Explore the evolving landscape of Bitcoin adoption, portfolio allocation strategies, and the crucial role of financial advisors in navigating the crypto world.

Bitcoin Adoption, Portfolio Allocation, and Financial Advisors: A New Era

The dynamics surrounding Bitcoin adoption, portfolio allocation, and the role of financial advisors are rapidly changing. Investors increasingly seek guidance in the crypto space, highlighting the need for advisors to adapt and offer informed support.

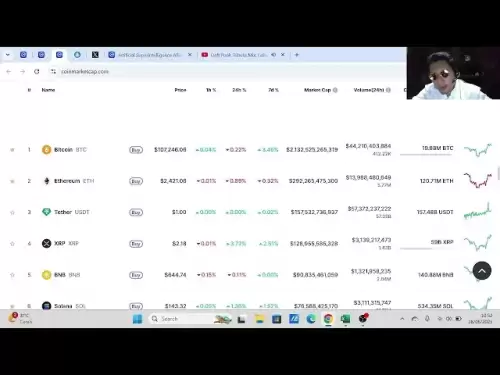

The Shifting Sands of Bitcoin Adoption

Initially dismissed by traditional investors, Bitcoin has gradually gained acceptance, spurred by endorsements from prominent figures like Paul Tudor Jones III and Kevin O'Leary. Early recommendations suggested a conservative allocation of around 1-5% to Bitcoin. However, this has drastically changed.

A Bold Recommendation: Up to 40% in Bitcoin

Ric Edelman, head of the Digital Assets Council of Financial Advisors, now suggests a staggering 40% allocation to Bitcoin. This monumental shift reflects Bitcoin's growing global status and the evolving regulatory landscape. Countries are now exploring Bitcoin as a reserve asset, signaling a significant change in perception.

The Outdated 60/40 Rule

The traditional 60/40 portfolio allocation (60% stocks, 40% bonds) may no longer suffice in today's market. Edelman argues for greater risk exposure and a higher allocation to stocks, particularly for younger investors. He suggests diversifying with crypto, especially Bitcoin, to enhance modern portfolio theory statistics, citing the potential for higher returns compared to other asset classes.

Financial Advisors: Bridging the Crypto Knowledge Gap

A recent CoinShares survey reveals that 88% of crypto investors already work with financial advisors. However, a significant disconnect exists between investors' desire for crypto guidance and their advisors' perceived expertise. Investors are becoming more self-educated but still seek trusted partners who understand the crypto space.

Crypto as a Core Component of Wealth Strategy

The CoinShares study indicates that 89% of current crypto holders plan to increase their crypto exposure in 2025, with over half actively trading or monitoring crypto daily. This suggests that digital assets are transitioning from speculative investments to core portfolio components. Advisors who commit to understanding crypto have a significant opportunity to differentiate themselves.

The Bottom Line

The convergence of Bitcoin adoption, strategic portfolio allocation, and informed financial advisors is reshaping the investment landscape. As Bitcoin matures and regulatory frameworks evolve, financial advisors must embrace crypto fluency to effectively guide their clients. So, buckle up, folks! The future of finance is here, and it's looking decidedly crypto-flavored.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.