|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jellyverse 是 Sei 区块链上的去中心化交易所 (DEX),过去一个月锁定的总价值 (TVL) 增加了两倍,达到创纪录的 1320 万美元

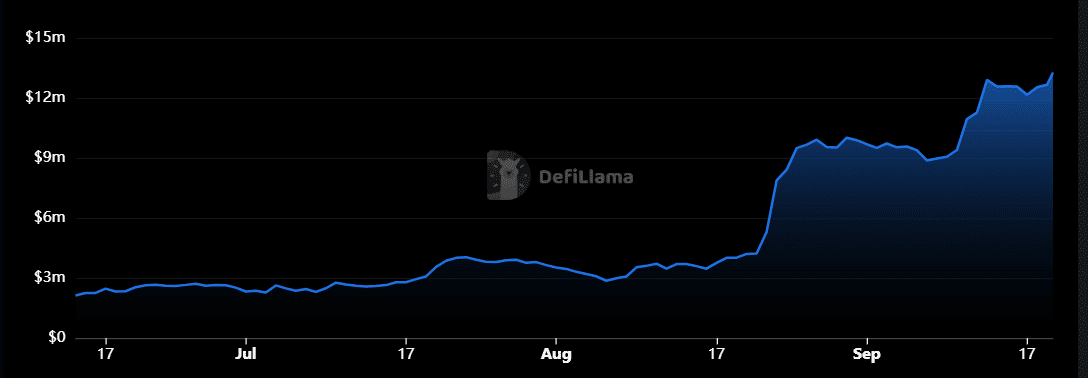

Jellyverse, a decentralized exchange (DEX) on the Sei blockchain, has seen a threefold increase in its total value locked (TVL) over the past month, reaching a record $13.2 million as of this writing.

Jellyverse 是 Sei 区块链上的去中心化交易所 (DEX),过去一个月其锁定总价值 (TVL) 增长了三倍,截至撰写本文时达到创纪录的 1320 万美元。

The DEX ranks as the second-best monthly performer among the Sei-supported DeFi applications. Thanks to its rapid growth, Jellyverse has become the second-largest DEX on Sei after Dragon Swap, whose TVL crossed the $20 million mark earlier today.

在 Sei 支持的 DeFi 应用程序中,DEX 的月度表现排名第二。由于其快速增长,Jellyverse 已成为 Sei 上第二大 DEX,仅次于 Dragon Swap,其 TVL 今天早些时候突破了 2000 万美元大关。

Launched in mid-June, Jellyverse is a Sei-focused DEX platform that was forked from Balancer V2. The broader ecosystem also consists of staking and synthetics protocols. Synthetics are tokenized versions of real-world assets, such as company shares, bonds, or commodities.

Jellyverse 于 6 月中旬推出,是一个专注于 Sei 的 DEX 平台,是从 Balancer V2 分叉出来的。更广泛的生态系统还包括质押和合成协议。合成资产是现实世界资产的代币化版本,例如公司股票、债券或商品。

The DEX hosts two three-token pools, one focused on USD stablecoins that generates an annual percentage rate (APR) of 9.7%, and another one offering exposure to Ethereum at reward rates of over 16% per year.

DEX 拥有两个三代币池,一个专注于美元稳定币,年利率 (APR) 为 9.7%,另一个提供以太坊投资,年回报率超过 16%。

The standard pools consist of token pairs that include its native JLY token, as well as wrapped FRAX, SEI (WSEI), USDC, wrapped Ethereum (WETH), and USDT, among others, with APR figures ranging from 13% to over 137%.

标准池由代币对组成,其中包括其原生 JLY 代币,以及打包的 FRAX、SEI (WSEI)、USDC、打包的以太坊 (WETH) 和 USDT 等,年利率范围从 13% 到超过 137% 。

FRAX and WSEI each have $2 million in TVL, followed by USDC, USDT, SFRAX, FRXETH, and SFRXETH.

FRAX 和 WSEI 的 TVL 各为 200 万美元,其次是 USDC、USDT、SFRAX、FRXETH 和 SFRXETH。

Daily trading volume on Jellyverse reached a record high of $802,300 on September 18, with total cumulative volume nearing $25 million.

9 月 18 日,Jellyverse 日交易量达到 802,300 美元的历史新高,累计总交易量接近 2500 万美元。

Meanwhile, the Sei blockchain is expanding its footprint in the decentralized finance (DeFi) sector, emerging as the best monthly performer among the top 90 blockchains by TVL.

与此同时,Sei 区块链正在扩大其在去中心化金融 (DeFi) 领域的足迹,成为 TVL 排名前 90 的区块链中月度表现最佳的区块链。

On Thursday, September 18, it surpassed the $150 million mark, reaching a new record of $154.5 million as of this writing. Earlier this month, we reported on Sei’s $115 million milestone.

9 月 18 日星期四,它突破了 1.5 亿美元大关,在撰写本文时达到了 1.545 亿美元的新纪录。本月早些时候,我们报道了 Sei 的 1.15 亿美元里程碑。

Sei is a high-speed Cosmos-based layer 1 blockchain that is geared towards DeFi and trading. It is also the first parallelized EVM blockchain, enabling it to serve as a scaling solution.

Sei 是一个基于 Cosmos 的高速第一层区块链,面向 DeFi 和交易。它也是第一个并行 EVM 区块链,使其能够作为扩展解决方案。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 哈萨克斯坦的加密飞跃:比特币ETF和中亚的数字融资未来

- 2025-08-13 11:59:45

- 哈萨克斯坦通过现场比特币ETF和创新营销在中亚的加密货币场景中大放异彩。看看它的影响。

-

-

-

- 比特币的疯狂骑行:集会,回调,接下来是什么

- 2025-08-13 09:00:19

- 比特币最近在回调之前飙升至122,000美元。检查市场量和链上数据,揭示了对比特币集会和潜在未来的见解。

-

- 比特币,Bitmax和机构需求:加密投资的新时代

- 2025-08-13 08:58:33

- 探索Bitmax的比特币扩展和更广泛的机构采用如何重塑加密货币景观,这是由战略投资和不断发展的法规驱动的。

-

-

- 乘坐加密浪潮:NFTS,DEFI和市场高4.2吨

- 2025-08-13 08:30:46

- 探索加密货币市场的最新趋势,包括NFTS的激增,Defi Innovations和主要见解,推动了该市场的售价4.2吨。

-

- 冷钱包:现金返还,加密货币和像老板一样的汽油费

- 2025-08-13 08:20:49

- 冷钱包改变了游戏。获得汽油,掉期等的现金返还。这是我们所知道的高加密费的终结吗?让我们潜入!

-