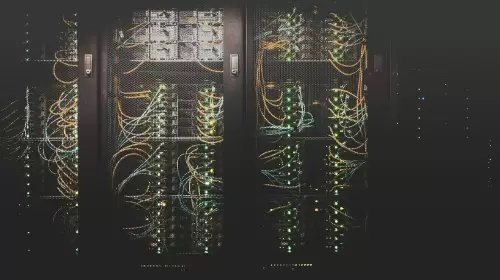

The Profit/Loss Ratio is a measure of how many people are in profit and how many people are in a loss in the Bitcoin investment.

Data from Glassnode shows that Bitcoin’s short-term holders are currently enjoying a profit dominance. The Profit/Loss Ratio for short-term holders has reached 1.2, indicating that a greater number of short-term Bitcoin holders are experiencing profits compared to those incurring losses. This marks a positive shift for Bitcoin’s short-term investors.

The Profit/Loss Ratio measures the proportion of investors who are experiencing profits and losses in their Bitcoin investment. A ratio above 1 signifies that a majority of investors are realizing profits. In recent times, this ratio has crossed 1 standard deviation above the 90-day moving average, indicating a shift in sentiment towards positivity. This positive sentiment may further suggest a continuation in the rise of Bitcoin price, as the majority of holders stand to gain from any future upside.

At present, Bitcoin is trading at $65,350, up by 4.60% over the last 24 hours. This recent surge in price has been particularly beneficial to investors who were concerned about Bitcoin’s price fluctuations. As more short-term holders move into profitability, the situation seems to be reflecting an improving confidence within the market.

The rising trend in Bitcoin price is also supported by a positive sentiment analysis of the cryptocurrency market. Many analysts have suggested that Bitcoin could continue to rise as institutional investors and demand for digital currencies increase. It has been noted that a higher percentage of investors in Bitcoin are focused on short-term gains compared to those who are invested for the long term.

However, it is crucial to remember that the crypto market is highly volatile. Price movements are not constant, and investors should continue to monitor other indicators, such as the Profit/Loss Ratio, to identify any future changes in trends.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.