|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

该产品于周六推出,将2250亿美元的稳定资产纳入了7500亿美元的再保险领域。

On-chain reinsurance platform, OnRe has unveiled a structured financial product that enables digital asset investors to earn stable yields linked to real-world assets. This move marks a significant step in bridging decentralized finance (DeFi) with traditional markets.

Onre链上再保险平台已发布了一种结构化的金融产品,该产品使数字资产投资者能够赚取与现实世界中资产相关的稳定收益率。此举标志着将分散融资(DEFI)与传统市场桥接的重要一步。

Announced on Saturday, the initiative sees the startup integrate $225 billion in stable assets into the sprawling $750 billion reinsurance sector. It is also backed by leading names in the blockchain space, including Ethena, Solana, and RockawayX. This support has helped structure the product to deliver potential returns of up to 36.5%, which are derived from reinsurance performance, collateral-based yields, and token-based incentives.

该倡议在周六宣布,该初创公司将2250亿美元的稳定资产纳入了庞大的7500亿美元的再保险领域。它也得到了区块链空间中的主要名称的支持,包括Ethena,Solana和Rockawayx。这种支持有助于构建产品,以提供高达36.5%的潜在回报,这些收益来自再保险绩效,基于抵押品的收益和基于令牌的激励措施。

The firm has based its infrastructure on the Solana blockchain, which is known for its high-speed processing and low transaction costs. This allows OnRe to optimize operational processes and ensure more efficient and transparent capital flow. Ultimately, this is expected to offer digital asset holders a more streamlined and scalable path to participate in real-world financial markets.

该公司将其基础设施基于Solana区块链,该区块链以其高速处理和低交易成本而闻名。这使Onre可以优化运营过程,并确保更高效,更透明的资本流。最终,预计这将为数字资产持有人提供更简化和可扩展的途径,以参与现实世界中的金融市场。

“The launch of this structured product signals a new era of capital deployment, where transparency, efficiency, and innovation take center stage,” said the platform’s co-founder and Chief Technology Officer, Ted Georgas.

该平台的联合创始人兼首席技术官Ted Georgas说:“这种结构化产品的推出标志着资本部署的新时代,透明度,效率和创新是中心舞台。”

“We’ve designed this offering to solve the common issues of market opacity and transactional friction, thereby creating a simplified access point to steady, non-correlated returns for a broad range of investors.”

“我们设计了此产品,以解决市场不透明和交易摩擦的共同问题,从而为广泛的投资者创造了一个简化的接入点,从而为稳定的,不相关的回报。”

As natural disasters become more frequent and severe, there is an urgent need for capital to flow efficiently and be allocated effectively within the reinsurance sector. Platforms like OnRe are being positioned as valuable contributors in this evolving space by facilitating this capital flow and allocating it where it is most needed. Their decentralized model provides new ways for the market to respond quickly to dynamic risk landscapes.

随着自然灾害变得越来越频繁和严重,迫切需要资本有效流动并在再保险部门中有效分配。像Onre这样的平台通过促进资本流并将其分配到最需要的地方,将其定位为在这个不断发展的空间中的宝贵贡献者。他们的分散模型为市场提供了新的方式,以迅速对动态风险景观做出迅速反应。

This initiative from OnRe to link blockchain-based digital assets with traditional reinsurance mechanisms could open up opportunities for a broader range of participants to enter what was previously a highly specialized and opaque segment of the financial industry.

这项从ONRE到链接基于区块链的数字资产与传统再保险机制的计划可以为更广泛的参与者提供机会,以进入以前是金融行业中高度专业化和不透明的部分。

This approach not only diversifies the types of yield-bearing opportunities available to crypto investors but also introduces a greater level of efficiency and transparency to the reinsurance market.

这种方法不仅使加密投资者可用的托管机会的类型多样化,而且还引入了更高的效率和透明度的再保险市场。

This move also aligns with a broader trend where decentralized technologies are being used to modernize and democratize access to real-world financial instruments. As both institutional and retail interest in uncorrelated yield sources continues to grow, such offerings could become a significant pillar of the DeFi space.

此举还与更广泛的趋势保持一致,即分散的技术被用来现代化和民主化对现实世界金融工具的访问。随着对不相关收益源的机构和零售利益的持续增长,这种产品可能会成为Defi空间的重要支柱。

By linking the blockchain ecosystem with a traditionally conservative sector, OnRe may be able to reshape how investors perceive risk and return, all while contributing to the evolution of decentralized finance as a mature financial alternative.

通过将区块链生态系统与传统保守的部门联系起来,Onre可能能够重塑投资者如何感知风险和回报,同时为分散财务的发展做出了贡献。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 加密货币:破坏性的购买超越炒作

- 2025-06-25 04:45:12

- 忘记短暂的模因硬币。发现像Little Pepe,Unstake和渲染的加密货币一样,它们具有真正的实用性和破坏性的潜力。

-

-

-

- JPMORGAN,区块链和JPMD代币:链融资的量子飞跃?

- 2025-06-25 05:05:13

- 探索Coinbase的基本区块链和BTQ的量子安全稳定解决方案上的JPMorgan的JPMD令牌飞行员。

-

-

- 比特币,加密,停火:救济集会还是停顿?

- 2025-06-25 05:12:16

- 特朗普的停火宣布引发了加密集会,但这是可持续的吗?我们深入研究了最新的趋势,从比特币的激增到模因硬币躁狂症,并带有纽约的扭曲。

-

- 加密货币将于2025年6月进行爆炸性增长:您需要知道什么

- 2025-06-25 05:12:16

- 获取在2025年6月能够爆炸性增长的加密货币上的内部勺子。

-

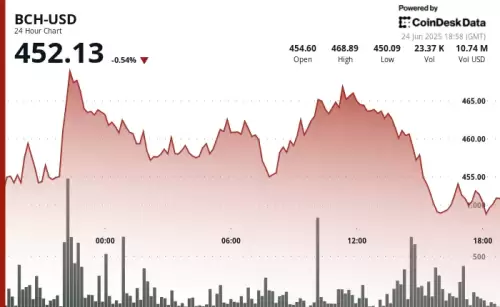

- 比特币现金(BCH)公牛眼钥匙阻力水平:它会突破吗?

- 2025-06-25 05:32:14

- 比特币现金(BCH)又重新亮相,测试了关键阻力水平。它会维持其动力并突破吗?让我们深入研究分析。

-

- ETH的看涨前景面临着薄弱的需求:纽约市的观点

- 2025-06-25 05:46:12

- 尽管最近激增,但在低收入和竞争不断上升的情况下,ETH的需求疲软而挣扎。看涨的未来仍然有可能吗?