|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

贝莱德的ibit不仅是另一个ETF。这是一台创收的机器,正在震撼财务世界。找出该比特币ETF的表现如何胜过巨人。

IBIT Takes the Crown: BlackRock's Bitcoin ETF Dominates the Revenue Game

ibit夺冠:贝莱德的比特币ETF主导了收入游戏

BlackRock's Bitcoin ETF, IBIT, has rapidly ascended to become a top revenue generator for the firm. Launched just recently, it's already outperforming some of BlackRock's most established funds. Let's dive into the story of IBIT's meteoric rise.

贝莱德的比特币ETF IBIT已迅速上升,成为该公司的最高收入。刚刚推出,它已经超过了贝莱德最成熟的资金。让我们深入了解Ibit迅速崛起的故事。

IBIT: A Revenue-Generating Powerhouse

IBIT:创收的电力公司

IBIT's performance is nothing short of remarkable. Despite being relatively new, this Bitcoin ETF has quickly climbed the ranks to become BlackRock's third-largest revenue-generating fund. It's raking in an estimated $191 million in annualized revenue, trailing only slightly behind the top spot.

IBIT的表现简直是出色。尽管相对较新,但这个比特币ETF迅速升级了排名,成为贝莱德的第三大收入基金。它的年收入估计为1.91亿美元,仅落后于最高点。

With over $76 billion in assets and a 0.25% expense ratio, IBIT has surpassed even larger funds like IVV in revenue contribution. This highlights the growing demand for crypto-linked investment vehicles and suggests that digital assets are becoming a key component of BlackRock's ETF strategy.

IBIT拥有超过760亿美元的资产和0.25%的费用比率,超过了更大的资金,例如IVV的收入供款。这凸显了对加密链接投资工具的需求不断增长,并表明数字资产已成为BlackRock ETF策略的关键组成部分。

Outperforming the Giants

超越巨人

To put IBIT's success into perspective, consider BlackRock's S&P 500 ETF, IVV. While IVV boasts over $627 billion in assets, its lower expense ratio of 0.03% limits its revenue to around $188 million. IBIT, on the other hand, generates more revenue with significantly fewer assets, showcasing the power of its fee structure and the intense investor interest in Bitcoin exposure.

为了将IBIT的成功置于透视上,请考虑BlackRock的标准普尔500 ETF,IVV。尽管IVV拥有超过6.27亿美元的资产,但其较低的费用比率为0.03%,其收入限制为约1.88亿美元。另一方面,IBIT产生了更多的收入,资产的收入大大减少,展示了其费用结构的能力以及对比特币敞口的强烈投资者兴趣。

BlackRock's Bitcoin Accumulation

贝莱德的比特币积累

BlackRock's commitment to Bitcoin is evident in its aggressive accumulation strategy. In June alone, the firm added approximately $3.85 billion worth of BTC to its holdings. This steady accumulation aligns with the growing success of IBIT, which continues to dominate the U.S. spot Bitcoin ETF landscape.

贝莱德对比特币的承诺在其积极的积累策略中很明显。仅在6月,该公司就其持股增加了约38.5亿美元的BTC。这种稳定的积累与IBIT的日益增长的成功保持一致,IBIT继续占据了美国比特币ETF景观的主导地位。

As of now, BlackRock's BTC portfolio holds over 696,874 Bitcoin, valued at approximately $80.7 billion. This substantial investment underscores BlackRock's belief in the long-term potential of Bitcoin and its commitment to providing investors with access to this burgeoning asset class.

截至目前,BlackRock的BTC投资组合持有696,874比特币,价值约为807亿美元。这项大量投资强调了贝莱德对比特币长期潜力的信念及其对为投资者提供这种新兴资产类别的承诺。

The Future of Crypto ETFs

加密ETF的未来

IBIT's success story is a testament to the transformative power of crypto ETFs. These innovative investment vehicles are making it easier than ever for institutional and retail investors to gain exposure to Bitcoin and other digital assets. As regulatory clarity improves and competition intensifies, we can expect to see even more exciting developments in the crypto ETF space.

Ibit的成功故事证明了加密ETF的变革力量。这些创新的投资工具使机构和散户投资者更容易获得对比特币和其他数字资产的影响。随着法规清晰度的提高和竞争的加剧,我们可以期望看到加密ETF领域的更令人兴奋的发展。

Final Thoughts

最后的想法

So, what does all this mean? BlackRock's IBIT is not just another ETF; it's a game-changer. It's proving that Bitcoin is here to stay and that institutional investors are taking it seriously. Keep an eye on IBIT – it's only just getting started, and who knows? Maybe you'll want to grab a slice of this pie. Cheers!

那么,这意味着什么?贝莱德的ibit不仅是另一个ETF。这是一个改变游戏规则的人。证明比特币将留在这里,机构投资者正在认真对待它。密切关注IBIT - 只是刚开始,谁知道?也许您需要抓住这个馅饼。干杯!

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 房子,特朗普比尔,比特币集会:宏观和加密货币的纽约分钟

- 2025-07-04 10:30:12

- 特朗普的法案激发了比特币的嗡嗡声!了解财政政策,清洁能源削减和模因硬币躁狂症如何在永远野生的加密世界中交织在一起。

-

- 硬币大师免费旋转:您的日常链接(2025年7月)

- 2025-07-04 10:50:12

- 每天链接中的硬币大师中无旋转!本指南涵盖了2025年7月的主动链接,向您展示了如何兑换它们以获取额外的游戏玩法。

-

-

- 2025年7月的AltCoins:市场动力和首选

- 2025-07-04 11:10:12

- 参与2025年7月的Altcoin市场,探索有准备增长的动力,关键趋势和出色的表演者。

-

-

-

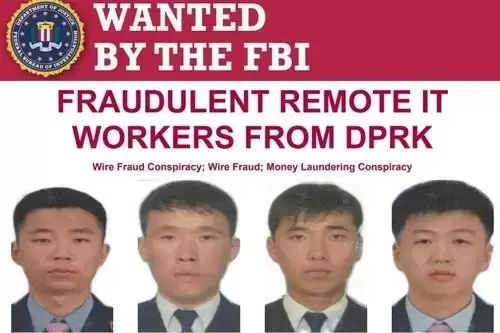

- 平壤在压力下:看美国起诉书和朝鲜演员

- 2025-07-04 08:30:12

- 解码美国对朝鲜人的最新起诉以及他们对平壤策略的揭示。

-

-

- Robinhood的风险游戏:假代币,真正的麻烦?

- 2025-07-04 09:10:14

- Robinhood进入令牌化资产的企业引发了争议,因为Openai距离“假”令牌距离,引发了有关风险和透明度的疑问。