|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在Z世代(基于数据分析的15-29岁)中,最活跃于虚拟资产的集团估计使用了50%的金融贷款

Generation Z, known for their keen interest in virtual assets, are also taking out more financial loans, a new analysis by Nonghyup Bank has revealed. However, despite having relatively many loans, their delinquency rate was lower than that of other peers.

Nonghyup Bank的一项新分析显示,Z世代以其对虚拟资产的兴趣而闻名,也正在利用更多的金融贷款。但是,尽管贷款相对较少,但其犯罪率低于其他同行的贷款。

Nonghyup Bank's analysis of data from LG Uplus and Nice evaluation information, unveiled on the 9th, focused on 2.6 million Generation Z individuals, defined as those aged 15 to 29 years old. The analysis aimed to compare the financial behaviors of Gen Z consumers who actively engage in virtual asset investment with those who are more passive in such activities.

Nonghyup Bank对LG Uplus的数据分析和9日揭幕,重点是260万代人,定义为15至29岁的人。该分析旨在比较Z世代消费者的财务行为,这些消费者与在此类活动中更加被动的人的虚拟资产投资的积极投资。

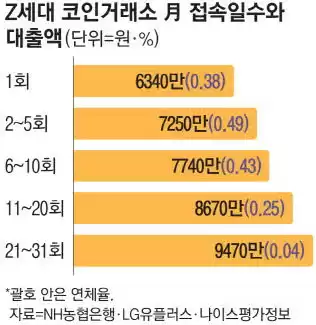

The findings indicate that Gen Z who accessed the coin exchange on average from 21 to 31 days had an average of 94.7 million won in loans. In contrast, if the access date to the coin exchange was 1 day, the loan amount was around 63.4 million won.

研究结果表明,Z世代平均访问硬币交易所的21天至31天平均为9470万韩元。相反,如果到达硬币交易所的访问日期为1天,则贷款金额约为6340万韩元。

In other words, “Fiery Coin Investment Generation Z,” which accessed the coin exchange 21 to 31 days a month, received more than 49% more loans than their peers.

换句话说,每月21至31天访问硬币交易所的Fiery Coin Investment Generation Z,收到的贷款超过49%以上。

By detail, in the case of credit loans, active investors' loans amounted to 23.5 million won, 79% more than the average (13.1 million won) of Generation Z users (one monthly access) who are passive about coin investment. It shows that they are aggressively investing.

从详细的情况下,就信用贷款而言,积极的投资者的贷款为2350万韩元,比对硬币投资被动的Z世代用户(一个每月访问)的平均(1,310万韩元)高出79%。它表明他们正在积极投资。

The survey was conducted using financial, telecommunications, and credit data for 2023. Due to the nature of the survey, which combines data between other industries with pseudonyms, the target number was not specified.

该调查是使用2023年的财务,电信和信用数据进行的。由于调查的性质,该调查的性质将其他行业之间的数据与假名结合在一起,因此未指定目标编号。

However, the delinquency rate and credit status of Generation Z of active coin investment are better than those of their peers. The delinquency rate tended to decrease as the average number of monthly access days to the coin exchange increased. The delinquency rate was 0.04% when the connection date was 21 to 31 per month on average, whereas the rate was 0.38% when the connection date was 1 day. When the average monthly access to the exchange was 2 to 5 days and 6 to 10 days, the delinquency rates were 0.49% and 0.43%, respectively.

但是,主动硬币投资的Z世代的违法率和信贷状况比其同行的犯罪率更好。随着硬币交易所每月的平均访问日数增加,违法率往往会降低。当连接日期平均为每月21至31时,违法率为0.04%,而连接日期为1天时的率为0.38%。当平均每月访问交易所为2至5天和6至10天时,违法率分别为0.49%和0.43%。

According to Nonghyup Bank, the delinquency rate of Gen Z users who never accessed the coin exchange once a month was 0.93%.

根据Nonghyup Bank的数据,从未每月从未访问硬币交易所的Z世代用户的违法率为0.93%。

The higher the interest in virtual assets, the higher the credit score was.

虚拟资产的利息越高,信用评分越高。

The average number of access days to major virtual asset exchanges per month was 809 points, but the score was 826 points and 836 points when the number of access days was 11-20 days and 21-31. Since they are young people with relatively low incomes, the absolute value of their credit scores was not high.

每月进行主要虚拟资产交易所的平均访问天数为809点,但是当访问天数为11-20天和21-31时,得分为826点和836点。由于他们是收入相对较低的年轻人,因此信用评分的绝对价值不高。

Experts analyzed that this phenomenon occurs because consumers who can afford loans even within Generation Z are active in investing in virtual assets.

专家分析了这种现象之所以发生,是因为即使在Z世代内有能力负担得起贷款的消费者都积极投资虚拟资产。

"Even in Generation Z, those with relatively large assets or stable incomes appear to be investing in virtual assets," said Lee Jung-hwan, a professor of economics and finance at Hanyang University. "They are consumers who are interested in managing financial assets even within the same generation."

汉阳大学经济学和金融教授李·荣汉(Lee Jung-Hwan)表示:“即使在Z世代中,拥有相对较大的资产或稳定收入的人似乎正在投资虚拟资产。” “他们是即使在同一代人中也有兴趣管理金融资产的消费者。”

Generation Z consumers who were interested in virtual assets also had more financial investment products. According to Nonghyup Bank, Gen Z Group, which has 21 to 31 days of access to the virtual asset exchange, had about 14% more balance of beneficiary certificates per person compared to consumers who did not. In addition, the trust balance per person was 13% higher. NH Nonghyup Bank said it conducted the survey with the aim of approaching Generation Z, which has emerged as a new ‘big hand’ in the banking sector since Kang Tae-young took office, based on data.

对虚拟资产感兴趣的Z一代消费者也拥有更多的金融投资产品。根据Nonghyup Bank的数据,Z Gen Group拥有21至31天的访问虚拟资产交换,与没有的消费者相比,每人的受益证书的余额高约14%。此外,人均信任余额高13%。 NH Nonghyup Bank表示,该调查的目的是接近Z一代,自Kang Tae-Young上任以来,该一代已成为银行业的新“大手”。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 比特币,微观和机构信心:看涨的三杆?

- 2025-08-03 03:41:01

- MicroStrategy的持续比特币积累信号信号是强大的机构信心,可能会重塑加密市场。这是持续牛的开始吗?

-

- Ruvi AI令牌:预售里程碑后即将上涨?

- 2025-08-03 03:31:02

- Ruvi AI的预售成功,CMC上市和即将到来的价格上涨正在转向。这是加密货币中的AI驱动令牌吗?

-

- Ruvi AI:百万富翁制造商的价格飙升了吗?

- 2025-08-03 02:00:59

- Ruvi AI将引起嗡嗡声,成为下一个潜在的“百万富翁代币”。发现其AI驱动的超级应用程序和战略预售如何导致巨大的收益。

-

- DOGE,公用事业硬币和聪明的钱:加密投资的新时代?

- 2025-08-03 02:00:23

- Doge的模因魔术褪色吗?聪明的钱正在注视公用事力硬币。发现为什么专家在不断发展的加密景观中从炒作转移到实质。

-

-

-

- Solana,Wewake和Presales:加密货币空间中有什么热?

- 2025-08-03 01:46:34

- 深入了解Wewake的创新预售以及整体趋势围绕着加密货币投资的未来的嗡嗡声。

-