Bitcoin dips below $100K, but experts like Raoul Pal and Arthur Hayes remain optimistic, predicting a strong recovery driven by macroeconomic factors and potential money printing.

Bitcoin Price Drop: Experts Predict Rebound Amid Market Fears

Bitcoin recently took a tumble, dipping below $100,000, stirring up some jitters in the crypto world. Escalating geopolitical tensions, particularly concerns around Iran, played a role. But before you start selling your hodlings, here’s the lowdown: top experts are seeing this as a temporary dip, not a disaster.

Experts Stay Bullish Despite the Dip

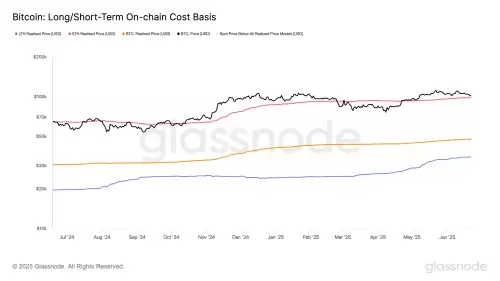

Despite the market's fearful sentiment, industry leaders like Raoul Pal (RealVision) and Arthur Hayes (ex-BitMEX) are keeping their cool. Pal points to Bitcoin's correlation with the global M2 money supply, suggesting this drop isn't out of the ordinary. Hayes anticipates central banks will soon fire up the money printers again, potentially sending Bitcoin soaring – maybe even to $1 million!

Even popular analyst TechDev sees potential for a rebound, saying "$95,000 would make sense structurally. Then $170,000 is closer than you think."

Retail Investors vs. The Experts

Interestingly, while experts are preaching patience and potential gains, retail investors are showing signs of fear. The Fear and Greed Index has dropped significantly, indicating a shift in sentiment. However, Santiment's analysis suggests Bitcoin often moves against retail sentiment. When everyone's panicking, Bitcoin tends to bounce back.

What's Driving the Optimism?

Several factors are fueling this expert optimism:

- Macroeconomic Factors: The potential for renewed money printing by central banks is a major driver.

- Technical Analysis: Some analysts see the current price levels as a temporary dip before a significant rebound.

- Historical Trends: Bitcoin has a history of recovering after periods of fear and uncertainty.

Potential Pitfalls

Of course, it's not all sunshine and roses. Geopolitical tensions remain unpredictable, and further escalations could impact the market. Additionally, some technical indicators suggest Bitcoin may be overbought, leading to a potential correction. The possibility of a decline to $92,000 is being discussed, which could trigger significant liquidations.

So, What Does It All Mean?

While the recent price drop may be unnerving, the consensus among many experts is that Bitcoin is poised for a recovery. The key is to stay informed, avoid panic selling, and consider the bigger picture.

Final Thoughts

In the crazy world of crypto, dips happen. It’s part of the rollercoaster ride. So, take a deep breath, maybe grab a cup of coffee, and remember: even Batman had a few bad days before he saved Gotham! And hey, who knows, maybe this is the perfect time to buy the dip. Just sayin'!