|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索稳定币的变革潜力,它们可能引发的货币革命以及它们对更广泛的数字资产格局的影响。

Stablecoins, Monetary Revolution, and Digital Assets: A New Era?

Stablecoins,货币革命和数字资产:一个新时代?

Are we on the cusp of a monetary revolution fueled by stablecoins and digital assets? It sure looks that way. Financial innovation, especially in decentralized finance (DeFi), is laying the groundwork for a potential shift to 'narrow banking,' impacting global finance, economic development, and geopolitics. Here's the lowdown.

我们是否在由稳定币和数字资产推动的货币革命的风口浪尖?它肯定是这样的。金融创新,尤其是在权力下放的金融(DEFI)中,为潜在转向“狭窄的银行业”的基础为全球金融,经济发展和地缘政治奠定了基础。这是低点。

The Rise of Stablecoins

稳定的兴起

Stablecoins, those decentralized 'digital dollars' (or euros, yen, you name it), are making waves. Unlike central bank digital currencies (CBDCs), stablecoins are privately created digital tokens, leveraging blockchain technology for secure and transparent transactions. Think of them as a bridge between traditional fiat money and the DeFi world.

稳定的“数字美元”(或欧元,Yen,您为其命名)的那些分散的“数字美元”正在浪费。与中央银行数字货币(CBDC)不同,Stablecoins是私人创建的数字代币,利用区块链技术进行安全和透明的交易。将它们视为传统菲亚特货币与菲迪世界之间的桥梁。

The numbers don't lie: stablecoin annual transaction volumes hit a whopping $35 trillion recently, more than doubling the previous year. User numbers are up over 50%, reaching over 30 million, and the total value of stablecoins is sitting pretty at around $250 billion.

数字没有说明:Stablecoin年度交易量最近达到了35万亿美元,上一年增加了一倍以上。用户数量上涨了50%以上,达到3000万以上,稳定币的总价值约为2500亿美元。

Narrow Banking and the Chicago Plan

狭窄的银行业务和芝加哥计划

This concept isn't new. The Chicago Plan, conceived by economists at the University of Chicago, aims to separate the functions of money creation and payments from credit creation. 'Narrow' banks would hold deposits backed one-to-one with safe assets, while 'broad' or 'merchant' banks would handle lending, funded by equity or long-term bonds. This setup eliminates deposit runs and stabilizes the payment system.

这个概念并不新鲜。芝加哥大学经济学家构想的芝加哥计划旨在将创造货币创造和付款的职能与信贷创造分开。 “狭窄”银行将持有以安全资产为一对一的存款,而“广泛”或“商人”银行将处理贷款,由股权或长期债券资助。此设置消除了存款运行并稳定付款系统。

Why Now? Shifting Political and Economic Sands

为什么现在?转移政治和经济沙子

So, why is this gaining traction now? Several factors are at play. First, bipartisan frustration with traditional banks hasn't gone away since the 2008 financial crisis. The Fed's monetary policy hasn't helped either.

那么,为什么现在要受到关注呢?有几个因素在起作用。首先,自2008年金融危机以来,两党对传统银行的挫败感并没有消失。美联储的货币政策也没有帮助。

Second, the crypto space has generated massive wealth, creating a powerful counterweight to traditional banking lobbies. Even institutional asset managers are eyeing the opportunities in DeFi.

其次,加密货币空间产生了巨大的财富,为传统的银行大厅创造了强大的配重。即使是机构资产经理也正在关注Defi的机会。

Third, the U.S. has a compelling national interest in developing stablecoins. They offer an alternative to payment systems controlled by rivals, like China, and could become major buyers of U.S. T-bills. Treasury Secretary Scott Bessent keeps mentioning this.

第三,美国对发展稳定的人具有令人信服的国家兴趣。他们提供了由中国等竞争对手控制的支付系统的替代方案,并可能成为美国T-Bills的主要买家。财政部长斯科特·贝斯特(Scott Bessent)不断提及这一点。

Fiserv, PayPal, and Interoperability

Fiserv,PayPal和互操作性

The collaboration between Fiserv and PayPal to build interoperability between FIUSD and PayPal USD (PYUSD) is a huge step. This will allow consumers and businesses to move funds domestically and internationally, expanding the use of stablecoins and programmable payments globally.

Fiserv与PayPal之间建立Fiusd和PayPal USD(PYUSD)之间互操作性的合作是巨大的一步。这将使消费者和企业能够在国内和国际上迁移资金,从而扩大了全球范围内使用Stablecoins和可编程付款的使用。

Bitcoin's

比特币的

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 加密货币:破坏性的购买超越炒作

- 2025-06-25 04:45:12

- 忘记短暂的模因硬币。发现像Little Pepe,Unstake和渲染的加密货币一样,它们具有真正的实用性和破坏性的潜力。

-

-

-

- JPMORGAN,区块链和JPMD代币:链融资的量子飞跃?

- 2025-06-25 05:05:13

- 探索Coinbase的基本区块链和BTQ的量子安全稳定解决方案上的JPMorgan的JPMD令牌飞行员。

-

-

- 比特币,加密,停火:救济集会还是停顿?

- 2025-06-25 05:12:16

- 特朗普的停火宣布引发了加密集会,但这是可持续的吗?我们深入研究了最新的趋势,从比特币的激增到模因硬币躁狂症,并带有纽约的扭曲。

-

- 加密货币将于2025年6月进行爆炸性增长:您需要知道什么

- 2025-06-25 05:12:16

- 获取在2025年6月能够爆炸性增长的加密货币上的内部勺子。

-

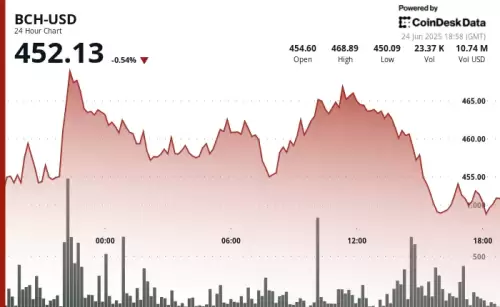

- 比特币现金(BCH)公牛眼钥匙阻力水平:它会突破吗?

- 2025-06-25 05:32:14

- 比特币现金(BCH)又重新亮相,测试了关键阻力水平。它会维持其动力并突破吗?让我们深入研究分析。

-

- ETH的看涨前景面临着薄弱的需求:纽约市的观点

- 2025-06-25 05:46:12

- 尽管最近激增,但在低收入和竞争不断上升的情况下,ETH的需求疲软而挣扎。看涨的未来仍然有可能吗?