|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密货币新闻

As Global Trade Tensions Intensify, Investors Scramble for Safe Havens, Sending Gold Prices Soaring to Historic Highs

2025/05/02 01:11

Global financial markets experienced a week of seismic shifts as investors grappled with intensifying trade tensions and macroeconomic uncertainty. Among the key changes, gold prices soared to new highs, while gasoline prices continued their decline.

As the US administration escalated its trade war with China, announcing new tariffs of 145% on a vast range of Chinese goods, macroeconomic risk appetite soured. This was particularly evident with the massive sell-off in long-dated US Treasurys, a move that typically occurs during market crises, not during periods of recovery.

The 10-year Treasury yield spiked to 4.56%, the highest since February, as confidence in US economic policies dwindled. In a surprising turn of events, safe-haven assets like US bonds and the dollar showed unexpected volatility, leading many to question the wisdom of current policy decisions.

However, this inconsistency also created opportunities. With optimism in US assets waning rapidly, investors found solace in gold, which surged to its strongest weekly performance since 2020. Futures prices for the yellow metal soared above $3,200 per ounce.

The shift to gold occurred as several countries, including Vietnam and the Philippines, were granted a 90-day tariff reprieve by the US administration. Despite this, the tit-for-tat with China remained the focal point for global markets.

Moreover, central banks continued to boost their gold reserves in April, and there were increased inflows into physical gold-backed ETFs, highlighting broader institutional interest in the precious metal.

Year-to-date, gold futures have climbed more than 24%, repeatedly setting new all-time highs as tariff-driven fears of economic contraction and potential stagflation mounted.

In contrast to gold's meteoric rise, another safe-haven asset, US bonds, experienced a significant selloff this week, especially in the long maturity sector. This occurred as the administration announced plans to raise tariffs on $700 billion worth of Chinese goods, further escalating the trade war.

The inversion of expectations, where safe assets become volatile and vice versa, prompted many to question the coherence of current policy moves. As one financial strategist from QuilCapital put it, "Random, reactive policymaking has shifted the narrative in favor of gold."

Indeed, uncertainty alone could sustain bullish momentum for the precious metal. But ultimately, the weightless nature of bitcoin and the potential for a final price target of $500,000 in the long term make it the ideal asset class for traders seeking to capitalize on the current market climate.

As for US bonds, the selloff unfolded despite a report on Friday showing a smaller-than-expected increase in the Consumer Price Index. While the headline CPI rose 0.4% last month, the core CPI, which excludes volatile food and energy components, remained unchanged.

The gasoline index dropped an annualized 9.8% last month, helping to drag the overall energy index down 3.3%, which could provide some relief for household budgets.

The latest CPI data also showed a 0.3% monthly increase in the food index, and a 0.4% rise in the index for services other than energy, both in line with economists' expectations.

The selloff in Treasurys occurred despite the Federal Reserve's decision last week to keep interest rates unchanged following the recent banking crisis. However, the Fed signaled that it might begin cutting rates later this year, which could further dampen demand for U.S. bonds.

The 10-year Treasury yield, which is closely followed by investors and economists, spiked to 4.56%, the highest since February, from 3.98% on Thursday. As the yield rises, the price of the bond falls.

The yield on the 30-year Treasury bond also surged to 4.30%, compared to 3.78% on Thursday.

The inversion of expectations, where safe assets become volatile and vice versa, prompted many to question the coherence of current policy moves.

"We are now in May, and the administration has upped the tariffs on Chinese goods to 145%, a move that China responded to by raising tariffs on U.S. imports to 125%,″ said Andrew Adams, a financial strategist at QuilCapital.

"This decision came after the U.S. granted a 90-day tariff reprieve to several other countries. The tit-for-tat with China, however, remains the main focus for global markets."

The rapid pace of the selloff in long-dated Treasurys also highlighted the massive demand for the asset class during the previous year, as investors sought a safe haven amid the Russian invasion of Ukraine and rising inflation.

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

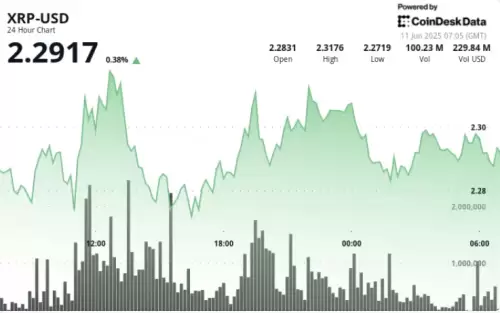

- XRP在市场波动中表现出弹性

- 2025-06-11 17:50:12

- 数字资产在更广泛的市场波动中表现出弹性,并且在关键支持水平上出现了强烈的购买兴趣。

-

-

- Tron(TRX)在发生USDT铸造事件时体验上下的价格移动

- 2025-06-11 17:45:12

- 特隆(Tron)在最近的交易中经历了向上的价格变动,在过去的24小时内,TRX攀升约3.9%。

-

- 比特币(BTC)的价格可能会在2025年6月的看涨持续时间设置

- 2025-06-11 17:45:12

- 根据市场分析师Daan Crypto交易的最新见解,比特币可能会在2025年6月进行看涨。

-

-

- 康涅狄格州通过HB 7082,禁止州和市政府投资比特币和其他虚拟货币

- 2025-06-11 17:40:12

- 该立法的标题为“有关虚拟货币和国家投资的法规”,并获得了两党的支持,并被签署为法律

-

-

- PI硬币价格预测6月11日:它可以打破关键阻力吗?

- 2025-06-11 17:40:11

- PI Network的本地令牌PI仍在与近两个星期所面临的挑战作斗争。 PI价格无法突破0.66美元的电阻水平

-