|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

不会撒谎 - 看到Tron上一周推高13%感到满意。为什么?因为我们称之为。

Not gonna lie — seeing TRON push up 13% this past week felt satisfying.

不会撒谎 - 看到Tron上一周提高了13%的幅度令人满意。

Why? Because we called it.

为什么?因为我们称之为。

In the last article, I shared how the price was accumulating on the daily, sitting right in a zone of uncertainty — but with liquidity sitting both above and below.

在上一篇文章中,我分享了价格如何在每日累积的,就位于不确定性的区域中,但流动性都位于上方和以下。

I mentioned that those high timeframe wicks? They weren’t random. They were liquidity magnets, and we were watching for a breakout.

我提到那些较高的时间范围?他们不是随机的。它们是流动性磁铁,我们正在关注突破。

Fast forward to now: TRON did exactly that. It took the upside liquidity, tapped right into the supply zone we had marked, and paused.

快进到现在:Tron就是这样做的。它采用了上升流动性,直接进入我们标记并停下的供应区。

Classic.

经典的。

Daily Played Out – But Now We Could See a Short-Term Reaction

每天都在玩 - 但是现在我们可以看到短期反应

With that daily liquidity sweep complete, things might shift a little.

随着每日流动性的完成,情况可能会有所改变。

We’re still in a bullish structure, yes. But once liquidity gets grabbed, especially at a well-defined supply level, you’ve got to ask: is this the start of a pullback, or just a breather before continuation?

是的,我们仍然处于看涨的结构。但是,一旦流动性被抓住,尤其是在定义明确的供应水平上,您必须问:这是回调的开始,还是仅在继续之前进行喘息?

Honestly? Either is possible. But one thing stands out to me: the lower liquidity that’s still untouched.

诚实地?两者都可能。但是一件事对我来说是突出的:较低的流动性仍未受到影响。

It’s like an itch the market hasn’t scratched yet.

就像市场还没有刮擦。

H4 View – Trendline Liquidity and Demand Zones in Play

H4视图 - 潮流流动性和需求区域

Zooming into the 4H chart, the picture sharpens.

缩放到4H图表中,图片逐渐增强。

We’ve got two clean trendlines, both acting as liquidity traps. You’ve probably seen this before — trendline buyers stacking in, stop-losses resting underneath. That’s tasty liquidity for smart money.

我们有两个干净的趋势线,都是流动性陷阱。您可能以前看过这一点 - 潮流购买者堆放在下面的停止损失。对于聪明的钱来说,这是美味的流动性。

So what’s one very real possibility

那么什么是真正的可能性

Now, I’m not saying that’s what will happen. But if I had to bet on a move that makes sense both technically and structurally — that’s the one I’m watching.

现在,我并不是说那将会发生。但是,如果我不得不押注在技术上和结构上都有意义的举动,那就是我正在观看的。

Why This All Matters – and Why It Might Not

为什么这一切都重要 - 为什么它可能不

I always like to end with this — because it’s important.

我一直喜欢以此为由 - 因为这很重要。

Yes, this analysis is detailed. Yes, these zones are based on real logic, not just random lines on a chart.

是的,此分析已详细介绍。是的,这些区域基于真实逻辑,而不仅仅是图表上的随机行。

But the market doesn’t owe us anything.

但是市场不欠我们任何东西。

Price can do whatever it wants. It can respect the levels we’ve mapped — or ignore them completely and go on a wild run. That’s the uncomfortable truth in trading.

价格可以做任何想要的事情。它可以尊重我们绘制的水平,或者完全忽略它们并进行狂野奔跑。这是交易中令人不安的事实。

What we do instead is play the best probabilities. We track liquidity, structure, and reactions.

相反,我们要做的是发挥最佳概率。我们跟踪流动性,结构和反应。

We prepare, but we don’t predict with arrogance.

我们准备,但我们没有傲慢预测。

Because in the end, uncertainty is part of the game — and learning to live with it? That’s where the edge is.

因为最终,不确定性是游戏的一部分 - 学习与之生活在一起吗?那就是边缘的地方。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- Pepe Coin的疯狂旅程:市场下降还是购买机会?

- 2025-06-21 00:25:13

- 随着价格下降,佩佩硬币面临着关键的时刻。是时候购买蘸酱了,还是不可避免的市场下跌?让我们深入研究分析。

-

-

-

- 金币,稀有,马:钱币综述

- 2025-06-20 22:45:13

- 从查尔斯二世几内亚到凯斯花园50ps,发掘了稀有的金币,以及他们讲的有趣的故事。另外,津巴布韦的黄金硬币计划停止。

-

-

-

-

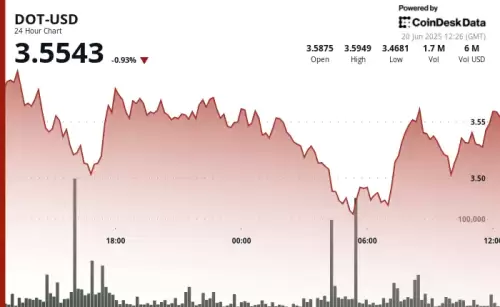

- Polkadot的点:导航三重底部和看涨逆转

- 2025-06-20 23:25:12

- Polkadot的点显示了弹性,在击中潜在的三重底部后形成了看涨的逆转模式。这是大规模集会的开始吗?

-