|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin (BTC) May Be Heading to One of Its Highest Price Levels This Year Based on Data From Polymarket

May 14, 2025 at 05:36 am

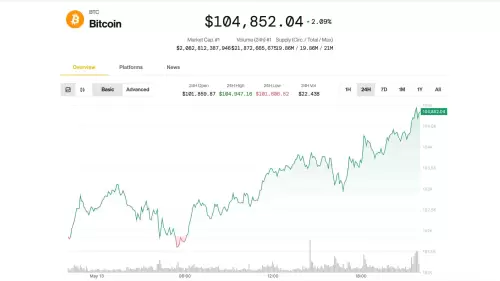

Bitcoin (BTC) may be heading for one of its highest price levels this year based on data from Polymarket, the popular prediction market.

Bitcoin (BTC) may be heading for one of its highest price levels this year, according to data from Polymarket, the popular prediction market.

As of Monday morning, Polymarket traders are placing a 63% chance that BTC will be trading at over $130,000 before this year comes to an end. The bulk of the BTC price momentum is due to rising institutional interest through spot Bitcoin ETFs.

The []).

According to the latest predictions, there's an 18% possibility for Bitcoin to reach $200,000 and an 11% chance for it to hit $250,000. Some more ambitious traders (about 3%) are betting that BTC price could cross $1 million before the end of the year.

The most likely outcome for the cryptocurrency, according to the market, is a price between $110,000 and $130,000. Bitcoin's future price is usually a hot discussion among crypto market players. Some believe that changes in crypto regulations and market volatility would prevent the coin's price from rising to expectations. However, there are others who are confident that the scarcity from halving events and greater adoption would lead to price increases.

It's important to note that prediction markets like Polymarket collect the wisdom of the crowd and generate probabilities for future events. Still, they aren't a guarantee and should be taken with a grain of salt.

Popular Bitcoin critic Peter Schiff is among those who don't buy into the hype, a U.Today report says.

In a related development, the cryptocurrency market experienced massive liquidations in the past hour, according to data from Coinglass. About $37.83 million worth of positions were forcibly closed across exchanges.

A breakdown shows that $22.93 million in short positions were liquidated, while it was $14.9 million for long positions.

The traders on the market lost a total of $37.83 million in the past hour, with those betting against the price tier to record the biggest losses.

The cryptocurrency traders on Polymarket are also placing bets on the price of BTC to no less than $130,000 by the end of the year.

As of Monday morning, the market is showing a 63% chance that BTC will be trading at over $130,000. The bulk of the BTC price momentum is due to rising interest from institutions through spot Bitcoin ETFs.

The new optimism in the market comes after the U.S. Securities and Exchange Commission (SEC) finally approved the first-ever spot Bitcoin ETFs from institutions like Invesco and BlackRock earlier this year.

The news sparked a rally in the BTC price, which is now up over 60% since the beginning of 2024.

The Polymarket forecast also shows that there's a 18% possibility for Bitcoin to reach $200,000 and an 11% chance for it to hit $250,000. Some more ambitious traders (about 3%) are betting that BTC price could cross $1 million before the end of the year.

The most likely outcome for the cryptocurrency, according to the market, is a price between $110,000 and $130,000. Bitcoin's future price is usually a hot discussion among crypto market players. Some believe that changes in crypto regulations and market volatility would prevent the coin's price from rising to expectations.

However, there are others who are confident that the scarcity from halving events and greater adoption would lead to price increases. It's also worth noting that prediction markets like Polymarket collect the wisdom of the crowd and generate probabilities for future events. They aren't a guarantee and should be taken with a grain of salt.

The cryptocurrency market has seen massive liquidations in the past hour, according to data from Coinglass. About $37.83 million worth of positions were forcibly closed across exchanges.

A breakdown shows that $22.93 million in short positions were liquidated, while it was $14.9 million for long positions.

The traders on the market lost a total of $37.83 million in the past hour, with those betting against the price tier to record the biggest losses.

It was also the most affected cryptocurrency, with Bitcoin and Solana following at $5.29 million and $1.88 million, respectively.

A single massive liquidation of $12.20 million stood out, making it the largest in recent history.

It occured on Binance for an unknown token called "998" on the BNB Smart Chain, with a value of $11.99. Only one trader was liquidated in the period, and the total loss was $12.20

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- Ruvi (RUV) Could Easily Outshine Avalanche (AVAX) as the Next Big Thing in Crypto

- May 14, 2025 at 11:40 am

- Disclaimer: The below article is sponsored, and the views in it do not represent those of ZyCrypto. Readers should conduct independent research before taking any actions related to the project mentioned in this piece. This article should not be regarded as investment advice.

-

-

-

-