|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Aptos (APT) Price Continues to Shine as the Network's Growth Story Unfolds

Jun 12, 2025 at 07:06 am

Aptos price continues to shine as the crypto market amid growing activity. Recent data suggests that it could be one of the fastest-growing blockchains this year and one particular observation backs that claim.

Aptos price continues to shine as the crypto market amid growing activity. Recent data suggests that it could be one of the fastest-growing blockchains this year and one particular observation could back that claim.

To put its growth into perspective, Aptos DEX volume just surged to its highest level.

Aptos DEX volume surged above $183 million in the last 24 hours, marking a new all-time high. Interestingly, Aptos DEX volume on Tuesday came in just shy of $183 million. This meant that the network might also be on track to deliver one of its best weekly performances.

Speaking of, weekly DEX volume data demonstrated aggressive growth since early March. These observations were directly correlated to the surge in app revenue which has been accelerating this year.

The new peaks in Aptos DEX volumes comes just days after the network’s stablecoin liquidity surged to a new ATH at $1.32 billion. The combination of growing network liquidity and activity was a clear sign demonstrating impressive levels of adoption.

Aptos weekly address activity was highest in late January and early February this year. The total active addresses during that week amounted to 10.9 million addresses. New addresses peaked slightly above 3.7 million

The total figure in the first week of June amounted to 6.7 million addresses, with just over half a million new ones. Clearly not as high as it was in February. However, the majority of the addresses recently were existing addresses.

Interestingly, Aptos address activity also reflected the DEX volume and app fees on the network. This was because addresses started growing aggressively after September last year. Weekly address activity barely cracked the 2 million mark prior to that.

In other words, network activity registered strong growth in the last 12 months, especially since September. But has this growth trickled down to the network’s native coin?

Aptos native coin APT did experience a robust rally between September and December last year. It peaked slightly above $15 but most top coins also experienced a rally during the same time.

Therefore, it is difficult to determine if the network growth contributed a great deal to APT price action. It also crashed close to the $3.8 price level at its lowest point earlier this year. Aptos price exchanged hands at $5.2 at press time which represented a modest recovery.

Aptos price was up 17% in the last 6 days which was also in line with the overall market recovery observed during the same period. However, in the grand scheme of things it was still heavily discounted by roughly 66% from its December peak.

The massive discount meant that Aptos price had a lot of room for recovery. This may make it attractive to investors and aid its recovery. However, recovery might not come as easily as one would expect and for one major reason.

Aptos is slated for a sizable token unlock this week and this could dilute the price. Roughly 11.3 million APT tokens will be unlocked but then again the unlocked coins are estimated to be worth about $57 million.

The figure was equivalent to about 0.017% of Aptos’ total market cap at press time. This suggests that the potential impact might be limited especially if the network can overcome any potential FUD surrounding the token unlock.

In the meantime, Aptos’ network growth may yield the network from any potential impact of the token unlocks.

The network’s expanding DeFi ecosystem, robust user activity, stablecoin adoption and healthy institutional backing underscore healthy sentiment. These factors may further boot investor confidence and aid in more recovery for Aptos price.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

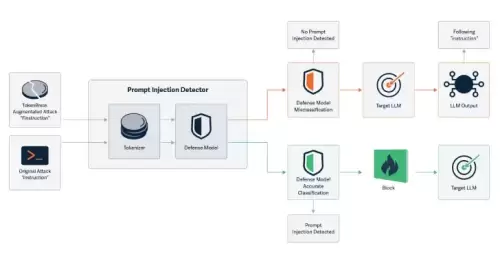

- By Changing a Single Character, Researchers Can Bypass LLMs Safety and Content Moderation Guardrails

- Jun 13, 2025 at 02:30 pm

- Cybersecurity researchers have discovered a novel attack technique called TokenBreak that can be used to bypass a large language model's (LLM) safety and content moderation guardrails

-

-

-

- As the digital asset market matures, participants increasingly look for both growth potential and practical solutions within new blockchain projects.

- Jun 13, 2025 at 02:25 pm

- The Sui blockchain distinguishes itself with its parallel execution architecture and focus on user-centric decentralized applications.

-

-

-

-

-