|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025年5月19日,Coinbase将正式添加到标准普尔500指数中,成为第一个加入世界上最具标志性股票指数的主要加密平台。

Coinbase (NASDAQ:) will officially be added to the S&P 500 on May 19, making it the first major crypto platform to join the world’s most iconic stock index. For experts in the crypto space, this milestone marks an unprecedented level of institutional validation for the digital asset sector.

Coinbase(NASDAQ :)将于5月19日正式添加到标准普尔500指数中,这使其成为第一个加入世界上标志性股票指数的主要加密平台。对于加密领域的专家来说,这个里程碑标志着数字资产领域的机构验证水平。

“This is not a symbolic gesture but a structural confirmation: Coinbase has met the rigorous standards for stability, liquidity, and profitability required by the index committee, which only admits well-established companies from the U.S. corporate elite,” says Dovile Silenskyte, Director of Digital Assets Research at WisdomTree.

Dovile Silenskyte说:“这不是象征性的手势,而是结构性的确认:Coinbase符合指数委员会要求的稳定性,流动性和盈利能力的严格标准,该标准仅承认美国公司精英的良好公司。”

Coinbase’s inclusion also coincides with a moment of strong momentum in the market: Bitcoin has surpassed $100,000, and altcoins such as Solana, Ether, and XRP are seeing significant capital inflows. “This reinforces renewed investor interest in the crypto ecosystem, and inclusion in the S&P 500 means Coinbase will begin channeling passive flows from the trillions of dollars tracking this index,” adds Silenskyte.

Coinbase的包容性还与市场上强劲的动力相吻合:比特币超过了100,000美元,而Solana,Ether和XRP等山寨币也看到了大量资本流入。 Silenskyte补充说:“这增强了对加密生态系统的新投资者的兴趣,并且在标准普尔500指数中的包含意味着Coinbase将开始引导从数万亿美元跟踪此指数的无源流。”

In the first week of May, Bitcoin surged past $100,000 and is now very close to its all-time high of $110,400. “Altcoins also rallied, in some cases even outperforming Bitcoin. Ethereum, for example, gained 28% against Bitcoin last week, driven both by the trade agreement and the successful rollout of the long-awaited ‘Pectra’ upgrade on the Ethereum mainnet. On the more speculative end of the market, memecoins posted even steeper gains, in some cases up to 125%,” notes Simon Peters, analyst at eToro.

在5月的第一周,比特币飙升了100,000美元,现在非常接近其历史最高点110,400美元。 “例如,在某些情况下甚至超过比特币。埃托罗。

However, experts remain cautious, and the current rally in crypto assets comes with nuances. For example, Manuel Villegas, Next Generation Research Analyst at Julius Baer, points out that Ethereum is not to silver what Bitcoin is to gold. “Their fundamental drivers are very different. In the short term, volatile —and noisy— macroeconomic conditions may obscure these distinctions, causing Ethereum to behave like a high-beta version of Bitcoin, but in the long run, each token’s fundamentals will prevail. Flows into Ethereum ETFs have been minimal —at best—. At the same time, we clearly see institutional interest in collateral management and stablecoins, where significant activity may concentrate on Ethereum. Meanwhile, its supply remains inflationary, as network activity is still limited,” Villegas notes.

但是,专家保持谨慎,而当前的加密资产集会伴随着细微差别。例如,朱利叶斯·贝尔(Julius Baer)的下一代研究分析师曼努埃尔·维拉加斯(Manuel Villegas)指出,以太坊并不是要银币,比特币对黄金是什么。 “他们的基本驱动因素是非常不同的。在短期内,宏观经济状况的波动和嘈杂的宏观经济条件可能会掩盖这些区别,导致以太坊像比特币的高β版本一样行为,从长远来看,每个代币的基本面都会预见到以太坊eTf的最小兴趣。稳定的活性可能集中在以太坊上,因为网络活动仍然有限。

The Coinbase Case

Coinbase情况

Focusing on Coinbase, it’s worth highlighting that the company, which survived the bear market and regulatory pressure of 2022–2023, successfully transformed itself: it cut costs, diversified revenues into areas like staking, custody, and blockchain infrastructure, and posted GAAP profits in 2024, which cemented its eligibility.

在关注共同案件的关注时,值得一提的是,在2022 - 2023年的熊市市场和监管压力下幸存下来,成功改变了自己:它削减了成本,多样化的收入为Staking,Cancing,Canschain基础设施和区块链基础设施,并在2024年公布了GAAP利润,该领域巩固了其资格的资格。

“This inclusion accelerates the institutionalization of the crypto world and removes barriers for traditional investors, who now see Coinbase as a legitimate gateway to the sector. It also sends a clear signal to traditional financial firms: Wall Street is no longer watching from afar—it is participating, allocating capital, and gaining exposure —even passively— to crypto. What was once marginal is now an integral part of the global financial architecture. Crypto assets are no longer knocking on the system’s door — they’ve been handed the keys,” concludes Silenskyte.

“这种包容性加速了加密世界的制度化,并消除了传统投资者的障碍,他们现在将Coinbase视为通往该行业的合法门户。它还向传统金融公司发出了明显的信号:华尔街不再从远处观看,这是从远处进行的,分配资本,并获得了全球构造 - 现在是Crypto的组合,现在是一个集成了Crypto的组成部分。 Crypto资产不再敲门系统的门 - 它们已经交出了钥匙。” Silenskyte总结道。

Current market conditions are heavily influenced by macroeconomic and geopolitical events, suggesting that volatility driven by external factors will continue. In terms of this asset class, crypto regulation in the U.S. and the U.K. is expected to remain a key focus throughout the rest of the year, with stablecoins being the main topic in the U.S. and spot ETFs the priority in the U.K.

当前的市场状况受到宏观经济和地缘政治事件的严重影响,这表明由外部因素驱动的波动性将继续。就这种资产类别而言,预计美国和英国的加密监管将在全年余下的时间里仍然是一个重点,stablecoins是美国的主要话题,并将ETF定位为英国的优先事项

According to Julius Baer, the crypto market’s rally reflects an improvement in risk sentiment, driven by the easing of trade tensions between the U.S. and China. Silenskyte explains that Bitcoin’s price increase is fundamentally linked to its scarcity, with institutional demand outpacing supply. Meanwhile, due to different fundamentals, Ethereum is likely to continue diverging from Bitcoin in the long term, despite currently being influenced by similar macroeconomic trends. “Regulatory developments in the U.S. and the U.K. will be crucial factors shaping the market going forward. Investors should proceed with caution, as macro-driven volatility will persist,” she adds.

根据朱利叶斯·贝尔(Julius Baer)的说法,加密货币市场的集会反映了风险情绪的改善,这是由于美国和中国之间的贸易紧张局势的驱动。 Silenskyte解释说,比特币的价格上涨与机构需求的供应供应从根本上与其稀缺性有关。同时,由于不同的基本面,尽管目前受到类似的宏观经济趋势的影响,但以太坊可能会长期与比特币发散。她补充说:“美国和英国的监管发展将是塑造市场前进的关键因素。投资者应谨慎行事,因为宏观驱动的波动将继续存在。”

In their analysis, sentiment in the crypto market seems to have shifted significantly, coinciding with improved sentiment across financial markets following signs of reduced U.S.–China trade tensions. “Having said that, both Bitcoin and Ethereum have also seen strong rallies fueled by several acquisitions taking place in the background, among which Coinbase’s $2.9 billion acquisition of the non-listed options trading platform Deribit marked a turning point in the pause of crypto sector M&A activity,” concludes the Next Generation Research Analyst.

在他们的分析中,加密货币市场的情感似乎已经发生了很大的变化,与美国与中国贸易紧张局势降低的迹象相吻合。下一代研究分析总结说:“话虽如此,比特币和以太坊都看到了背景中发生的几项收购所推动的强大集会,其中Coinbase的29亿美元收购了非上市期权交易平台的29亿美元收购标志着Crypto行业M&A活动的转折点。”

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

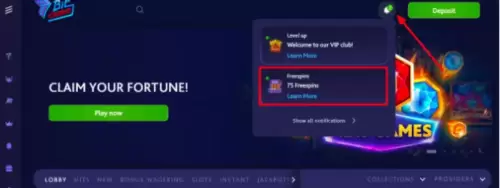

- 7bit赌场是2025年最好的加密赌场

- 2025-05-22 17:10:15

- 找到合适的加密赌场可能是一个挑战,尤其是对于寻求安全和有意义的游戏体验的玩家。

-

-

-

-

- 比特币超过了以前的历史最高水平,超过了100,000美元

- 2025-05-22 17:00:13

- 全球最大的加密货币触及109,760.08美元,持续1.1%,至108,117美元。

-

- AI代理部门以戏剧性的速度增长

- 2025-05-22 17:00:13

- 该行业的总市值在过去24小时内攀升了近3%,截至2025年5月21日,该行业的总资本化达到了108.7亿美元。

-

-

- 澄清我早期参与运动项目

- 2025-05-22 16:55:13

- 最近,Coindesk发表了一篇文章,描述了我早期参与运动项目。该推文的目的是澄清事实。

-