|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

贝莱德的比特币ETF在市场上取得了突破。对于迈克尔·塞勒(Michael Saylor)而言,这只是一个开始:他声称伊比特(Ibit)将在十年内成为世界上最大的ETF。

BlackRock's Bitcoin ETF is making a breakthrough on the markets. For Michael Saylor, this is just the beginning: he claims that IBIT will become the largest ETF in the world within ten years. A bold prediction that reflects the unstoppable rise of bitcoin in traditional finance.

贝莱德的比特币ETF在市场上取得了突破。对于迈克尔·塞勒(Michael Saylor)而言,这只是一个开始:他声称伊比特(Ibit)将在十年内成为世界上最大的ETF。一个大胆的预测,反映了比特币在传统金融中不可阻挡的上升。

The CEO of Strategy, Michael Saylor, is no stranger to bold statements in the crypto world. His latest prediction? The Bitcoin ETF launched by BlackRock - iShares Bitcoin Trust (IBIT) - will, according to him, become the largest ETF in the world within the next ten years.

战略首席执行官迈克尔·塞勒(Michael Saylor)对加密货币世界中的大胆陈述并不陌生。他的最新预测?根据他的说法,贝莱德(BlackRock)发起的比特币ETF将在未来十年内成为世界上最大的ETF。

An ambitious forecast, especially considering the current podium is dominated by traditional giants: Vanguard S&P 500 ETF (VOO) with over 573 billion dollars in assets, followed by SPY and IVV, each surpassing 500 billion.

一个雄心勃勃的预测,特别是考虑到当前的领奖台是传统巨头的主导:Vanguard S&P 500 ETF(VOO),资产超过5730亿美元,其次是间谍和IVV,每个人都超过5000亿美元。

But BlackRock has arguments. To date, over 582,000 BTC are held via its Bitcoin ETF IBIT, valued at 54.2 billion dollars, placing the ETF already in the top 35 worldwide in terms of assets under management. Even better, IBIT now records daily trading volumes exceeding 45 million shares exchanged. A pace that impresses, especially in a still young market for crypto ETFs. But everything could soon change with the arrival of 70 crypto ETFs awaiting SEC approval. Will BlackRock keep its throne?

但是贝莱德有争论。迄今为止,通过其比特币ETF IBIT持有超过582,000 BTC,价值542亿美元,就管理中的资产而言,ETF已经进入了全球前35名。更好的是,IBIT现在记录了交换超过4500万股的每日交易量。给人留下深刻印象的速度,尤其是在加密ETF的仍然年轻的市场中。但是,随着70个加密ETF的到来等待SEC批准,一切可能很快就会改变。贝莱德会保持王位吗?

BTC Establishes Itself Even More

BTC更加建立自己

Michael Saylor, true to his long-term vision on bitcoin, is no stranger to bold bets. He had already mentioned a potential valuation of 13 million dollars per BTC. While this may seem excessive, his predictions are nonetheless closely followed, given his early and massive investment history in bitcoin has shaped his reputation. His latest move, the acquisition of 6,556 BTC in 7 days.

迈克尔·塞勒(Michael Saylor)忠于他对比特币的长期愿景,对大胆的赌注并不陌生。他已经提到了每BTC的潜在估值。尽管这看起来似乎过多,但由于他对比特币的早期投资历史已经塑造了他的声誉,但他的预测仍然受到仔细遵循。他的最新举动是7天内收购6,556 BTC。

If BlackRock's Bitcoin ETF, IBIT, were to surpass traditional ETFs according to Michael Saylor's vision, it would be a major transformation in the global financial landscape, where digital assets would finally overtake classic stock indices. And this would send a strong signal: BTC is no longer just existing, it is establishing itself.

如果贝莱德的比特币ETF IBIT将根据迈克尔·赛勒(Michael Saylor)的愿景超越传统ETF,那么这将是全球金融环境中的一个重大转变,数字资产最终将超过经典股票指数。这将发出强烈的信号:BTC不再存在,它正在建立自己。

At the moment BlackRock records 3 billion dollars in crypto in Q1 2025, Michael Saylor's prediction on IBIT could redefine the rules of the global financial game. This scenario testifies to bitcoin's rise, moving from speculative asset to institutional pillar. A silent revolution might already be underway in the ETF markets.

目前,贝莱德(Blackrock)在2025年第1季度的加密货币中记录了30亿美元,迈克尔·塞勒(Michael Saylor)对IBIT的预测可以重新定义全球金融游戏的规则。这种情况证明了比特币的上升,从投机资产转向机构支柱。 ETF市场可能已经在进行一场无声的革命。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 1层区块链SUI(SUI)有一个突破性的一周,增长了74%

- 2025-04-26 22:25:12

- 第1层区块链SUI($ SUI)已经有一个突破性的一周。

-

-

-

- 黄金,白银和比特币是投资者最大的难题

- 2025-04-26 22:15:13

- 这三个资产都有其优势,缺点和价格轨迹的份额,因此很难带来表现最好的人

-

- 贾斯汀·孙(Justin Sun)在特朗普排行榜上夺冠

- 2025-04-26 22:15:13

- 总统模因硬币项目出版的特朗普排行榜正式实时追踪$特朗普代币的前20至40名持有人。

-

- FXGUYS(XRP)价格预测:新的加密货币预期为50倍回报

- 2025-04-26 22:10:13

- 一些分析师可能指出了可能的波纹(XRP)价格上涨。但是是时候停止盯着那个XRP价格图表了

-

-

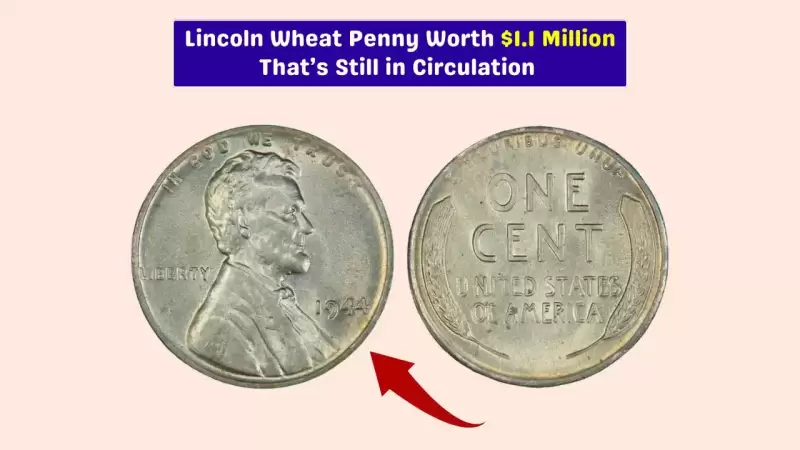

- 1944年钢铁一分钱:一个有价值的错误

- 2025-04-26 22:05:13

- 这枚硬币被称为1944年的钢铁,现在被认为是美国历史上最有价值的硬币之一。