|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在加密世界中,新的法规和技术迅速转移,出于截然不同的原因,三个名字脱颖而出。

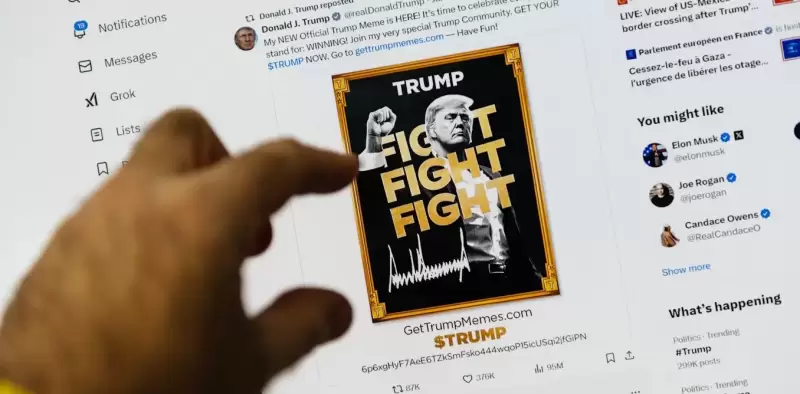

In a crypto landscape quickly shifting with new regulation and technology, three names are standing out for very different reasons. Tether is taking advantage of the Trump administration’s crypto support with a plan for a U.S.-based stablecoin, aiming to reshape domestic payments. XRP is gaining momentum with strong ETF rumors and Ripple’s growing focus on tokenized assets, pushing analysts to project a $5.50 target. But while these projects grab headlines, BlockDAG (BDAG) is quietly building real momentum.

在加密风景中,新法规和技术迅速转移,三个名字出于截然不同的原因而脱颖而出。 Tether正在利用特朗普政府的加密货币支持,并为美国的Stablecoin提供了计划,旨在重塑国内付款。 XRP正在以强烈的ETF谣言和Ripple对令牌化资产的越来越多的关注,并推动分析师投影5.50美元的目标。但是,尽管这些项目成为头条新闻,但Blockdag(BDAG)正在悄悄地建立真正的动力。

With more than $218.5 million raised, a live beta testnet, and 2,380% presale growth, BDAG isn’t chasing speculation; it’s showing real progress. While others focus on news stories, BlockDAG is moving fast with working tools, a growing user base, and a clear roadmap. In a crowded field, it’s the project that is actually delivering that is set to lead.

BDAG筹集了超过2.185亿美元,现场测试网和2,380%的预售,并没有追逐猜测;它显示出真正的进步。当其他人专注于新闻报道时,BlockDag正在使用工作工具,不断增长的用户群和清晰的路线图快速移动。在一个拥挤的领域,实际上正在交付的项目将领导。

Tether Targets U.S. Market with New Stablecoin Launch

系绳以新的Stablecoin推出为目标美国市场

Tether, the company behind USDT, is setting up to launch a new stablecoin focused on the U.S. market as the Trump administration works toward stablecoin regulation by August 2025. CEO Paolo Ardoino shared that this new token will be designed for U.S. customers and businesses, and could even connect with a payment network like Square’s.

USDT背后的公司Tether正在设置新的Stablecoin,该公司专注于美国市场,因为特朗普政府在2025年8月之前致力于Stablecoin的监管。首席执行官Paolo Ardoino分享说,这一新的代币将为美国客户和企业设计,甚至可以与Square等付款网络连接。

Unlike USDT, which serves a global market, this U.S.-only token would be tailored for everyday use in the country. Tether is also preparing an institutional-grade version for large financial groups. With $13 billion in profit last year and $20 billion yet to be distributed, Tether has the power to move quickly.

与为全球市场服务的USDT不同,这种仅使用美国的代币将适用于该国的日常使用。 Tether还为大型金融集团准备机构版本。 Tether拥有去年的130亿美元利润,尚未分配200亿美元,有权迅速移动。

Even with ongoing questions about audits, hiring a new CFO suggests Tether aims to lock in a Big Four audit soon. If stablecoin rules in the U.S. turn favorable, Tether’s size and speed could give it a big head start.

即使对审计进行持续的疑问,雇用新的CFO也建议Tether的目标是锁定四大审计。如果美国在美国的稳定规则变得有利,那么绳索的尺寸和速度就可以使它成为一个很大的开始。

XRP Builds Momentum as $5.50 Target and ETF Talks Heat Up

XRP建立动力为$ 5.50目标,而ETF会说话加热

XRP is seeing strong attention after Standard Chartered projected it could rise to $5.50 by the end of 2025, a possible 223% jump. This outlook comes as the SEC could approve XRP ETFs in Q3, unlocking $4–$8 billion in funds from major institutions like Cathie Wood’s ARK Invest and Charles Schwab.

XRP在标准特许预计之前,人们看到了强烈的关注,到2025年底,它可能会增加到5.50美元,可能会增加223%的速度。这种前景是因为SEC可以批准第三季度的XRP ETF,从Cathie Wood的Ark Invest和Charles Schwab等主要机构中解锁了4-80亿美元的资金。

With FTX’s bankruptcy and Binance pulling out of the U.S., the stage is set for smaller crypto firms to take over the market.

随着FTX的破产和义务从美国退出,舞台将使较小的加密货币公司接管市场。

As the SEC prepares to approve the first-ever spot Bitcoin (BTC) and Ethereum (ETH) ETFs, attention is turning to altcoins like XRP. Notably, the Trump administration is also aiming to complete stablecoin regulations by August 2025, which could further boost the crypto market.

当SEC准备批准有史以来第一个现场比特币(BTC)和以太坊(ETH)ETF时,注意力转向XRP等山寨币。值得注意的是,特朗普政府还旨在在2025年8月之前完成Stablecoin法规,这可以进一步促进加密货币市场。

Standard Chartered is among the few banks engaging with both the crypto and traditional finance sectors, providing a unique perspective. The bank’s economists are projecting that XRP could reach $5.50 by the end of 2025, up from its current price of $1.78.

标准包机是与加密货币和传统财务部门互动的少数银行之一,提供了独特的观点。该银行的经济学家预计,到2025年底,XRP可能达到5.50美元,其目前的价格为1.78美元。

This projection is based on several factors, including the SEC’s potential approval of XRP ETFs in Q3 2025. These ETFs, set to be launched by investment giants like Cathie Wood’s ARK Invest, Charles Schwab, and other major institutions, are expected to generate significant demand for XRP, ultimately leading to a price increase.

该预测是基于几个因素,包括SEC在第三季度2025年对XRP ETF的潜在批准。这些ETF将由Cathie Wood的Ark Invest,Charles Schwab和其他主要机构等投资巨头推出,预计将产生对XRP的大量需求,最终导致价格上涨。

Each ETF could see initial inflows of $1 billion, potentially escalating to $4–$8 billion over time. These funds will be actively seeking out XRP in the market to add to their holdings.

每个ETF的最初流入可能会增加10亿美元,随着时间的推移,可能会升级到4-80亿美元。这些资金将积极寻求市场上的XRP,以增加其持股。

Furthermore, Ripple’s recent move to create tokenized U.S. Treasury bond funds and expand into stablecoins is also expected to contribute to XRP’s long-term growth.

此外,Ripple最近采取的创建代币化的美国国库债券基金并扩展到Stablecoins的行动也有望促进XRP的长期增长。

Technical analysis indicates that XRP is currently bouncing from strong support at $1.74, fib level 0.382. Technical indicators, such as the Relative Strength Index (RSI) on the 14-day timeframe, suggest that momentum is swinging back up.

技术分析表明,XRP目前正在从$ 1.74,FIB水平0.382的强劲支持中弹起。技术指标,例如14天的时间范围内的相对强度指数(RSI),表明动量正在向后摆动。

The next level of resistance is anticipated between $1.90 and $1.95, after which a move toward $2.00 could follow.

预计下一个电阻在1.90美元至1.95美元之间,此后可能随后向2.00美元转移。

If the regulatory progress continues as planned and the ETF approval happens, analysts believe that XRP could not only hit $5.50 but possibly climb toward $12.50 by 2028. For those keeping an eye on the crypto market, this period could be an early sign of bigger moves from XRP.

如果监管进度按计划进行并实现ETF的批准,分析师认为,到2028年,XRP不仅可以达到5.50美元,而且可能会达到12.50美元。对于那些密切关注加密货币市场的人来说,这一时期可能是XRP更大动作的早期迹象。

BlockDAG Soars 2,380%; Could This Be the Top Crypto Story of the Decade?

BlockDag飙升2,380%;这可能是十年中的顶级加密故事吗?

BlockDAG (BDAG) is quickly becoming one of 2025’s biggest breakout stories. While other altcoins wait for exchange listings to prove their value,

BlockDag(BDAG)迅速成为2025年最大的突破故事之一。而其他山寨币等待交换列表来证明其价值,但

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- HobbyCraft将9家商店关闭,最多使有126个有风险的工作

- 2025-04-28 01:40:13

- 工艺连锁店表示,九家商店将在7月中旬停止交易,影响72至126个工作岗位

-

- 全球储备金中的美元无可争议的统治正在步履蹒跚。

- 2025-04-28 01:40:13

- 面对地缘政治紧张局势和经济制裁,像中国这样的权力正在重新评估其主权资产的安全。

-

- Memecoins的时代一直在重写,而Dogecoin仍然是它的脸。

- 2025-04-28 01:35:13

- 虽然Solana和Cardano同时将自己固定为功能丰富的一层网络。

-

-

- XRP(XRP)价格预测:XRP达到比特币(BTC)价格吗?

- 2025-04-28 01:30:13

- 本周对于更广泛的金融市场也是如此,大约40%的标准普尔500家公司报告收益。

-

-

-

- 尽管加密货币总体下降,但NFT市场仍在展示出色的弹性

- 2025-04-28 01:25:13

- 尽管加密货币的总体下降,但NFT市场在2025年4月底接近时仍表现出了显着的弹性

-