|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Binance BNB Chain’s stablecoin reserves expanded sharply this week

May 01, 2025 at 05:55 pm

Binance BNB Chain’s stablecoin reserves expanded sharply this week, adding more than $2 billion in value following the debut of USD1, a politically branded dollar token issued by World Liberty Financial.

DefiLlama data shows that the chain’s stablecoin market capitalization surged 30% over the past seven days to reach $9.26 billion. That gain narrowed the gap between BSC and Solana to just $3.8 billion, marking the closest distance between the networks since memecoins propelled Solana ahead.

USD1’s introduction on BSC coincided with its positioning as an institutional-grade stablecoin backed by U.S. Treasury bills and safeguarded by BitGo. Its launch comes at a time when stablecoins broadly have been regaining momentum. The sector’s total market capitalization rose 2.5% this week to $240.47 billion, indicating renewed on-chain activity despite ongoing regulatory headwinds.

The sharp expansion in BSC’s stablecoin supply may alter the competitive landscape among layer-1 blockchains. While Ethereum continues to dominate with more than $124 billion in stablecoin assets, amounting to 52% market share, and Tron retains a commanding 29% share at $71 billion, BSC’s increase to 3.8% brings it within reach of Solana’s 5% share.

There is now a chance of BSC overtaking Solana in stablecoin volume amid the Solana memecoin collapse, which could redirect liquidity flows and developer attention across decentralized finance platforms.

USD1’s growth on BSC reflects both strategic and political dimensions. The token, promoted as fully audited and compliant, carries the association of former U.S. President Donald Trump through its issuer, World Liberty Financial.

This link introduces new regulatory and reputational considerations not typically associated with other dollar-backed assets. BitGo’s involvement as custodian, combined with the stablecoin’s fiat and T-bill backing, positions USD1 as a direct challenger to entrenched competitors such as USDT and USDC.

Momentum around USD1 accelerated further as Eric Trump announced the stablecoin will be used to settle MGX’s $2 billion investment in Binance. He described the move as a major step toward creating a transparent, regulated, and borderless digital dollar, adding new weight to USD1’s institutional ambitions and potential role in large-scale capital flows.

USD1 is currently placed 7th by market cap among all stablecoins, beating out PayPal PYUSD, FDUSD, and Ethena USDTB.

While the on-chain expansion signals interest, liquidity remains thin. Major exchanges have not listed USD1; full audit details, including smart contract assessments and reserve attestations, have not been disclosed publicly. Incentive programs driving early adoption may also be temporary, raising questions about the sustainability of the current momentum.

World Liberty Financial’s Zach Witkoff framed USD1 as an enabler for “sovereign investors and major institutions” to conduct secure cross-border settlements. Others expressed skepticism. Kevin Lehtiniitty of Borderless.xyz remarked that launching a stablecoin is relatively straightforward, but fostering widespread adoption presents a more complicated challenge.

Despite this, the debut has already had a significant impact on stablecoin trends on BSC. If USD1's liquidity deepens and audit transparency improves, BSC's proximity to Solana could foreshadow a reshuffling of the layer-1 hierarchy. For now, the influx of capital marks the most substantial weekly jump in BSC's stablecoin market since early 2023.

Liam 'Akiba' Wright

Also known as "Akiba," Liam Wright is a reporter, podcast producer, and Editor-in-Chief at CryptoSlate. He believes that decentralized technology has the potential to make widespread positive change.

News Desk

CryptoSlate is a comprehensive and contextualized source for crypto news, insights, and data. Focusing on Bitcoin, macro, DeFi and AI.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

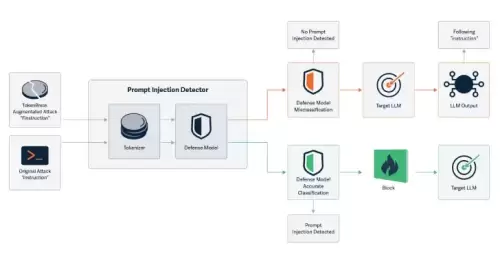

- By Changing a Single Character, Researchers Can Bypass LLMs Safety and Content Moderation Guardrails

- Jun 13, 2025 at 02:30 pm

- Cybersecurity researchers have discovered a novel attack technique called TokenBreak that can be used to bypass a large language model's (LLM) safety and content moderation guardrails

-

-

-

- As the digital asset market matures, participants increasingly look for both growth potential and practical solutions within new blockchain projects.

- Jun 13, 2025 at 02:25 pm

- The Sui blockchain distinguishes itself with its parallel execution architecture and focus on user-centric decentralized applications.

-

-

-

-

-