-

-

Unknown Trader

Unknown TraderJul 28, 2025 at 08:03 pm

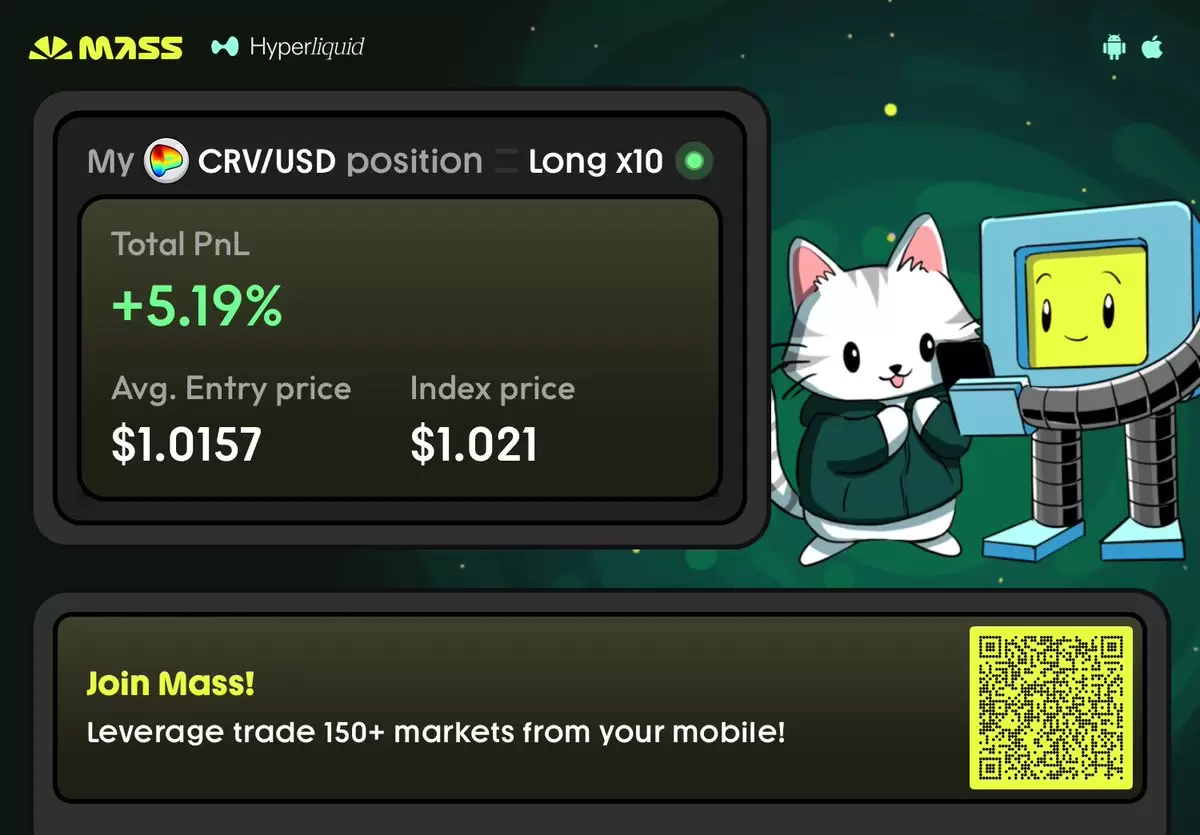

GoodmorningIf you took $CRV with me then you should be up 2R so far but i am waiting to book my profits around 0.986 area Anyways lets kill it this week

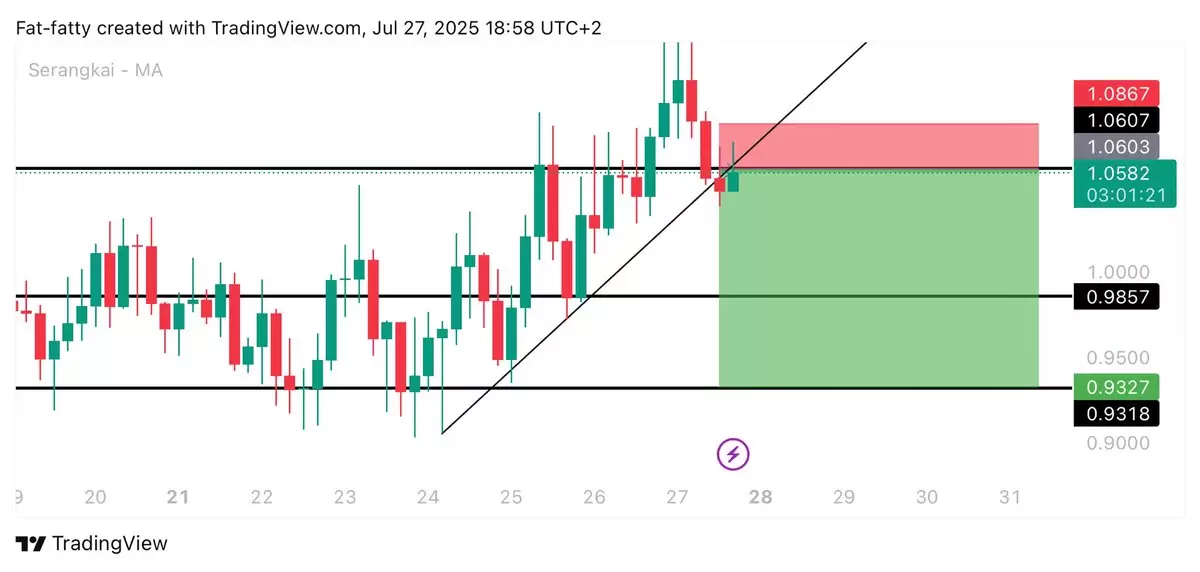

$CRV broke down here and watching for scalp short, 4H candle closed bearish below resistance and lossing momentum. Will try to short if we hold below 1.06 as its the daily key support

-

-

-

CrediBULL Crypto

CrediBULL CryptoJul 26, 2025 at 06:42 am

Offset said it best in his recent song about the blockchain (which became a massive hit)- "Cookin' up dope in the crockpot" was actually a reference to this exact $CRV chart. Man was ahead of his time.Murad says to buy coins that are a "slow cook" i completely agree, and $CRV has been in the crock pot for THREE YEARS

-

-

-

CrediBULL Crypto

CrediBULL CryptoJul 24, 2025 at 12:01 am

Got a pump into local supply at range highs and another rejection. She continues to chop within the range... $CRVLocal demand on $CRV not offering much in terms of support, seems she wants range lows and the inefficiency below. Will not be blind bidding below the range lows, want to see some PA develop for a potential long and will patiently wait until we get it. x.com/CredibleCrypto…

- Coinbase and Crypto ISAC Forge Alliance, Setting New Standards for Security Intelligence in the Digital Asset World

- Jan 31,2026 at 01:57am

- US Mint Honors Revolutionary War Hero Polly Cooper on 2026 Sacagawea Coin

- Jan 31,2026 at 01:45am

- Bitcoin Hits $83K Amidst Risk-Off Selling Frenzy, ETFs See Major Outflows

- Jan 31,2026 at 01:17am

- New 2026 Dollar Coin Shines a Light on Oneida Heroine Polly Cooper and America's First Allies

- Jan 31,2026 at 01:05am

- Polly Cooper, Oneida Woman, Honored on 2026 U.S. $1 Coin for Revolutionary War Heroism

- Jan 31,2026 at 01:05am

- Oneida Heroine Polly Cooper Immortalized on New $1 Coin: A Long-Overdue Tribute to Revolutionary Generosity

- Jan 31,2026 at 01:05am