All-time High

All-time Low

Volume(24h)

91.02M

Turnover rate

15.91%

Market Cap

572.0847M

FDV

1.2B

Circulating supply

1.42B

Total supply

2.33B

Max supply

3.03B

Website

Contracts

Explorers

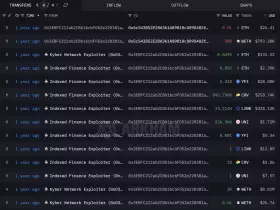

https://etherscan.io/token/0xD533a949740bb3306d119CC777fa900bA034cd52

https://etherscan.io/token/0xD533a949740bb3306d119CC777fa900bA034cd52

https://app.nansen.ai/token-god-mode?chain=ethereum&tab=transactions&tokenAddress=0xD533a949740bb3306d119CC777fa900bA034cd52

https://arbiscan.io/token/0x11cDb42B0EB46D95f990BeDD4695A6e3fA034978

https://optimistic.etherscan.io/token/0x0994206dfE8De6Ec6920FF4D779B0d950605Fb53

https://gnosisscan.io/token/0x712b3d230f3c1c19db860d80619288b1f0bdd0bd

Currency Calculator

{{conversion_one_currency}}

{{conversion_two_currency}}

| Exchange | Pairs | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

Community sentiment

26%

74%

Bullish

Bearish

https:// t.me/upx_ai_bot

https:// t.me/upx_ai_bot

| Exchange | Pair | Price | Volume (24h) | Volume % | Confidence | Liquidity Score | Earn |

|---|---|---|---|---|---|---|---|

| {{val.marketPair}} | {{val.price}} | {{val.volume24h}} | {{val.volumePercent}} | Low Moderate High | {{val.effectiveLiquidity}} | Buy / Sell | |

About Curve DAO Token

Where Can You Buy Curve (CRV)?

CRV is a freely-tradable token and is available against cryptocurrency, stablecoin and fiat currency pairs on major exchanges. These include [Binance](https://coinmarketcap.com/exchanges/binance/), [OKEx](https://coinmarketcap.com/exchanges/okex/) and [Huobi Global](https://coinmarketcap.com/exchanges/huobi-global/), which hold the lion’s share of trading volume as of September 2020. New to cryptocurrency and want to know how to buy [Bitcoin](https://coinmarketcap.com/currencies/bitcoin/) (BTC) or any other token? Check out the details [here](https://coinmarketcap.com/how-to-buy-bitcoin/).

How Is the Curve Network Secured?

Curve carries the standard risks associated with depositing funds in smart contracts and dealing with AMMs, namely [impermanent loss](https://coinmarketcap.com/alexandria/glossary/impermanent-loss). As Curve only supports stablecoins, the risk of markets moving too quickly is reduced, but users can still lose money once markets are rebalanced to reflect cross-market prices. Curve has been audited, but this does not do anything to counter the risks involved in being exposed to a specific cryptocurrency.

How Many Curve (CRV) Coins Are There in Circulation?

Curve (CRV) launched in August 2020, along with the Curve DAO. Its purpose is to function as a governance medium, incentive structure and fee payment method, along with long-term earnings method for liquidity providers. The total CRV supply is 3.03 billion tokens, the majority of which (62%) are distributed to liquidity providers. The remainder is divided as follows: 30% to shareholders, 3% to employees and 5% to a community reserve. The shareholder and employee allocations come with a two-year vesting schedule. CRV had no premine, and the gradual unlocking of tokens means that around 750 million should be in circulation one year after launch.

What Makes Curve Unique?

Curve has gained considerable attention by following its remit as an AMM specifically for stablecoin trading. The launch of the DAO and CRV token brought in further profitability, given CRV’s use for governance, as it is awarded to users based on liquidity commitment and length of ownership. The explosion in DeFi trading has ensured Curve’s longevity, with AMMs turning over huge amounts of liquidity and associated user profits. As such, Curve caters to anyone involved in DeFi activities such as [yield farming](https://coinmarketcap.com/alexandria/glossary/yield-farming) and liquidity mining, as well as those looking to maximize returns without risk by holding notionally non-volatile stablecoins. The platform makes money by charging a modest fee which is paid to liquidity providers.

Who Are the Founders of Curve?

The founder and CEO of Curve is Michael Egorov, a Russian scientist who has various experience with cryptocurrency-related enterprises. In 2015, he co-founded and became CTO of NuCypher, a cryptocurrency business building privacy-preserving infrastructure and protocols. Egorov is also the founder of decentralized bank and loans network LoanCoin. Curve’s regular team is part of the CRV allocation structure, and will receive tokens according to a two-year vesting schedule as part of the initial launch plan. In August 2020, Egorov said that he “overreacted” by locking up a large amount of CRV tokens as a response to [yearn.finance’s](https://blog.coinmarketcap.com/2020/09/02/inside-ethereums-testnet-headwinds-growth-in-tokenized-bitcoin-a-data-perspective-by-intotheblock-2/) voting power, awarding himself 71% of governance in the process.

What Is Curve (CRV)?

Curve is a decentralized exchange for [stablecoins](https://coinmarketcap.com/alexandria/article/what-is-a-stablecoin) that uses an automated market maker ([AMM](https://coinmarketcap.com/alexandria/glossary/automated-market-maker-amm)) to manage [liquidity](https://coinmarketcap.com/alexandria/glossary/liquidity). Launched in January 2020, Curve is now synonymous with the decentralized finance ([DeFi](https://coinmarketcap.com/alexandria/article/what-is-decentralized-finance)) phenomenon, and has seen significant growth in the second half of 2020. In August, Curve launched a decentralized autonomous organization ([DAO](DAO)), with CRV as its in-house token. The DAO uses [Ethereum](https://coinmarketcap.com/currencies/ethereum/)-based creation tool Aragon to connect multiple [smart contracts](https://coinmarketcap.com/alexandria/glossary/smart-contract) used for users’ deposited liquidity. Issues such as governance, however, differ from Aragon in their weighting and other respects.

Curve DAO Token News

-

Bitcoin faces volatility as Saylor and Kiyosaki remain bullish. Will Kiyosaki's crash warning trigger panic or a major breakout?

Nov 05, 2025 at 08:17 am

-

CZ's personal investment in Aster Token sparks market frenzy. This blog explores CZ's history with crypto investments, the rise of Aster, and market risks.

Nov 05, 2025 at 06:00 am

-

Bitcoin's recent tumble below $100,000 signals a deepening crypto correction. What's behind the plunge, and is this a buying opportunity or a sign of more pain to come?

Nov 05, 2025 at 05:22 am

-

Navigating the crypto market's volatility: Analyzing Bitcoin's dips, XRP's developments, and emerging trends for 2025. Stay informed on the forces shaping digital asset investments.

Nov 05, 2025 at 03:52 am

-

A deep dive into the ASTER crash, Binance's influence, and the resulting market chaos, exploring the psychology behind crypto volatility and offering insights for navigating the turbulent landscape.

Nov 05, 2025 at 03:48 am

-

BNB price faces sharp decline amid broader crypto sell-off. Is this a temporary dip or a sign of deeper troubles? Let's analyze the situation.

Nov 05, 2025 at 03:46 am

-

Explore NIP Group's expanded Bitcoin mining, Bitget's altcoin liquidity program, and the potential of tokens like Little Pepe in shaping the next crypto bull run.

Nov 05, 2025 at 03:45 am

-

Bitcoin plunges below $104K amid massive liquidations and ETF outflows. Is this a temporary blip or a sign of deeper trouble? Plus, MicroStrategy's bold Euro move.

Nov 05, 2025 at 03:34 am

-

Bitcoin plunges below $101K, triggering a $200B crypto market rout. Is this a buying opportunity or the start of a deeper correction?

Nov 05, 2025 at 03:25 am

Similar Coins

Twitter

GitHub

Close