|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

这包括但不仅限于每个加密证券的单位,以下其他用交易符号AAVE,ADA,ALGO,AMP,APE描述

Regulators in Oregon have expanded the legal assault on crypto firms, taking direct aim at Coinbase for allegedly enabling the unlawful trading of 31 crypto tokens.

俄勒冈州的监管机构扩大了对加密货币公司的法律攻击,直接针对Coinbase涉嫌实现了31个加密代币的非法交易。

The complaint, filed on April 19 by Oregon officials, claims that Coinbase’s main trading platform and its Prime service allowed users in the state to buy and sell dozens of tokens that Oregon considers to be unregistered securities.

俄勒冈州官员于4月19日提交的投诉声称,Coinbase的主要交易平台及其主要服务使该州的用户可以买卖数十种俄勒冈州认为是未注册的证券的代币。

The filing names 31 crypto tokens, prompting commentary from crypto policy experts on the case’s breadth. Justin Slaughter, vice president of regulatory affairs at Paradigm and former senior adviser at the U.S. Securities and Exchange Commission (SEC) and chief policy adviser at the Commodity Futures Trading Commission (CFTC), noted the vast number of tokens covered.

归档名称31加密代币,促使加密政策专家对案件的广度发表评论。范式监管事务副总裁贾斯汀·斯劳特(Justin Slaughter),美国证券交易委员会(SEC)的前高级顾问,商品期货交易委员会(CFTC)的首席政策顾问,指出了大量的代币。

“The Oregon AG suit … actually covers many more tokens than the SEC complaint did, with 31 tokens claimed to be unregistered securities, including UNI, AAVE, FLOW, LINK, MKR, and even XRP,” he stated on social media platform X on April 21.

他在4月21日在社交媒体平台X上说:“俄勒冈州AG诉讼实际上比SEC投诉涵盖了更多的代币,有31个令牌声称是未注册的证券,包括Uni,Aave,Flow,Link,Link,MKR,MKR甚至XRP。”

The legal complaint asserts that Coinbase violated state securities laws by offering and facilitating the trading of these tokens without proper registration.

法律投诉断言,Coinbase通过在没有适当注册的情况下提供和促进这些令牌的交易来违反了州证券法。

“Coinbase—through the Coinbase Platform and Prime—has made available for trading in Oregon crypto assets that are offered and sold as investment contracts, and thus as securities,” reads the complaint.

投诉说:“通过Coinbase平台和Prime,Coinbase可以在俄勒冈州加密货币资产上进行交易,这些资产可作为投资合同提供和出售。”

It further alleges: “Coinbase has participated or materially aided in the purchase or sale of unregistered crypto securities by Oregon customers.”

它进一步指控:“ Coinbase已参与或实质上有助于俄勒冈州客户购买或出售未注册的加密证券。”

These assets were allegedly bought and sold for U.S. dollars, other fiat currencies, and cryptocurrencies, with consistent pricing across platforms.

据称,这些资产以美元,其他法定货币和加密货币的价格购买和出售,跨平台的价格始终如一。

As described in the complaint: “Each unit of a particular crypto asset on the Coinbase Platform, or made available through Prime, including but not limited to each of the crypto securities, trades at the same price as another unit of that same asset.”

如投诉中所述:“ Coinbase平台上特定加密资产的每个单位,或通过Prime提供,包括但不限于每种加密货币证券,以与同一资产的另一个单位相同的价格进行交易。”

The Oregon complaint includes a detailed list of tokens that Oregon considers to be unregistered securities. It states:

俄勒冈州的投诉包括俄勒冈州认为是未注册证券的详细令牌。它指出:

This includes, but is not limited to, the units of each of the crypto securities further described below with trading symbols AAVE, ADA, ALGO, AMP, APE, ATOM, AVAX, AXS, CHZ, COMP, DASH, DDX, EOS, FIL, FLOW, ICP, LCX, LINK, MATIC, MIR, MKR, NEAR, POWR, RLY, SAND, SOL, UNI, VGX, wLUNA, XRP, and XYO (the ‘crypto securities’).

This includes, but is not limited to, the units of each of the crypto securities further described below with trading symbols AAVE, ADA, ALGO, AMP, APE, ATOM, AVAX, AXS, CHZ, COMP, DASH, DDX, EOS, FIL, FLOW, ICP, LCX, LINK, MATIC, MIR, MKR, NEAR, POWR, RLY, SAND, SOL, UNI, VGX, wLUNA, XRP,和Xyo(“加密证券”)。

The SEC has dropped its lawsuits against both Coinbase and Ripple Labs, signaling a shift in regulatory approach.

SEC已针对Coinbase和Ripple Labs提起诉讼,这表明监管方法发生了变化。

The SEC’s case against Coinbase, which began in June 2023 with allegations of operating as an unregistered securities exchange, was dismissed without any fines or changes to Coinbase’s business model.

SEC针对Coinbase的案件始于2023年6月,指控作为未注册的证券交易所运营,而没有对Coinbase的商业模式进行任何罚款或更改。

Similarly, the long-standing lawsuit against Ripple, which began in December 2020 and centered on the classification of XRP as an unregistered security, concluded in March 2025, with the SEC dropping its appeal following a partial court victory for Ripple in 2023.

同样,针对Ripple的长期诉讼始于2020年12月,并以XRP为中心为未注册的安全性,于2025年3月结束,在2023年为Ripple取得部分法院胜利后,SEC撤销了其上诉。

As state-level actions increasingly target crypto firms, many in the industry are calling for consistent federal legislation to avoid a fragmented regulatory landscape that could hinder innovation and growth.

随着州级行动越来越多地针对加密公司,该行业的许多人呼吁始终如一的联邦立法,以避免零散的监管景观,这可能会阻碍创新和增长。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 比特币的售价超过$ 90K,以太坊和山寨币现很出色的收益

- 2025-04-25 17:55:13

- 全球加密货币市场继续反映出看涨的情绪,比特币保持稳定的立场高于93,000美元。

-

- 分析师说

- 2025-04-25 17:55:13

- 一位广泛关注的加密分析师说,比特币(BTC)可能在看跌逆转之前向上行进程。

-

-

- SUI区块链的本地令牌SUI本周飙升了62%以上

- 2025-04-25 17:50:13

- SUI区块链的原住民令牌SUI本周飙升了62%以上,这是由于猜测与Pokémon的潜在合作所推动。

-

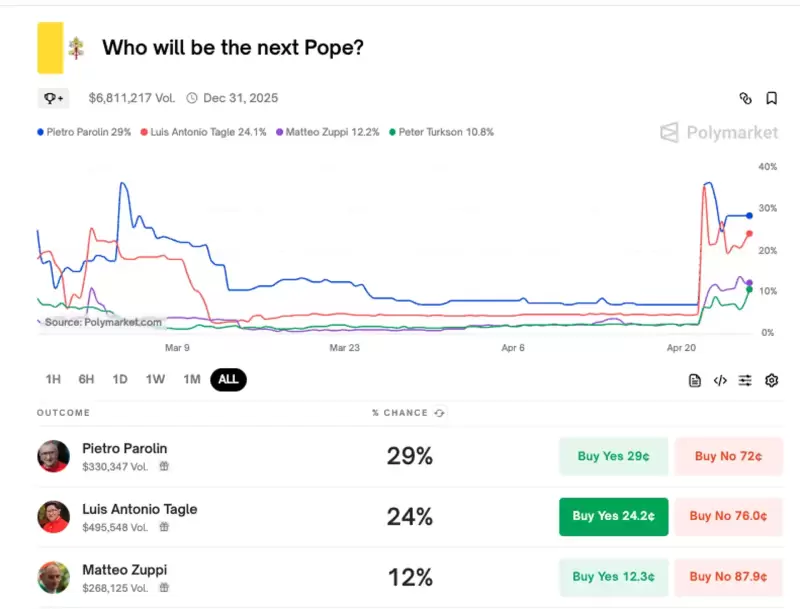

- 多聚市场捕获

- 2025-04-25 17:45:13

- 由于预计将在下个月举行的“结论”(教皇选举秘密会议)选举下一届教皇时,围绕教皇候选人主题的Meme Coins引起了人们的关注。

-

-

-

- DraftKings支付1000万美元以解决NFT证券集体诉讼

- 2025-04-25 17:40:13

- 流行的体育博彩和幻想体育公司Draftkings已同意达成1000万美元的和解,以解决集体诉讼

-