|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) has surged more than 10% over the past seven days and is currently trading in the low $90,000 range.

Apr 25, 2025 at 03:30 pm

Crypto analyst Titan of Crypto suggests that further gains may be on the horizon based on Fibonacci extension levels.

Crypto analyst Titan of Crypto has predicted that Bitcoin (BTC) could hit $135,109 by July-August 2025, if the flagship digital asset continues on its current bull market path. The analyst used Fibonacci extension levels to determine the potential price targets.

For the uninitiated, Fibonacci extension levels are technical analysis tools used to identify potential price targets during strong trends, projecting key Fibonacci ratios beyond a recent price swing. Traders use these levels to anticipate where an asset might find resistance or complete a move after a breakout.

As per the following weekly BTC chart shared by Titan of Crypto, a 100% Fibonacci extension from Bitcoin’s recent retest of the $76,000 support level projects its next major target near $135,109. The chart highlights similar price behavior from August 2024, when BTC surged nearly 100%, setting a new all-time high (ATH) around $73,000 by November 2024. If the current trend follows a similar trajectory, BTC might post a new ATH by July 2025.

Other crypto analysts have also predicted positive price action for the leading digital asset. For example, crypto analyst Jelle shared a chart showing BTC breaking through a downside deviation.

Jelle noted that BTC is giving bulls “exactly what they want to see.” Following the recent rally, BTC experienced a shallow pullback and appears poised to confirm a range-low reclaim before potentially pushing higher. The analyst added that BTC could next test resistance near $100,000.

BTC is giving mkfs exactly what they want to see. Shallow pullback after the rally, appears to be setting up a range-low reclaim. Could test the $100K handle next.

According to a CryptoQuant Quicktake post by Novaque Research, BTC outflows from Binance have risen significantly since April 19, which could be attributed to the ongoing surge in retail interest. The post adds:

“The exchange reserves have also decreased, indicating less short-term selling pressure and a retail-driven market. High-leverage longs were flushed out between $82K and $88K, indicating that weak hands had been eliminated. Large short positions remain susceptible above $92,000, creating the possibility of a short squeeze, which might act as the next step higher.”

Broader macroeconomic factors could also contribute to BTC’s upside. For instance, rising concerns over the US Federal Reserve’s autonomy may drive investors toward decentralized assets like Bitcoin.

At press time, BTC trades at $93,302, up 0.8% in the last 24 hours.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- As US President Donald Trump Announces a 90-day Tariff Delay, Cryptocurrencies Bitcoin (BTC), XRP, and Dogecoin (DOGE) Are Showing Signs of a Potential Breakout.

- Apr 26, 2025 at 12:20 am

- In addition to Trump's hint at pausing the 50% tariff on China, all eyes are on its potential impact on the broader crypto market.

-

- Top Business Tycoons Including Elon Musk Will Reportedly Attend the May 22 Dinner with President Donald Trump

- Apr 26, 2025 at 12:15 am

- Top business tycoons such as Elon Musk are reportedly going to attend the May 22 dinner in Washington, D.C. to meet President Donald Trump. Crypto industrialist Justin Sun is also a part of the VIP dinner list. By .

-

- Ethereum (ETH), Dogecoin (DOGE), and Mutuum Finance (MUTM) are all poised for huge rallies in 2025.

- Apr 26, 2025 at 12:15 am

- ETH is currently trading at $1,582, while DOGE is trading at $0.16. At a price of just $0.025, Mutuum Finance is fast making a name for its innovative DeFi approach and growing community.

-

-

-

-

-

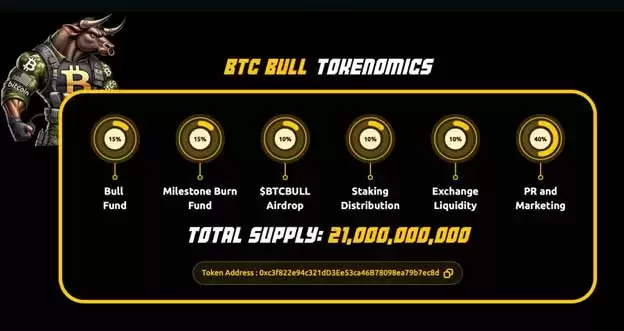

- A new Bitcoin-themed meme coin called BTC Bull Token ($BTCBULL) has just surpassed the $5 million raised milestone.

- Apr 26, 2025 at 12:05 am

- A new Bitcoin-themed meme coin called BTC Bull Token ($BTCBULL) has just surpassed the $5 million raised milestone. It's happening as echoes of institutional Bitcoin adoption send the altcoin market soaring.