|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密货币新闻

Liquid Restaking Token (LRT) netflows have overturned movements after EigenLayer introduced its slashing mechanism

2025/05/02 09:00

Liquid Restaking Token (LRT) netflows have overturned their past downturn movements after EigenLayer introduced its slashing mechanism, according to metrics reported today by the IntoTheBlock.

This past Monday, EigenLayer, the leading liquid restaking protocol in the crypto market, announced the launch of its slashing mechanism, designed to penalize stakers and users who violate the restaking platform’s rules, strengthening integrity and accountability within the network.

This launch has triggered increased demand for LRT protocols, with funds inflows moving proportionately. Among the major LRT protocols, EtherFi registered inflows of more than $45 million after the slashing feature’s launch.

Other LRT protocols, such as Rocket Pool and Lido, experience continuing outflows. Rocket Pool recorded an outflow of $8 million following the launch, while Lido registered a loss of $12 million.

This shift showcases investors’ preference for EtherFi, potentially due to its superior yield returns and user-friendly trading platform.

While EtherFi’s TVL has increased by 18% in the past 2 days, climbing to $1.2 billion as of today, the TVL of the wider LRT market surged by only 5% during the same timeline, currently standing at $3.8 billion.

This event highlights the evolving nature of DeFi markets, where protocol-focused projects can quickly attract investor sentiment and shift money movements. The event provides traders with a great chance to engage with LRT assets and take advantage of the price performance of EtherFi’s primary asset, ETHFI, which recorded a price increase of 12% from yesterday.

In the rapidly growing DeFi market, EigenLayer paves the way as a revolutionary protocol that brings a narrative called restaking service to the market. On EigenLayer, crypto users can reuse their staked ETH on the Ethereum protocol and earn extra rewards by securing networks of other services, popularly known as AVS (Actively Validation Services) like Eigenpie, EtherFI, and others, like the ones named above.

According to metrics from DefiLlama, the TVL of Liquid Restaking Token (LRT) on Ethereum currently stands at $$3.8 billion. This figure could rise in the coming months as increasing number of ETH stakers continue to diversify their holdings in various DeFi platforms to earn extra income.

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- Pepe Coin的疯狂旅程:市场下降还是购买机会?

- 2025-06-21 00:25:13

- 随着价格下降,佩佩硬币面临着关键的时刻。是时候购买蘸酱了,还是不可避免的市场下跌?让我们深入研究分析。

-

-

-

- 金币,稀有,马:钱币综述

- 2025-06-20 22:45:13

- 从查尔斯二世几内亚到凯斯花园50ps,发掘了稀有的金币,以及他们讲的有趣的故事。另外,津巴布韦的黄金硬币计划停止。

-

-

-

-

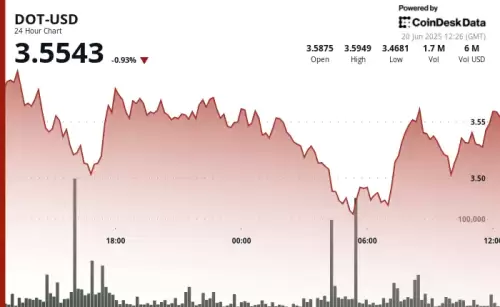

- Polkadot的点:导航三重底部和看涨逆转

- 2025-06-20 23:25:12

- Polkadot的点显示了弹性,在击中潜在的三重底部后形成了看涨的逆转模式。这是大规模集会的开始吗?

-