Bitcoin hits a new ATH, sparking rally predictions! Will it sustain momentum amid company interest, trade talks, and potential Fed rate cuts?

Bitcoin Blasts Past $112,000: Will the ATH Rally Prediction Hold?

Bitcoin is making headlines again, surging to a new all-time high (ATH) of $112,022! The big question now is: can this rally continue, and will predictions of even higher prices come to fruition?

New Highs and Market Dynamics

On Wednesday afternoon, Bitcoin (BTC) broke free from its consolidation phase, hitting that impressive $112,022 mark. This surge is seen by some as a retest of the previous ATH from May 22nd. According to John Glover, the chief investment officer at Ledn, this level faced selling pressure. Interestingly, companies like Trump Media & Technology Group and GameStop are showing interest in buying Bitcoin, which could further impact the market. The popularity of Bitcoin among publicly traded companies appears to be growing, which could significantly impact market dynamics.

Factors Influencing the Rally

The sustainability of this rally depends on a few key factors. Macroeconomic conditions and trade negotiations are critical. Any setbacks in trade talks before President Trump's deadline could challenge Bitcoin's price. On the flip side, positive progress in trade and easing inflation might lead the Federal Reserve to cut interest rates, potentially boosting Bitcoin's upward trajectory. As Coinpedia reported, regulatory clarity has also played a role in the rally.

Expert Predictions: $120,000 - $130,000 Target?

Market expert Doctor Profit is super bullish, declaring, "THE PARTY IS NOT OVER YET!" He predicts a potential new ATH soon, targeting a range of $120,000 to $130,000 for this cycle. He outlines two scenarios: a slight correction after hitting $113,000-$114,000, followed by a rebound, or a straight shot through that resistance level. The reaction around that $113,000-$114,000 range will be crucial in determining the speed and direction of Bitcoin's next move.

Altcoin Market Follows Suit

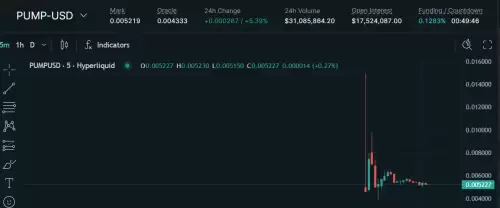

The recent Bitcoin rally has also impacted the wider altcoin market, with Ethereum (ETH), XRP, and Solana (SOL) seeing positive movement. The surge led to significant liquidations of short traders, increasing the chances of a short squeeze, which could further fuel bullish sentiment. Some analysts, like James Seyffart from Bloomberg, even suggest that altseason 2025 might have begun with this BTC price pump.

Mobile Mining Accessibility

Interestingly, access to Bitcoin is becoming even easier. MiningToken, a Swiss blockchain company, has launched a mobile crypto mining app for both Android and iOS. Now, anyone can mine Bitcoin, Litecoin, and Dogecoin directly from their smartphones, receiving stablecoin payouts. No technical experience or expensive hardware is needed!

Final Thoughts: Will Bitcoin Keep Climbing?

So, what's the verdict? Bitcoin's recent ATH is exciting, and expert predictions suggest even higher prices are possible. The key will be watching macroeconomic factors, trade negotiations, and how the market reacts to critical price levels. But hey, even if you're not a trading guru, you can now mine Bitcoin from your phone! It's like the future is now, right? Just remember, crypto involves risk, so do your homework before diving in.