|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

香港将成为Stablecoin创新的枢纽,因为它准备向合格的发行人颁发许可证,这标志着数字融资法规的重要一步。

Hong Kong is stepping into the future of finance, ready to issue stablecoin licenses to qualified companies. This move highlights Hong Kong's dedication to fostering a responsible and innovative digital asset landscape. Let's dive into what this means for the future of stablecoins in the region.

香港正在踏入金融的未来,随时准备向合格公司颁发Stablecoin许可证。此举强调了香港致力于培养负责任的创新数字资产环境。让我们深入了解这对该地区的Stablecoins的未来意味着什么。

Hong Kong Prepares to Issue Stablecoin Licenses

香港准备签发Stablecoin许可证

Hong Kong's Financial Secretary, Paul Chan Mo-po, announced that the Hong Kong Monetary Authority (HKMA) will begin issuing licenses for stablecoin issuers in the coming months. This follows the passage of the Stablecoins Ordinance on May 21, which requires any entity issuing fiat-referenced stablecoins (FRS), including those pegged to the Hong Kong Dollar (HKD), to obtain a license from the HKMA.

香港的财政秘书保罗·陈·莫波(Paul Chan Mo-Po)宣布,香港货币管理局(HKMA)将在未来几个月内开始为Stablecoin发行人颁发许可证。这是在5月21日通过《稳定条例》的通过之后,该法令要求发行菲亚特引用的稳定股(FRS)的任何实体,包括与香港美元(HKD)挂钩的实体,以从HKMA获得许可证。

Key Aspects of the Stablecoins Ordinance

Stablecoins条例的关键方面

The Stablecoins Ordinance, set to take effect on August 1, 2025, will allow licensed entities to offer FRS in Hong Kong. Retail investors will have access to tokens issued only by these qualified institutions. The ordinance aims to enhance regulatory oversight, promote innovation, and ensure “responsible, sustainable” development within the digital assets sector.

定于2025年8月1日生效的Stablecoins条例将允许获得许可的实体在香港提供FRS。散户投资者将只能使用这些合格机构发行的代币。该条例旨在增强监管监督,促进创新,并确保数字资产部门内“负责,可持续”的发展。

Major Firms Eyeing Stablecoin Adoption

主要公司关注稳定的采用

Several companies have already applied for the HKMA license, including logistics technology firm Reitar Logtech and Ant Group. JD.com, through its fintech arm JD Coinlink, has been testing HKD-pegged tokens under the regulator’s sandbox program and aims to secure a license by early Q4 2025.

几家公司已经申请了HKMA许可证,包括物流技术公司Reitar LogTech和Ant Group。 JD.com通过其Fintech Arm JD Coinlink,一直在监管机的沙盒计划下测试HKD-PEGGGEGGGENS令牌,并旨在在第四季度2025年初获得许可证。

Hong Kong's Phased Approach

香港的分阶段方法

The Hong Kong government is taking a step-by-step approach to develop the sector, starting with the regulation of fiat-backed stablecoins. The second phase may involve stablecoins linked to other assets that are “integrated with the real economy,” focusing on practical use cases rather than speculative instruments.

香港政府正在采取逐步的方法来发展该行业,首先是对菲亚特支持的稳定的稳定者的监管。第二阶段可能涉及与“与实际经济融为一体”的其他资产相关的稳定币,重点是实用用例,而不是投机仪器。

Why Stablecoins Matter

为什么稳定剂很重要

Stablecoins, particularly those referenced to fiat currencies, have numerous use cases, including enhancing efficiency and reducing costs for cross-border payments. Hong Kong's move aims to strike a balance between innovation and financial security, building public trust in digital assets.

稳定币,尤其是那些提到法定货币的稳定币,有许多用例,包括提高效率和降低跨境支付的成本。香港的举动旨在在创新与金融安全之间取得平衡,建立公众对数字资产的信任。

Hong Kong as a Digital Finance Hub

香港作为数字金融枢纽

Hong Kong is positioning itself as a global leader in digital asset regulation. The city has already licensed 10 trading platforms and has several more awaiting investigation. Industry leaders believe that clear regulations will attract greater institutional participation and transform the region into a crypto innovation hotspot.

香港将自己定位为数字资产法规的全球领导者。该市已经获得了10个交易平台许可,并进行了一些正在等待的调查。行业领导人认为,明确的法规将吸引更多的机构参与,并将该地区转变为加密创新热点。

My Take: Hong Kong's Strategic Move

我的看法:香港的战略举动

Hong Kong's proactive approach to regulating stablecoins is a smart move. By focusing on fiat-backed tokens first, they're laying a solid foundation for broader digital asset adoption. This measured approach, combined with the interest from major firms, suggests Hong Kong is serious about becoming a key player in the digital finance world. The emphasis on real-world use cases over speculation should foster a more stable and sustainable ecosystem.

香港积极的调节Stablecoins的方法是明智的举动。首先要专注于菲亚特支持的代币,他们为采用更广泛的数字资产奠定了坚实的基础。这种测得的方法,加上主要公司的兴趣,表明香港很认真地成为数字金融界的关键参与者。对现实世界用例的强调而不是猜测,应该促进一个更稳定和可持续的生态系统。

Stablecoin Summer and Beyond

Stablecoin夏季及以后

As Hong Kong gears up to issue stablecoin licenses, it joins the broader “Stablecoin Summer” trend. With Circle's USDC supply surging and major players like Tron DAO and Kraken Exchange embracing stablecoins, the future looks bright. Stablecoins are increasingly powering real-world assets, DeFi yield farming, and cross-border payments, making them an integral part of the evolving financial landscape.

随着香港的努力颁发Stablecoin许可,它加入了更广泛的“ Stablecoin Summer”趋势。随着Circle的USDC供应激增,Tron Dao和Kraken Exchange等主要参与者拥抱Stablecoins,未来看起来很光明。 Stablecoins越来越多地为现实世界中的资产提供动力,Defi Trobled养殖和跨境支付,使其成为不断发展的金融景观不可或缺的一部分。

So, keep your eyes peeled! Hong Kong's stablecoin scene is about to heat up, and it promises to be an exciting ride. Who knows? Maybe we'll all be paying for our dim sum with HKD-pegged stablecoins before we know it!

因此,请保持眼睛剥皮!香港的Stablecoin场景即将升温,这有望成为激动人心的旅程。谁知道?也许我们所有人都会用HKD-Peggged Stablecoins支付点心!

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 加密货币:破坏性的购买超越炒作

- 2025-06-25 04:45:12

- 忘记短暂的模因硬币。发现像Little Pepe,Unstake和渲染的加密货币一样,它们具有真正的实用性和破坏性的潜力。

-

-

-

- JPMORGAN,区块链和JPMD代币:链融资的量子飞跃?

- 2025-06-25 05:05:13

- 探索Coinbase的基本区块链和BTQ的量子安全稳定解决方案上的JPMorgan的JPMD令牌飞行员。

-

-

- Hedera Price:趋势逆转还是下降趋势延续?

- 2025-06-25 06:05:12

- Hedera(HBAR)是否准备好看好逆转,还是下降趋势会持续存在?分析最新的价格动作和关键阻力水平。

-

- 比特币,加密,停火:救济集会还是停顿?

- 2025-06-25 05:12:16

- 特朗普的停火宣布引发了加密集会,但这是可持续的吗?我们深入研究了最新的趋势,从比特币的激增到模因硬币躁狂症,并带有纽约的扭曲。

-

- 加密货币将于2025年6月进行爆炸性增长:您需要知道什么

- 2025-06-25 05:12:16

- 获取在2025年6月能够爆炸性增长的加密货币上的内部勺子。

-

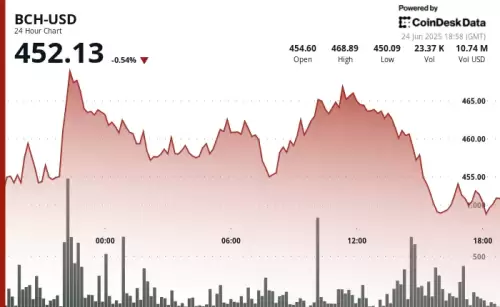

- 比特币现金(BCH)公牛眼钥匙阻力水平:它会突破吗?

- 2025-06-25 05:32:14

- 比特币现金(BCH)又重新亮相,测试了关键阻力水平。它会维持其动力并突破吗?让我们深入研究分析。