|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Base's On-Chain Narrative: A BitMart Research Deep Dive

Jul 02, 2025 at 07:10 am

BitMart Research analyzes Base's explosive growth, evolving narratives, and institutional alignment, highlighting its role in bridging traditional finance and Web3.

Yo, crypto fam! Base is buzzin' with activity, transforming from a speculative playground into a serious on-chain contender. BitMart Research is droppin' knowledge on this ecosystem's explosive growth, so let's dive into the deets.

Base's Meteoric Rise

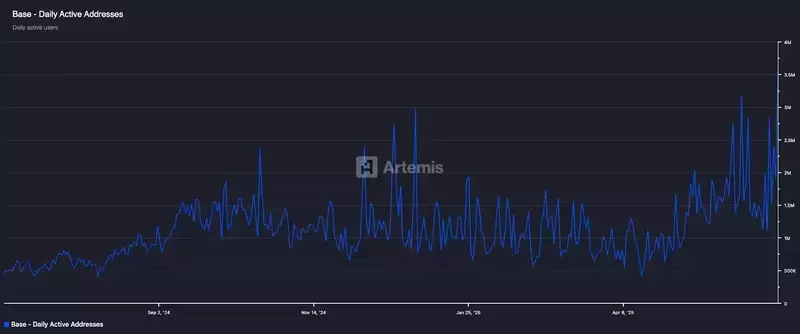

Since May 2025, Base has exploded, hitting record highs in daily active addresses (3.6 million!), TVL (nearly $4 billion), and on-chain transactions (averaging 9 million daily). What's fuelin' this rocket ship? Multiple trending narratives are capturin' mad attention.

The recent Circle IPO injected major optimism into the stablecoin scene, makin' Base look real attractive to traditional institutions. Regulatory tailwinds are helpin' too.

Trending Projects: Virtual and Kaito

Virtual is shakin' things up with its innovative token launch mechanism. It allows users to participate at super low entry prices. But, to curb early sell-offs, they introduced a "Green Lock" mechanism. It might've cooled market sentiment temporarily, but it's all about long-term stability, ya know?

Kaito is leadin' the "Information Finance" (InfoFi) charge. Its Yaps module rewards content creators on X (formerly Twitter), buildin' a Web3-native content-driven influence model. Community engagement is through the roof, drivin' social and narrative-driven content on Base.

Coinbase's Grand Strategy

Coinbase is all-in on Base, with a three-pronged strategy:

- Regulated On-Chain Asset Access: Bridging Coinbase balances to Base with the Verified Pools feature.

- Compliant Stablecoin Ecosystem: Partnering with Wall Street giants like JPMorgan Chase to pilot compliant stablecoins and deposit tokens. This is about digitizing traditional finance infrastructure.

- Diverse On-Chain Ecosystem: Expanding Base with on-chain U.S. stock trading, Circle Payments Network (CPN) integration, global crypto payments, compliant DeFi, and AI Agents.

Coinbase isn't just buildin' a highway for regulated assets; they're constructin' a whole value loop for USD stablecoins. Smart move!

Projects to Watch

- Aerodrome: As the flagship DEX on Base and a Coinbase partner, Aerodrome is poised to benefit from institutional liquidity flows.

- Uniswap: Another DEX integrated by Coinbase, expect increased on-chain liquidity and platform revenue.

- Keeta: A high-performance RWA-focused chain with serious speed, expect collaboration with Base on compliant RWA integration.

- Creator Bid: Partnered with Kaito, launchin' new features to boost user engagement and expand creator economy models.

- Upside: The first socially driven prediction market on Base, blending prediction and content mechanics.

The Bottom Line

Base is evolvin' from a tradin' L2 into a complete on-chain financial and content powerhouse. From innovative projects to Coinbase's strategic moves, the narrative is strong.

Short-term hype might fade, but Base's long-term strength lies in its consistent storytelling and institutional alignment. It's a vital reference point for trackin' the shift toward compliance, financialization, and utility.

So, keep your eyes on Base, folks. It's not just a flash in the pan; it's a foundational layer for the future of finance. And who knows, maybe we'll all be tradin' tokenized Apple stock on-chain sooner than we think! Peace out!

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- Work Dogs Unleashes TGE Launch, Sets Sights on Mid-2026 Listing & Ambitious $25 Token Target

- Jan 31, 2026 at 01:52 pm

- Work Dogs ignites its Token Generation Event, charting a course for a mid-2026 exchange listing with a $25 price target, backed by robust tokenomics and a vibrant Telegram P2E community.

-

- WD Coin's TGE Launch Ignites Excitement: A Billion Tokens Set to Hit the Market

- Jan 31, 2026 at 01:24 pm

- WD Coin's TGE is live, with its 1 Billion tokens gearing up for a market debut, sparking significant buzz across the crypto world. Learn about its tokenomics, listing timeline, and price predictions.

-

-

-

- Coin Nerds Forges Trust in the Digital Asset Trading Platform Landscape Amidst Evolving Market

- Jan 31, 2026 at 12:41 pm

- Coin Nerds Inc. is reshaping digital asset trading by prioritizing trust, education, and real-world accessibility, aligning with the market's pivot towards regulated and secure platforms.

-

- Blockchains, Crypto Tokens, Launching: Enterprise Solutions & Real Utility Steal the Spotlight

- Jan 31, 2026 at 11:49 am

- The crypto landscape is evolving at warp speed, with a spotlight on robust enterprise blockchain solutions and a demand for tokens with tangible utility, reshaping how Blockchains, Crypto Tokens, and even investment products are launching.

-

- Crypto Market Rollercoaster: Bitcoin Crash Recovers Slightly Amidst Altcoin Slump and Lingering Fear

- Jan 31, 2026 at 10:33 am

- The crypto market navigates a tumultuous week, with Bitcoin's recent crash giving way to a tentative recovery as altcoins remain volatile, all under the shadow of persistent 'extreme fear' and a cocktail of global economic headwinds.

-

-

![Ultra Paracosm by IlIRuLaSIlI [3 coin] | Easy demon | Geometry dash Ultra Paracosm by IlIRuLaSIlI [3 coin] | Easy demon | Geometry dash](/uploads/2026/01/31/cryptocurrencies-news/videos/origin_697d592372464_image_500_375.webp)