-

bitcoin

bitcoin $87959.907984 USD

1.34% -

ethereum

ethereum $2920.497338 USD

3.04% -

tether

tether $0.999775 USD

0.00% -

xrp

xrp $2.237324 USD

8.12% -

bnb

bnb $860.243768 USD

0.90% -

solana

solana $138.089498 USD

5.43% -

usd-coin

usd-coin $0.999807 USD

0.01% -

tron

tron $0.272801 USD

-1.53% -

dogecoin

dogecoin $0.150904 USD

2.96% -

cardano

cardano $0.421635 USD

1.97% -

hyperliquid

hyperliquid $32.152445 USD

2.23% -

bitcoin-cash

bitcoin-cash $533.301069 USD

-1.94% -

chainlink

chainlink $12.953417 USD

2.68% -

unus-sed-leo

unus-sed-leo $9.535951 USD

0.73% -

zcash

zcash $521.483386 USD

-2.87%

OKX Exchange v6.113.0 latest official Android version usage tutorial

The Android version of Ouyi Exchange v6.113.0 provides digital currency transactions such as Bitcoin and Ethereum, optimizing functions and security experience. Support official website download and need to enable installation permissions from unknown sources. Registration requires email, mobile phone verification and identity authentication, and provides a variety of login methods. It has market analysis, price reminders and learning resources to help users trade conveniently.

Apr 01, 2025 at 04:19 pm

Download and install the latest official Android version of Ouyi Exchange v6.113.0

First, click the download link of Ouyi official app provided in this article to download the installation package on your mobile phone. Make sure you download the latest version of the installation package for the latest features and security updates.

Please ensure the network is stable when downloading to avoid interruptions or file corruption.

Installation precautions

Register and log in

Registration process

1. Open the Ouyi Exchange APP, find and click the [Login/Register] button below the APP homepage to enter the registration page.

2. On the registration page, first select your country. Make sure the country you selected matches your subsequent ID card address.

3. Enter a long-term stable and normal login email (such as QQ email, 163 email, 126 email, 189 email, gmail email, etc.), and the email will be used for subsequent cash withdrawal and other operations, and must be filled in accurately. 4. After entering the email address, the system will send a verification code to the email address, go to the email address to check the verification code and enter it to the corresponding location of the APP, and click Next.

4. After entering the email address, the system will send a verification code to the email address, go to the email address to check the verification code and enter it to the corresponding location of the APP, and click Next.

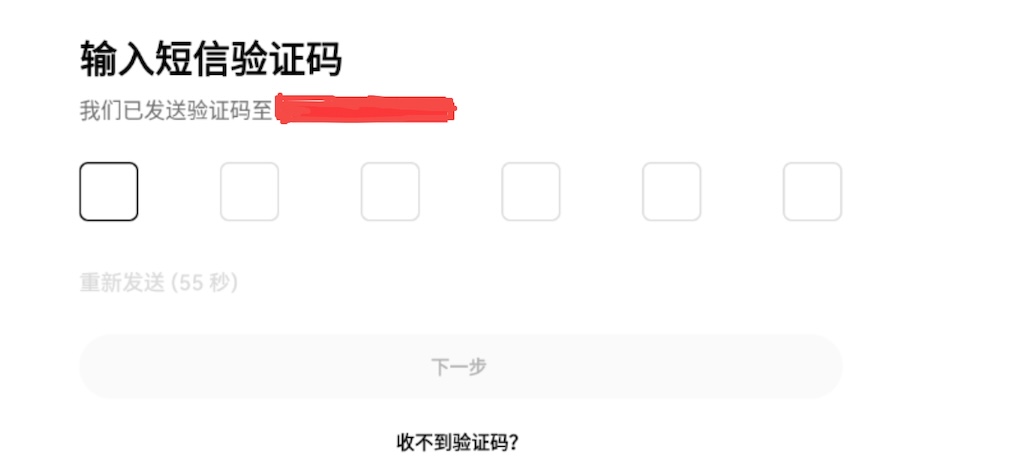

5. Then enter the mobile phone number, which is mainly used to facilitate login and verification operations.

6. Enter the SMS verification code received by the mobile phone.

7. Set a password containing upper and lower case letters, special characters and numbers to enhance account security. After the setup is completed, your registration process is basically completed, but authentication is still required.

8. For identity verification, you can choose your ID card or passport and follow the prompts of the APP to complete the authentication steps step by step.

Login method

Click [No verification code received? 】, apply for unbinding your mobile phone number according to the prompts on the page.

Use the email address bound to the account to send a photo of the front and back of the ID card (original) and indicate the mobile phone number that needs to be unbound. Go to the official email address: service@OKX.com, and staff will follow up and deal with it.

Trading operations

Trading interface introduction

Steps for placing an order

Choose a trading pair: Choose the digital currency pair you want to trade among the many trading pairs based on your investment plan and your judgment of the market.

Select a trading type: Ouyi Exchange offers a variety of trading types, common limited price orders and market orders. A limit order is where you can set an expected price to buy and sell. The order will only be sold when the market price reaches the price you set; the market order is sold immediately at the best price in the current market.

Enter the transaction quantity and price (for limit order): If you select a limit order transaction, enter the number of digital currency you want to buy or sell at the corresponding position, and the expected transaction price.

Confirm the order: Carefully check the transaction quantity, price, transaction pairs and handling fees and other information, and after ensuring that it is correct, click the order button. After the order is successfully placed, you can check the status of the order in the transaction history, such as transactions, unsold, partial transactions, etc.

Asset Viewing and Management

Market analysis and tool use

Check the market chart

Price warning settings

Learning Resources Acquisition

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

- Bitcoin's Four-Year Cycle: Navigating Drawdowns and the Road Ahead

- 2026-02-10 18:30:02

- Crypto Exchange Backpack Eyes Unicorn Status Amidst Token Launch and Quantum Defense Concerns

- 2026-02-10 18:40:02

- BNB Price Milestone: ICE Futures Launch Signals Institutional Interest Amid Price Predictions

- 2026-02-10 19:20:02

- Ethereum Foundation Teams Up with SEAL to Combat Crypto Drainers, AI Poised to Enhance Security

- 2026-02-10 19:20:02

- Bitcoin Holds Steady Amidst Quantum Quibbles and Market Swings: CoinShares Weighs In

- 2026-02-10 19:15:01

- Big Apple Beat: Delisting, Coin Stocks, and a Sweeping Market Reorganization

- 2026-02-10 18:40:02

Related knowledge

How to buy JasmyCoin (JASMY) on Bybit?

Feb 09,2026 at 03:40am

Creating a Bybit Account1. Navigate to the official Bybit website and click the 'Sign Up' button located in the top-right corner. 2. Enter a valid ema...

How to contact Bybit customer support for urgent help?

Feb 05,2026 at 11:40pm

Accessing Bybit Support via Live Chat1. Log in to your Bybit account using the official website or mobile application. 2. Navigate to the Help Center ...

How to buy Injective (INJ) on Bybit in 2026?

Feb 09,2026 at 05:39pm

Account Registration and Verification Process1. Navigate to the official Bybit website and click the “Sign Up” button located in the top-right corner....

How to use Bybit Dual Asset investment for high yield?

Feb 06,2026 at 12:20am

Understanding Bybit Dual Asset Investment Mechanics1. Dual Asset Investment is a structured product offered by Bybit that combines a stablecoin deposi...

How to fix Bybit login issues quickly?

Feb 09,2026 at 06:00am

Troubleshooting Common Authentication Errors1. Incorrect credentials often trigger immediate rejection during Bybit login attempts. Users frequently o...

How to buy Aptos (APT) on Bybit today?

Feb 06,2026 at 07:40am

Creating a Bybit Account1. Navigate to the official Bybit website and click the “Sign Up” button located at the top right corner of the homepage. Ente...

How to buy JasmyCoin (JASMY) on Bybit?

Feb 09,2026 at 03:40am

Creating a Bybit Account1. Navigate to the official Bybit website and click the 'Sign Up' button located in the top-right corner. 2. Enter a valid ema...

How to contact Bybit customer support for urgent help?

Feb 05,2026 at 11:40pm

Accessing Bybit Support via Live Chat1. Log in to your Bybit account using the official website or mobile application. 2. Navigate to the Help Center ...

How to buy Injective (INJ) on Bybit in 2026?

Feb 09,2026 at 05:39pm

Account Registration and Verification Process1. Navigate to the official Bybit website and click the “Sign Up” button located in the top-right corner....

How to use Bybit Dual Asset investment for high yield?

Feb 06,2026 at 12:20am

Understanding Bybit Dual Asset Investment Mechanics1. Dual Asset Investment is a structured product offered by Bybit that combines a stablecoin deposi...

How to fix Bybit login issues quickly?

Feb 09,2026 at 06:00am

Troubleshooting Common Authentication Errors1. Incorrect credentials often trigger immediate rejection during Bybit login attempts. Users frequently o...

How to buy Aptos (APT) on Bybit today?

Feb 06,2026 at 07:40am

Creating a Bybit Account1. Navigate to the official Bybit website and click the “Sign Up” button located at the top right corner of the homepage. Ente...

See all articles