|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tether浏览了Stablecoin景观,司法部合作和IPO注意事项。发现关键趋势和洞察力塑造数字金融的未来。

Tether, Stablecoins, and Public Offerings: A New York Perspective

系绳,稳定币和公共产品:纽约的观点

The world of stablecoins is buzzing, and Tether is right in the thick of it. From collaborating with the DOJ to block fraud to addressing rumors about a potential public offering, there's never a dull moment. Let's dive into the latest happenings.

Stablecoins的世界在嗡嗡作响,系绳就在其中。从与司法部的合作到阻止欺诈到解决有关潜在公开募股的谣言,从来没有一个沉闷的时刻。让我们研究最新事件。

Tether's Stance on Going Public

系绳对公开的立场

Paolo Ardoino, CEO of Tether, recently stated that the company has no plans to go public, despite Circle's successful Wall Street debut. Ardoino cited Tether's profitability and conservative management as key reasons behind the decision. "We are not interested to go public, especially given the fact that the company is very profitable," he said. He also emphasized that Tether doesn't need "cheap capital" and prefers to reinvest earnings in safe assets like gold and Bitcoin. Plus, who wants to live "quarter by quarter trying to please a couple of analysts from JP Morgan?" Not Tether, apparently.

Tether的首席执行官Paolo Ardoino最近表示,尽管Circle成功举行了华尔街的首次亮相,该公司仍未计划上市。 Ardoino认为Tether的盈利能力和保守管理是该决定的关键原因。他说:“我们不感兴趣公开,尤其是考虑到该公司非常有利可图的事实。”他还强调,系绳不需要“廉价的资本”,并且更喜欢再投资于黄金和比特币等安全资产。另外,谁想居住“四分之一试图取悦JP Morgan的分析师?”显然不是系绳。

Fighting Fraud with the DOJ

与司法部打架

Tether has been actively collaborating with the United States Department of Justice (DOJ) to combat fraud, particularly the insidious “pig butchering” schemes. By adopting advanced real-time monitoring systems, Tether has managed to block over 2.7 billion USDT linked to illicit activities. This collaboration demonstrates Tether’s commitment to financial security and transparency in the digital ecosystem. In March 2025, Tether helped freeze 23 million USDT linked to the Garantex exchange, and another joint operation blocked over 100 million USDT tied to illicit funds.

Tether一直与美国司法部(DOJ)积极合作,以打击欺诈,尤其是阴险的“猪屠杀”计划。通过采用先进的实时监控系统,Tether设法阻止了超过27亿美元与非法活动相关的USDT。这项合作表明,系梅对数字生态系统中财务安全和透明度的承诺。 2025年3月,Tether帮助冻结了与Garantex Exchange相关的2300万美元,而另一项联合业务封锁了与非法资金相关的1亿美元。

Ripple's Stablecoin Play: RLUSD

Ripple的Stablecoin Play:Rlusd

Meanwhile, Ripple is making significant strides in the stablecoin arena with its institutional-grade stablecoin, RLUSD. Designed to maintain a 1:1 value with the U.S. Dollar, RLUSD aims to facilitate seamless digital asset transactions for regulated entities. It's initially minted on both the XRP Ledger and Ethereum blockchains and is regulated by the New York Department of Financial Services (NYDFS). RLUSD transactions boast exceptional speed and ultra-low fees, making it ideal for high-volume institutional use cases.

同时,Ripple凭借其机构级Stablecoin Rlusd在Stablecoin竞技场取得了长足的进步。 RLUSD旨在维持1:1的价值,旨在促进监管实体的无缝数字资产交易。它最初是在XRP分类帐和以太坊区块链上铸造的,并由纽约金融服务部(NYDFS)监管。 RLUSD交易具有出色的速度和超低费用,因此非常适合大批量机构用例。

The XRPL as a Stablecoin Hub

XRPL作为稳定枢纽

Ripple is also cultivating the XRP Ledger into a hub for various fiat-backed stablecoins, attracting issuers with its “compliance-first architecture.” USDC, XSGD, and EURØP have already debuted on the XRPL, expanding its utility across decentralized finance and cross-border payments. This strategic move aligns with Ripple’s 2025 roadmap, focusing on building a comprehensive institutional DeFi ecosystem on the XRP Ledger.

Ripple还将XRP Ledger培养成一个枢纽,以供各种菲亚·稳定的稳定者,以其“合规优先建筑”吸引发行人。 USDC,XSGD和Eurøp已经在XRPL上首次亮相,将其公用事业扩展到了分散的金融和跨境支付中。这一战略举动与Ripple的2025年路线图相吻合,重点是在XRP Ledger上建立全面的机构Defi生态系统。

DeFi Development Corp's Solana Shift

Defi Development Corp的Solana Shift

In other news, DeFi Development Corp withdrew its attempt to raise US$1B to buy more Solana (SOL) after the SEC rejected its filing. While this particular venture hit a snag, the company remains committed to Solana, running its own validator and participating in on-chain finance within the Solana ecosystem.

在其他新闻中,Defi Development Corp撤回了其在SEC拒绝提交文件后筹集1B美元购买更多Solana(Sol)的尝试。尽管这项特殊的冒险陷入困境,但该公司仍致力于Solana,运行自己的验证者并参与Solana生态系统内的链融资。

Final Thoughts

最后的想法

The stablecoin landscape is dynamic and ever-evolving. Tether's focus on profitability and security, Ripple's strategic stablecoin initiatives, and the occasional regulatory hiccup all contribute to a fascinating narrative. As investors, it's important to stay informed, be cautious, and choose platforms that prioritize transparency and security. After all, in the world of crypto, a little bit of New York savvy can go a long way.

Stablecoin景观是动态且不断发展的。 Tether的关注盈利能力和安全性,Ripple的战略性Stablecoin倡议以及偶尔的监管打ic,都促成了令人着迷的叙述。作为投资者,重要的是要保持知情,谨慎,并选择优先考虑透明度和安全性的平台。毕竟,在加密货币世界中,一点点纽约的精明性可能会有很长的路要走。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- PI网络,KYC Sync和PI2Day:深入了解最新发展

- 2025-06-20 18:45:13

- 探索PI网络上的最新KYC同步功能,其对用户的影响以及围绕即将举行的PI2DAY活动的预期。

-

- Dogecoin的三角探戈:看涨的情绪会导致突破吗?

- 2025-06-20 19:05:12

- Dogecoin形成了对称的三角形模式,暗示了潜在的60%的价格转移。看涨的情绪会占上风并引发突破吗?

-

- 以太坊,比特币,价格预测:在动荡的市场中导航加密潮

- 2025-06-20 19:05:12

- 在地缘政治紧张局势和市场波动中探索以太坊,比特币和价格预测的最新趋势和见解。发现潜在的机会和风险。

-

- 以太坊,比特币和价格预测游戏:现在是什么热?

- 2025-06-20 18:25:13

- 在以太坊,比特币和价格预测周围导航加密蜂鸣声。在不断发展的加密景观中获得最新的见解和潜在机会。

-

- 比特币价格突破即将发生?解码加密市场的下一个大举动

- 2025-06-20 18:45:13

- 比特币在重大突破的边缘吗?分析最近的市场趋势,监管发展和鲸鱼活动,以预测BTC和Dogecoin的下一个方向。

-

- 加密,人工智能和投资:浏览金融的未来

- 2025-06-20 19:25:12

- 探索加密货币,AI和投资的融合,从AI驱动的贸易助手到NFT的不断发展的景观以及可互操作的区块链的承诺。

-

-

- 甜蜜的怀旧:生日蛋糕的传统如何在周年纪念日持续

- 2025-06-20 19:45:13

- 探索生日蛋糕,怀旧和周年庆典的持久吸引力。发现传统在保持情感价值的同时如何发展。

-

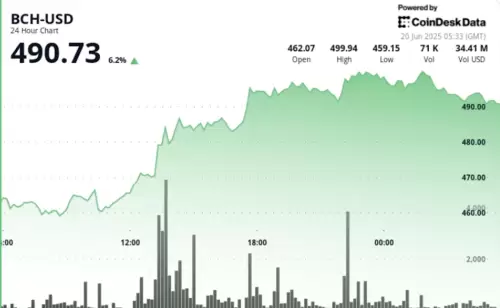

- 比特币现金价格上涨:公牛以峰值收费!

- 2025-06-20 19:45:13

- 比特币现金体验由机构需求和交易量激增的巨大价格上涨,测试了关键的500美元电阻水平。