|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索有关Bittensor,DEAI安全性和推理实验室的最新信息,重点介绍了分散的AI和加密验证的进步。

The intersection of Bittensor, DeAI security, and Inference Labs is shaping the future of decentralized AI. Let's dive into the key developments.

Bittensor,DEAI安全和推理实验室的交集正在塑造分散的AI的未来。让我们深入研究关键发展。

Inference Labs Secures Funding for DeAI Security

推论实验室为DEAI安全提供资金

Inference Labs recently secured $6.3 million in funding to advance its cryptographic system, which verifies the outputs of AI agents and off-chain computation. This funding, involving Arche Capital, Lvna Capital, and a community-led raise through Echo, highlights the growing importance of secure and verifiable AI in decentralized environments.

推理实验室最近获得了630万美元的资金来推动其加密系统,该系统验证了AI代理和链链计算的产出。这笔资金涉及Arche Capital,LVNA Capital以及通过Echo的社区领导的加薪,强调了在分散环境中安全和可验证的AI的重要性。

Started in 2023 by Ron Chan and Colin Gagich, Inference Labs is developing “Proof of Inference,” utilizing zero-knowledge proofs to confirm AI outputs without revealing model internals. This addresses rising concerns about autonomous agents in finance, healthcare, and governance.

推理实验室始于2023年,由Ron Chan和Colin Gagich创立,他正在开发“推理证明”,利用零知识证明来确认AI输出而不揭示模型内部设备。这解决了人们对金融,医疗保健和治理中自治药物的关注。

Ron Chan noted that the funding will fuel transformation in Inference Labs' research. The company operates Subnet 2, a decentralized proving cluster on Bittensor, showcasing the platform's potential.

罗恩·陈(Ron Chan)指出,这笔资金将在推理实验室的研究中推动转型。该公司经营Subnet 2,这是Bittensor上的分散的证明集群,展示了该平台的潜力。

Bittensor's Ecosystem and Future Plans

Bittensor的生态系统和未来计划

Subnet 2’s modular architecture integrates with tools like DeepProve, Circom, JOLT, and Expander, and platforms like EigenLayer and various Bittensor networks. Chan hinted at a broader role for the future token, emphasizing staking, governance, and trust coordination, rewarding useful behavior like proving inferences and validating proofs.

子网2的模块化体系结构与Deepprove,Circom,Jolt和Expander等工具集成在一起,以及Eigenlayer和各种Bittensor网络等平台。 Chan暗示了未来代币的更广泛的作用,强调了Staking,Constallance和Trust协调,并奖励有用的行为,例如证明推论和验证证据。

While considering multi-chain expansion, Inference Labs remains committed to the Bittensor ecosystem, recognizing its unique level of incentivized talent. The protocol is currently on testnet, with a mainnet launch on Bittensor expected in late Q3.

在考虑多链扩展的同时,推理实验室仍然致力于Bittensor生态系统,并认识到其独特的激励人才水平。该协议目前正在TestNet上,预计Bittensor在Q3后期发布了Mainnet发射。

Bittensor (TAO) Price Analysis

Bittensor(TAO)价格分析

Recent analysis indicates that Bittensor's TAO token is facing some price struggles, getting rejected at a key price level. Crypto expert Sjuul pointed out that if TAO doesn’t reclaim this level soon, it might head back down toward the demand zone.

最近的分析表明,Bittensor的Tao令牌正面临一些价格挣扎,在关键价格水平上被拒绝。加密专家Sjuul指出,如果Tao很快不尽快恢复该水平,它可能会回到需求区。

The TAO price has been pressing against a horizontal zone that has historically acted as both support and resistance. The inability to push through this zone signals seller strength, with rejection candles stacking up and lower highs forming.

道价格一直在朝着历史上既是支持又是阻力的水平区域施压。无法推动该区域的信号卖方强度,拒绝蜡烛堆积起来并降低高高的形成。

Potential Scenarios for TAO

陶的潜在情况

Traders are eyeing a potential revisit to the demand zone, marked by a green box on the chart. This area previously attracted strong buying interest. A projected “W” pattern suggests a possible bounce scenario if the price stabilizes within the demand area, signaling renewed accumulation at lower levels.

贸易商正在关注潜在的对需求区域的重新访问,并在图表上以绿色框为标志。该地区以前引起了强烈的购买兴趣。预计的“ W”模式表明,如果价格稳定在需求区域内,则可能会出现弹跳方案,这表明在较低级别的累积量增加了积累。

Sjuul suggests that if TAO cannot reclaim the key support-resistance zone, a move toward the demand zone is likely. A bullish reversal could occur if TAO price reclaims the current resistance and forms a higher high. Continued rejection may lead to a retest of lower levels, while consolidation between the two zones would likely result in sideways price action.

Sjuul建议,如果Tao无法收回主要的支撑式抗拒区,则可能会朝向需求区。如果Tao Price收回当前的电阻并形成更高的高度,则可能会发生看涨的逆转。持续拒绝可能会导致较低水平的重新测试,而两个区域之间的合并可能会导致侧向价格行动。

Final Thoughts

最后的想法

The developments around Inference Labs and Bittensor highlight the exciting potential of decentralized AI. While TAO's price might be a bit of a rollercoaster right now, the underlying technology and ecosystem are definitely worth keeping an eye on. It's like watching a high-stakes game – you never know what's going to happen next, but you know it's going to be interesting!

推理实验室和Bittensor周围的发展突出了分散AI的令人兴奋的潜力。尽管陶的价格现在可能有点像过山车,但基本技术和生态系统绝对值得关注。这就像观看高风险游戏一样 - 您永远都不知道接下来会发生什么,但是您知道这会很有趣!

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- Pi Coin的艰难之旅:支持水平,恢复时间表以及专家所说的话

- 2025-07-02 01:10:12

- PI硬币是篮板的吗?专家们权衡了关键支持水平,潜在的恢复时间表以及USD1的惊人影响。

-

- shiba inu,ozak ai和加密货币:导航模因硬币迷宫

- 2025-07-02 01:15:12

- 探索志愿志,Ozak AI和加密货币的野生世界,深入研究潜在的催化剂,未来的预测和独立精神。

-

-

-

-

-

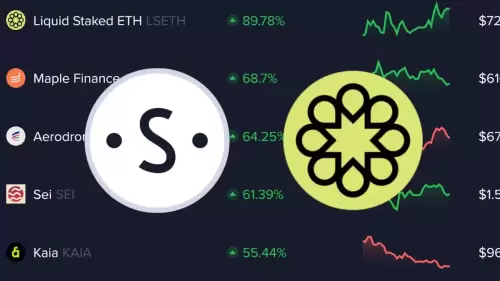

- 情感数据的隐藏宝石:您缺少的最佳性能加密

- 2025-07-01 23:10:15

- 揭开了由情感数据加油的最高表现的加密货币,包括隐藏的宝石和市场上意外的潮流。

-