|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

自 2009 年推出以来,领先的加密货币比特币已经取得了显着的发展,并稳步赢得了主流企业的关注。

The National Center for Public Policy Research (NCPPR) is reportedly continuing its efforts to promote Bitcoin (BTC) proposals for major tech companies, aiming to integrate the leading cryptocurrency into their corporate strategies.

据报道,国家公共政策研究中心(NCPPR)正在继续努力向大型科技公司推广比特币(BTC)提案,旨在将领先的加密货币纳入其企业战略。

According to a recent report from The Block, the NCPPR, a conservative think tank, is currently engaged in discussions with a “major” company for a potential Bitcoin initiative. However, the identity of the company remains undisclosed.

根据 The Block 最近的一份报告,保守派智库 NCPPR 目前正在与一家“大”公司讨论潜在的比特币计划。然而,该公司的身份仍未公开。

In its latest push for Bitcoin adoption, the NCPPR is said to be expressing concerns about financial markets being used to suppress individual freedoms. The entity argues that Bitcoin can serve as a protection for corporations against inflation.

据说,在最新推动比特币采用的过程中,NCPPR 表达了对金融市场被用来压制个人自由的担忧。该实体认为,比特币可以为企业抵御通货膨胀提供保护。

Earlier this year, the NCPPR submitted a proposal to e-commerce giant Amazon for consideration at the 2025 annual shareholder meeting, urging the company to allocate at least 5% of its assets into Bitcoin. The proposal will be put to a vote by Amazon shareholders at the upcoming meeting in April.

今年早些时候,NCPPR 向电商巨头亚马逊提交了一份提案,供 2025 年年度股东大会审议,敦促该公司将至少 5% 的资产配置为比特币。该提案将由亚马逊股东在四月份即将召开的会议上进行投票。

The move follows a previous attempt by a group of Amazon shareholders to get the company to add Bitcoin to its balance sheet at the 2023 annual shareholder meeting. Despite projections of substantial market growth, Microsoft shareholders ultimately voted against a proposal that would have seen the company integrate Bitcoin into its balance sheet.

此前,亚马逊的一群股东曾试图让该公司在 2023 年年度股东大会上将比特币添加到其资产负债表中。尽管预计市场将大幅增长,但微软股东最终投票反对该公司将比特币纳入其资产负债表的提议。

The company’s board had recommended a “no” vote on the proposal, arguing that it was not in the best interests of Microsoft or its shareholders. After the rejection, Bitcoin’s price briefly dropped to $94,000 but later recovered to $96,400.

该公司董事会建议对该提案投“反对”票,认为这不符合微软或其股东的最佳利益。被拒绝后,比特币的价格一度跌至 94,000 美元,但随后回升至 96,400 美元。

Currently, the largest publicly traded companies that are known to be holding Bitcoin on their balance sheets are mainly crypto-related firms, such as Coinbase and MicroStrategy. In these cases, Bitcoin has been touted as a way for companies to diversify their corporate reserves and embrace innovative financial strategies.

目前,资产负债表上持有比特币的最大上市公司主要是加密相关公司,例如 Coinbase 和 MicroStrategy。在这些情况下,比特币被吹捧为公司实现公司储备多元化和采用创新财务策略的一种方式。

According to the MicroStrategy Tracker, the company’s Bitcoin holdings are valued at over $40 billion, which reportedly translates to an estimated profit of around $17 billion for MicroStrategy.

据 MicroStrategy Tracker 称,该公司持有的比特币价值超过 400 亿美元,据报道,这意味着 MicroStrategy 的预计利润约为 170 亿美元。

Top 4 Publicly Traded Companies Holding Bitcoin on Their Balance Sheets

资产负债表上持有比特币的四大上市公司

According to data from Bitcoin Treasuries, here are the top 4 publicly traded companies that are known to be holding Bitcoin on their balance sheets, as of March 2023:

根据 Bitcoin Treasuries 的数据,截至 2023 年 3 月,已知资产负债表上持有比特币的前 4 家上市公司如下:

1. Coinbase Global (NASDAQ:COIN) - 4,744 BTC

1.Coinbase Global(纳斯达克股票代码:COIN)- 4,744 BTC

2. MicroStrategy (NASDAQ:MSTR) - 132,500 BTC

2.MicroStrategy(纳斯达克股票代码:MSTR)- 132,500 BTC

3. Galaxy Digital (TSX:GLXY) - 16,400 BTC

4. Block (NYSE:SQ) - 88 BTC, 294 BTC Class A common stock, and 143 Class C common stock

4. Block (NYSE:SQ) - 88 BTC、294 BTC A 类普通股和 143 BTC C 类普通股

It's worth noting that these holdings may have changed since the last reported update. Additionally, there could be other publicly traded companies that hold Bitcoin but have not disclosed their holdings.

值得注意的是,自上次报告更新以来,这些持股可能已发生变化。此外,可能还有其他上市公司持有比特币,但尚未披露其持有量。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 以太坊,玛加科因财务和通货膨胀:加密投资者重点的转变

- 2025-07-02 10:30:12

- 以太坊和雪崩表现出冷却的迹象,因为玛加科因金融获得了吸引力。在市场谨慎的情况下,投资者正在探索以叙事驱动的新机会。

-

-

-

- USDC采矿与云采矿:2025年解锁每日奖励

- 2025-07-02 09:15:12

- 探索2025年USDC采矿和云采矿的兴起,重点关注DRML矿工等平台,这些平台可提供每日奖励和可访问的加密货币收益。

-

- XRP,云采矿和2025市场:纽约人的拍摄

- 2025-07-02 08:30:12

- 探索XRP在云采矿和2025市场中的作用。查找Hashj和DRML矿工等平台如何改变游戏,从而提供稳定性和轻松。

-

-

-

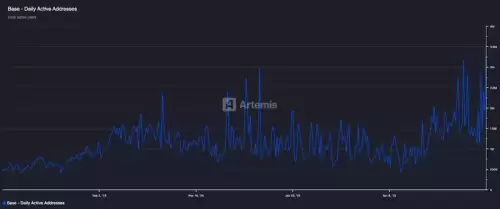

- 基地的链叙事:Bitmart研究深度潜水

- 2025-07-02 08:50:12

- BITMART研究分析了Base的爆炸性增长,不断发展的叙述以及机构一致性,突显了其在弥合传统金融和Web3中的作用。