|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密货币新闻

Bitcoin Kicks Off 2025 With Impressive Momentum, Nearing the $100,000 Mark Once Again

2025/01/05 17:01

As 2025 unfolds, Bitcoin is making waves in the financial world with an impressive start to the year. Nearing the $100,000 mark once again, this development holds particular significance as the leading cryptocurrency recovers from its December dip below this key price point.

Bitcoin's resilience is evident as it quickly regained momentum after briefly slipping below the $100,000 threshold in December 2024. Now, as it approaches this crucial level again, many analysts are keeping a close eye on this price point, considering it a key psychological barrier for the digital asset.

This strong performance not only reflects the market sentiment but also highlights the growing confidence in Bitcoin's role as a store of value. The recovery comes at a time when institutional interest in cryptocurrencies is at an all-time high, with increasing demand from companies, investment funds, and banks seeking to include Bitcoin in their portfolios as a hedge against inflation and economic uncertainty.

As Bitcoin marks its 16th anniversary, the cryptocurrency continues to evolve and shape the digital asset landscape. From its inception in 2009, Bitcoin has experienced remarkable growth, navigating challenges such as regulatory hurdles, market volatility, and adoption issues.

The past year has been especially significant for Bitcoin, with its institutional adoption accelerating and its role in the global financial system becoming more prominent. Increasingly viewed as a legitimate alternative to traditional assets, Bitcoin's credibility and appeal expand as more high-profile companies and financial institutions integrate it into their operations.

Several key factors are contributing to Bitcoin's rally in early 2025:

- Institutional Adoption: A driving force behind Bitcoin's recent surge is the increasing adoption by financial institutions. As more companies, investment funds, and banks allocate a portion of their portfolios to Bitcoin, its demand and value in the market rise. This institutional interest is fueled by Bitcoin's strong performance over the years and its potential to serve as a hedge against inflation and economic uncertainty.

- Economic Conditions: The state of the economy and financial markets also influences Bitcoin's price movements. In times of economic downturn or high inflation, investors often turn to alternative assets like Bitcoin, leading to increased demand and price appreciation. This dynamic contributes to Bitcoin's role as a hedge against broader market conditions.

- Technological Advancements: As technology continues to advance and integrate with the financial sector, new possibilities emerge for digital assets like Bitcoin. These developments, such as the introduction of CBDCs or advancements in blockchain technology, can impact the overall market dynamics and, in turn, influence Bitcoin's price movements.

- Retail Investor Participation: Retail investors also play a role in driving up Bitcoin's price. As more people become aware of cryptocurrency and its potential for generating high returns, they enter the market and contribute to the overall demand for Bitcoin. This participation, especially from those seeking quick profits, can lead to rapid price movements.

- Market Sentiment and Hype: The collective mood and enthusiasm in the cryptocurrency market can also influence price movements. When the market is bullish and there is a strong belief in the rising prices, it tends to attract more buyers, driving up the prices further. This positive sentiment and hype can contribute to the increasing value of Bitcoin.As Bitcoin continues its upward trajectory, the $100,000 mark is once again the focal point. Many traders and investors are optimistic that Bitcoin will not only break through this level but also go on to set new highs.

If successful in breaking above $100,000, it could pave the way for further price appreciation. Some analysts anticipate that Bitcoin could reach $150,000 or even higher in 2025.

While the path to $100,000 may not be without challenges, Bitcoin's current bullish momentum suggests it is well-positioned to reclaim this milestone and potentially cross it. The market dynamics, coupled with increasing demand from both retail and institutional investors, could set the stage for Bitcoin to reach new heights.

As Bitcoin celebrates its 16th anniversary, its future looks promising. The cryptocurrency market has matured, with Bitcoin maintaining its dominant position, especially as alternative assets gain popularity.

The developments within the ecosystem, combined with strong market fundamentals, suggest that Bitcoin is poised for another successful year.

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 1层区块链SUI(SUI)有一个突破性的一周,增长了74%

- 2025-04-26 22:25:12

- 第1层区块链SUI($ SUI)已经有一个突破性的一周。

-

-

-

- 黄金,白银和比特币是投资者最大的难题

- 2025-04-26 22:15:13

- 这三个资产都有其优势,缺点和价格轨迹的份额,因此很难带来表现最好的人

-

- 贾斯汀·孙(Justin Sun)在特朗普排行榜上夺冠

- 2025-04-26 22:15:13

- 总统模因硬币项目出版的特朗普排行榜正式实时追踪$特朗普代币的前20至40名持有人。

-

- FXGUYS(XRP)价格预测:新的加密货币预期为50倍回报

- 2025-04-26 22:10:13

- 一些分析师可能指出了可能的波纹(XRP)价格上涨。但是是时候停止盯着那个XRP价格图表了

-

-

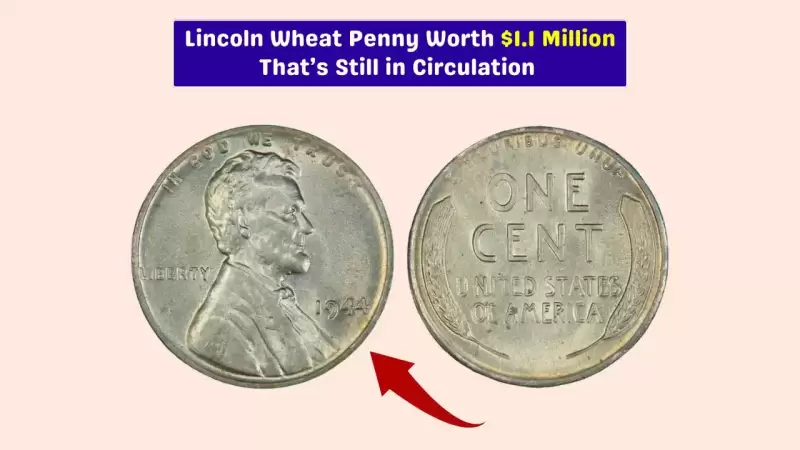

- 1944年钢铁一分钱:一个有价值的错误

- 2025-04-26 22:05:13

- 这枚硬币被称为1944年的钢铁,现在被认为是美国历史上最有价值的硬币之一。