now go forth and trade wisely (and maybe take some profits along the way!).

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- Bitcoin Price Breakdown Looms as Institutions Pull Billions: BTC Faces Critical Juncture

- Jan 31, 2026 at 07:41 pm

- Institutional investors are pulling billions from Bitcoin ETFs, pushing BTC to critical support levels amidst a cautious market and macroeconomic pressures, hinting at a potential price breakdown.

-

-

-

- Big Apple Bets: Altcoins with a Gamified Edge and Jaw-Dropping ROI Potential Redefine the Crypto Playbook

- Jan 31, 2026 at 06:20 pm

- The crypto scene is buzzing. Smart money's now eyeing altcoins blending gamified engagement with serious ROI potential, signaling a fresh era for digital assets beyond the usual suspects.

-

-

![Ultra Paracosm by IlIRuLaSIlI [3 coin] | Easy demon | Geometry dash Ultra Paracosm by IlIRuLaSIlI [3 coin] | Easy demon | Geometry dash](/uploads/2026/01/31/cryptocurrencies-news/videos/origin_697d592372464_image_500_375.webp)