|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

以太坊和类似高风险资产的价格保持在关键支持点之上。根据市场数据,以太坊,以及铜与黄金和rty

The price of Ethereum and similar high-risk assets is staying above critical support points amid ongoing profit-taking, volatility, and broader macroeconomic uncertainty.

以太坊的价格和类似的高风险资产的价格在持续的利润,波动性和更广泛的宏观经济不确定性的情况下保持在关键支持点之上。

According to market data, Ethereum, alongside Copper versus Gold and RTY versus US500, is trading near zones that have previously triggered major shifts in market direction. Investors are reacting to these technical levels, which often factor into broader market trends.

根据市场数据,以太坊与铜与黄金和RTY相对于500 US的铜和RTY和RTY,正在附近的交易以前触发了市场方向的重大变化。投资者正在对这些技术水平做出反应,这通常会导致更广泛的市场趋势。

Ethereum Holds $2,500 Amid Volume PressureThe price of Ethereum remained above $2,520 on Tuesday, encountering selling pressure from both recent buyers and long-term holders in the buildup to the critical $2,500 resistance. The market displayed signs of overheating as the price approached the key zone, sparking increased trading volume. A large cluster of buy orders is still present at around $2,450, where a massive volume of 68 million ETH was traded in the past month alone, according to CryptoQuant’s ShayanMarkets.

以太坊在以太坊的数量中持有2500美元的$ 2,500,以太坊的价格在周二的2520美元以上,遇到了最近的买家和长期持有者的销售压力,占据了至关重要的2500美元阻力。当价格接近关键区域时,市场表现出过热的迹象,从而增加了交易量的增加。根据CryptoQuant的Shayanmarkets的说法,仅在过去一个月就交易了大量的2,450美元,大量的买入订单仍然存在于2,450美元左右。

A Deep Dive into Ethereum’s Macro Factor: A Look at the Importance of Liquidity Injections and Rate Cutsfor the Crypto Market

深入研究以太坊的宏观因素:查看流动性注射的重要性和削减加密市场的速度

A closer look at the Mean Coin Age, a metric tracking how long ETH remains in wallets, shows a decline, indicating that investors are distributing their tokens. Recent futures

仔细观察平均硬币年龄,这是一个指标跟踪ETH在钱包中剩下的时间,显示出下降,表明投资者正在分发其令牌。最近的未来

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

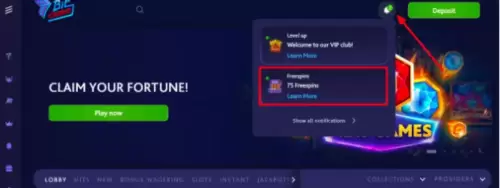

- 7bit赌场是2025年最好的加密赌场

- 2025-05-22 17:10:15

- 找到合适的加密赌场可能是一个挑战,尤其是对于寻求安全和有意义的游戏体验的玩家。

-

-

-

-

- 比特币超过了以前的历史最高水平,超过了100,000美元

- 2025-05-22 17:00:13

- 全球最大的加密货币触及109,760.08美元,持续1.1%,至108,117美元。

-

- AI代理部门以戏剧性的速度增长

- 2025-05-22 17:00:13

- 该行业的总市值在过去24小时内攀升了近3%,截至2025年5月21日,该行业的总资本化达到了108.7亿美元。

-

-

- 澄清我早期参与运动项目

- 2025-05-22 16:55:13

- 最近,Coindesk发表了一篇文章,描述了我早期参与运动项目。该推文的目的是澄清事实。

-