-

bitcoin

bitcoin $111375.742210 USD

-8.60% -

ethereum

ethereum $3780.311592 USD

-13.98% -

tether

tether $1.001299 USD

0.07% -

bnb

bnb $1093.375857 USD

-13.01% -

xrp

xrp $2.339375 USD

-16.91% -

solana

solana $185.029017 USD

-16.69% -

usd-coin

usd-coin $1.000230 USD

0.04% -

tron

tron $0.319531 USD

-5.16% -

dogecoin

dogecoin $0.190791 USD

-23.59% -

cardano

cardano $0.638663 USD

-21.82% -

ethena-usde

ethena-usde $0.998483 USD

-0.20% -

hyperliquid

hyperliquid $37.741486 USD

-14.68% -

chainlink

chainlink $17.229851 USD

-22.17% -

stellar

stellar $0.316546 USD

-16.74% -

bitcoin-cash

bitcoin-cash $507.861193 USD

-13.18%

What is the maximum leverage for Deepcoin delivery contracts?

Deepcoin's maximum leverage for delivery contracts varies based on the cryptocurrency pair, with BTC/USDT and ETH/USDT offering up to 50x leverage.

Nov 27, 2024 at 02:40 pm

Deepcoin, a popular cryptocurrency exchange, offers delivery contracts with varying leverage options. Leverage allows traders to amplify their trading positions and potentially increase their profits or losses.

The maximum leverage available for Deepcoin delivery contracts depends on the specific cryptocurrency pair and market conditions. Here's a breakdown of the leverage options for various cryptocurrency pairs on Deepcoin:

Maximum Leverage for Deepcoin Delivery Contracts- BTC/USDT: 50x

- ETH/USDT: 50x

- BNB/USDT: 40x

- ADA/USDT: 30x

- XRP/USDT: 25x

- SOL/USDT: 25x

Leverage is a tool that allows traders to make larger trades with less capital. By borrowing funds from the exchange, traders can amplify their trading positions and potentially increase their profits. However, it's important to note that leverage also magnifies potential losses.

For instance, if a trader has a margin balance of $1000 and uses 10x leverage, they can open a position worth $10,000. If the market moves in their favor, their profits will be multiplied by the leverage factor, increasing their potential gains. Conversely, if the market moves against them, their losses will also be multiplied by the leverage factor, resulting in amplified losses.

Factors Influencing Leverage Usage- Risk Tolerance: Traders should carefully consider their risk tolerance before utilizing leverage. High leverage can lead to substantial losses, especially in volatile market conditions.

- Market Volatility: The volatility of the underlying cryptocurrency pair can also impact leverage usage. Highly volatile pairs may require lower leverage to manage risk.

- Margin Requirements: Exchanges impose margin requirements that determine the amount of capital required to open a leveraged position. Traders must maintain sufficient margin to avoid margin calls.

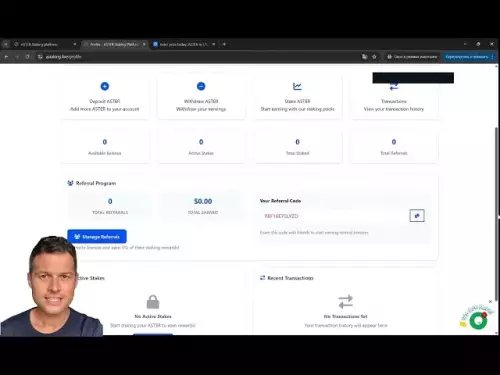

- Open an Account and Fund Your Margin Wallet: Create an account on Deepcoin and transfer funds to your margin wallet to cover the initial margin requirements.

- Select the Desired Leverage: Once you have funded your margin wallet, select the desired leverage level for your trading pair.

- Place an Order: Specify the order type, quantity, and price you wish to trade at.

- Monitor Your Position: Closely monitor your leveraged position and adjust your stop-loss orders as needed to manage risk.

- Close Your Position: When you are ready to exit the trade, close your position by placing a closing order.

Leverage can be a powerful tool for traders, but it must be used with caution. Traders should assess their risk tolerance, understand the mechanics of leverage, and monitor their positions closely to manage potential risks. Deepcoin offers a range of leverage options for delivery contracts, allowing traders to customize their trading strategies based on their individual risk profiles.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

- Bittensor (TAO): Super Bullish Signals Point to Potential 2x Rally

- 2025-10-11 10:25:12

- Silver Price Correction: Navigating the Dip & Identifying Key SEO Keywords

- 2025-10-11 10:25:12

- MoonBull: The Crypto Meme Coin Promising 1000x Gains?

- 2025-10-11 10:30:01

- Crypto Payroll Revolution: Stablecoins, Altcoins, and the Future of Salary Payments

- 2025-10-11 10:30:01

- Decoding Crypto Trends: XRP's Bitcoin Dream, BlockDAG's Rise, and the PayFi Revolution

- 2025-10-11 10:30:01

- Amina Bank & Polygon: Institutional Staking with a Sweet 15% Yield

- 2025-10-11 10:30:15

Related knowledge

How to calculate the ROI for Ethereum contracts?

Oct 09,2025 at 04:36pm

Understanding Ethereum Contract ROI Basics1. Return on Investment (ROI) for Ethereum contracts begins with tracking the initial capital deployed into ...

What is the best risk-to-reward ratio for XRP contracts?

Oct 11,2025 at 04:18am

Understanding Risk-to-Reward in XRP Futures Trading1. The risk-to-reward ratio is a fundamental metric used by traders to evaluate the potential profi...

How do I calculate my breakeven point on XRP contracts?

Oct 09,2025 at 08:36pm

Understanding the Breakeven Point in XRP Futures TradingCalculating the breakeven point for XRP contracts is essential for traders who engage in futur...

Where can I find historical data for SOL contracts?

Oct 10,2025 at 06:54pm

Accessing Historical Data for SOL Contracts1. Solana blockchain explorers provide comprehensive tools to retrieve historical data related to smart con...

How to place a take-profit order for Dogecoin contracts?

Oct 10,2025 at 05:01am

Understanding Take-Profit Orders in Dogecoin Futures Trading1. A take-profit order is a tool used by traders to automatically close a position when th...

What are quarterly futures for Ethereum contracts?

Oct 11,2025 at 02:19pm

Understanding Quarterly Futures in the Ethereum Ecosystem1. Quarterly futures for Ethereum are derivative contracts that settle on a predetermined dat...

How to calculate the ROI for Ethereum contracts?

Oct 09,2025 at 04:36pm

Understanding Ethereum Contract ROI Basics1. Return on Investment (ROI) for Ethereum contracts begins with tracking the initial capital deployed into ...

What is the best risk-to-reward ratio for XRP contracts?

Oct 11,2025 at 04:18am

Understanding Risk-to-Reward in XRP Futures Trading1. The risk-to-reward ratio is a fundamental metric used by traders to evaluate the potential profi...

How do I calculate my breakeven point on XRP contracts?

Oct 09,2025 at 08:36pm

Understanding the Breakeven Point in XRP Futures TradingCalculating the breakeven point for XRP contracts is essential for traders who engage in futur...

Where can I find historical data for SOL contracts?

Oct 10,2025 at 06:54pm

Accessing Historical Data for SOL Contracts1. Solana blockchain explorers provide comprehensive tools to retrieve historical data related to smart con...

How to place a take-profit order for Dogecoin contracts?

Oct 10,2025 at 05:01am

Understanding Take-Profit Orders in Dogecoin Futures Trading1. A take-profit order is a tool used by traders to automatically close a position when th...

What are quarterly futures for Ethereum contracts?

Oct 11,2025 at 02:19pm

Understanding Quarterly Futures in the Ethereum Ecosystem1. Quarterly futures for Ethereum are derivative contracts that settle on a predetermined dat...

See all articles