|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密货币新闻

Virtual asset exchanges and non-profit corporations will be able to sell virtual assets (coins) from June.

2025/05/01 22:33

Virtual asset exchanges and non-profit corporations will be able to sell virtual assets (coins) from June. However, only virtual assets that support transactions will be able to sell on three or more won exchanges. In the case of the exchange, only virtual assets that meet this condition among coins in the top 20 market capitalization will be able to sell.

The Financial Services Commission (FSC) held the 4th Virtual Asset Committee at the Seoul Government Complex on the morning of the 1st and confirmed the establishment of guidelines for the sale of virtual assets by non-profit corporations and exchanges. This guideline is a follow-up to the "Roadmap of Corporations' Participation in the Virtual Asset Market" announced at the last meeting.

Among the exchanges, only those that have reported as virtual asset business operators are allowed to sell under the Act on Reporting and Use of Specific Financial Transaction Information (Special Privileges Act).

However, they are allowed to sell virtual assets only if they pay taxes such as corporate taxes, cover operating expenses such as labor costs, and there is a clear concern about default.

Virtual assets that can be sold were limited to coins that are supported by more than three won exchanges out of the top 20 semi-annual total stocks of each of the five domestic exchanges. Targeted virtual assets are disclosed on the website of the Digital Asset Exchange Joint Consultative Body (DAXA) every half year.

More than 10 virtual assets, including Bitcoin, Ethereum, XRP, Solana, Tether, and USDC, are expected to meet the guidelines. Most of the virtual assets that rank within the top 20 in terms of global market capitalization are supported for sale on three or more won exchanges.

Exchanges cannot sell coins they hold through themselves and must sell them to more than two Korean won exchanges in a distributed manner. In addition, related plans should be disclosed before and after the sale. A daily sale limit (within 10% of the total sales volume, etc.) was also granted.

Some predict that allowing the sale of virtual assets could be good news for the exchange, which is in the red.

"The deficit exchange will be able to breathe with the sales price of virtual assets," an official from the virtual asset industry said. "Although there are limited virtual assets that can be sold, it will definitely help in terms of operating funds."

"Mainly deficit exchanges will sell coins, which could result in increased liquidity in large exchanges as they have to use two other exchanges," he added.

In addition, the sale of virtual assets was allowed to externally audited corporations with more than five years of business experience among non-profit corporations that receive donations and sponsorships.

The donation target was limited to coins supported by three or more won exchanges. In addition, anonymous donations and transfers between wallets are restricted. Only donations and transfers are allowed through the accounts of the Korean won exchange.

Non-profit corporations must cash virtual assets that have received donations as soon as they receive them. In addition, a "donation review committee" should be established inside the corporation to deliberate on the appropriateness of donations and the plan for monetization in advance.

Non-profit corporations and exchanges can start applying for support for issuing virtual asset sales accounts from next month. The Financial Services Commission plans to come up with a customer identification plan when trading virtual assets of non-profit corporations and exchanges in May. In addition, it will push ahead with the plan to issue real-name accounts to listed corporations and corporations registered as professional investors with the aim of announcing them in the second half of the year.

In addition, "Amendment to Best Practices for Transaction Support" will be applied to virtual assets that will be listed after the 1st of next month. This amendment focuses on strengthening standards for supporting transactions to prevent instability in the virtual asset market.

In particular, the authorities presented standards to prevent a listing beam (a sudden change in price due to an imbalance in supply and demand immediately after supporting the transaction). In order to prevent a listing beam in the future, exchanges will be obliged to secure a minimum distribution volume before starting trading. The minimum distribution volume will be set in consideration of the size of pre-receiving of items that have not been listed. In addition, market price orders will be restricted for a certain period of times after trading begins.

In the case of "Zombie Coin," which has a small volume or market capitalization, and "Memcoin," whose purpose or value is unclear, each exchange is required to prepare its own standards related to transaction support.

The Financial Services Commission said it will reflect the core contents of the amendment when preparing an integrated law on virtual assets.

"We will support the issuance of virtual asset sales accounts to non-profit corporations and exchanges from June after the field preparation period, and apply the revision of best practices to transaction support stocks after the 1st of next month," Vice Chairman Kim said. "In the future, the Virtual Asset Committee will continue to play a pivotal role in discussions for the sound development of the

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

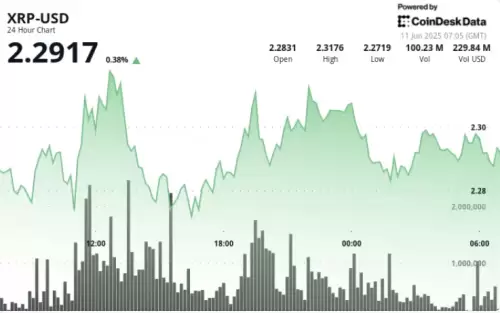

- XRP在市场波动中表现出弹性

- 2025-06-11 17:50:12

- 数字资产在更广泛的市场波动中表现出弹性,并且在关键支持水平上出现了强烈的购买兴趣。

-

-

- Tron(TRX)在发生USDT铸造事件时体验上下的价格移动

- 2025-06-11 17:45:12

- 特隆(Tron)在最近的交易中经历了向上的价格变动,在过去的24小时内,TRX攀升约3.9%。

-

- 比特币(BTC)的价格可能会在2025年6月的看涨持续时间设置

- 2025-06-11 17:45:12

- 根据市场分析师Daan Crypto交易的最新见解,比特币可能会在2025年6月进行看涨。

-

-

- 康涅狄格州通过HB 7082,禁止州和市政府投资比特币和其他虚拟货币

- 2025-06-11 17:40:12

- 该立法的标题为“有关虚拟货币和国家投资的法规”,并获得了两党的支持,并被签署为法律

-

-

- PI硬币价格预测6月11日:它可以打破关键阻力吗?

- 2025-06-11 17:40:11

- PI Network的本地令牌PI仍在与近两个星期所面临的挑战作斗争。 PI价格无法突破0.66美元的电阻水平

-