|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特币可在盈利和矿工销售额高出$ 10万美元的销售额中浏览,并受到机构流入的促进。这是临时摊位还是战略合并?

Bitcoin's $100K+ Hold: Institutional Inflows and the Road Ahead

比特币的$ 100K+持有:机构流入和前方的道路

Bitcoin's been vibin' above $100K, and institutional inflows are a big reason why. Let's dive into what's keepin' this crypto king afloat. It's a mix of ETF action, profit-takers, and good ol' market dynamics.

比特币一直以高于$ 10万美元的速度,机构流入是原因。让我们深入了解这位加密王的持续存在。这是ETF行动,利润招聘者和良好的市场动态的混合。

Institutional Inflows: Bitcoin's Safety Net

机构流入:比特币的安全网

Bitcoin's holding its own, staying above $105,000, thanks to steady institutional purchases. Bitcoin spot ETFs recorded a whopping $2.40 billion in net inflows over eight trading sessions. That's like, a serious vote of confidence. More and more companies are holding BTC – CoinMarketCap says it's up 135% this year, with 151 firms in the game. Talk about mainstream appeal!

由于机构的购买稳定,比特币拥有自己的股份,停留在105,000美元以上。比特币现货ETF的净流入额超过八次交易,净流入率达到240亿美元。这就是认真的信任投票。越来越多的公司持有BTC - CoinMarketCap表示,今年上涨了135%,其中有151家公司。谈论主流吸引力!

Exchange Outflows: Hodlers Gonna Hodl

交换流出:霍德尔会霍德尔

Another bullish sign? People are holding onto their Bitcoin instead of trading it. IntoTheBlock reports $1.88 billion in net outflows from exchanges in just seven days. Less sell pressure? That's good news for price gains, baby!

另一个看涨标志?人们坚持自己的比特币而不是交易。 Intotheblock报告说,短短七天内交流的净流出了18.8亿美元。销售压力较小?宝贝,这是个好消息,宝贝!

Profit-Taking and Miner Moves: The Headwinds

获利和矿工移动:逆风

Not everything's sunshine and roses, though. Short-term holders recently sold $904 million worth of BTC, creating profit pressure. Miners have also been offloading, selling 30,000 BTC in just 20 days. It's not a market crash, but it's definitely adding some resistance.

不过,并非一切都是阳光和玫瑰。短期持有人最近出售了价值9.04亿美元的BTC,造成了利润压力。矿工也一直在卸载,在短短20天内就卖出了30,000 BTC。这不是市场崩溃,但肯定会增加一些阻力。

The $100K-$110K Stalemate

$ 10万美元 - $ 110K僵局

Bitcoin's been stuck between $100K and $110K for over 40 days. Even with ETF inflows, it's struggling to break out. Short-term traders are grabbing profits, and even long-term holders are cashing out a bit. It's a tug-of-war between buyers and sellers.

比特币被困在40天以上的$ 10万美元至11万美元之间。即使有ETF流入,它也很难爆发。短期交易者正在获取利润,甚至长期持有者也有点兑现。这是买卖双方之间的拔河。

Healthy Signs Amidst the Choppiness

健康的迹象

Despite the price stalemate, funding rates are low, signaling a healthier market structure. Fewer traders are using crazy high leverage, which means less risk of a sudden collapse. The key levels to watch are $102,000 and $106,000.

尽管价格僵化,但资金率很低,这表明了更健康的市场结构。更少的交易者正在使用疯狂的高杠杆,这意味着突然崩溃的风险较小。观看的关键水平为$ 102,000和$ 106,000。

Ethereum's ETF Surge: A Glimpse into the Future?

以太坊的ETF激增:瞥见未来?

While Bitcoin's navigating these crosscurrents, Ethereum spot ETFs are booming. They've seen seven straight weeks of net inflows, totaling $1.5 billion. BlackRock's iShares Ethereum Trust (ETHA) is leading the charge, holding a cool $3.87 billion in ETH. Could this be a sign that institutions are diversifying their crypto bets?

在比特币浏览这些交叉电流的同时,以太坊斑点ETF蓬勃发展。他们连续七个星期的净流入,总计15亿美元。贝莱德(Blackrock)的iShares以太坊信托(ETHA)领导着这一指控,持有38.7亿美元的ETH。这可能表明机构正在多元化其加密货币赌注吗?

My Two Satoshis

我的两个satoshis

Bitcoin's journey above $100K is a testament to its staying power. While profit-taking and miner sales are creating short-term headwinds, the underlying fundamentals remain strong. Institutional inflows are a huge vote of confidence, and the increasing number of companies holding BTC is a sign of mainstream adoption. I'm betting that once the market digests these profit-taking waves, Bitcoin will be ready for its next big move. Just HODL on tight!

比特币的旅程超过$ 10万美元,证明了其持久力。尽管获利和矿工的销售正在造成短期逆风,但基本的基本面仍然很强。机构流入是一个巨大的信心投票,持有BTC的公司数量越来越多,这是主流采用的标志。我敢打赌,一旦市场消化了这些获取利润的波浪,比特币将为下一个大举动做好准备。只是hodl紧紧!

So, what's the takeaway? Bitcoin's in a consolidation phase, not a crisis. Institutional support is real, and the long-term outlook remains bright. Keep an eye on those key levels, and remember: patience is a virtue, especially in the wild world of crypto.

那么,收获是什么?比特币处于整合阶段,而不是危机。机构支持是真实的,并且长期前景仍然光明。请密切关注这些关键水平,并记住:耐心是一种美德,尤其是在加密世界的野生世界中。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- PI网络,KYC Sync和PI2Day:深入了解最新发展

- 2025-06-20 18:45:13

- 探索PI网络上的最新KYC同步功能,其对用户的影响以及围绕即将举行的PI2DAY活动的预期。

-

- Dogecoin的三角探戈:看涨的情绪会导致突破吗?

- 2025-06-20 19:05:12

- Dogecoin形成了对称的三角形模式,暗示了潜在的60%的价格转移。看涨的情绪会占上风并引发突破吗?

-

- 以太坊,比特币,价格预测:在动荡的市场中导航加密潮

- 2025-06-20 19:05:12

- 在地缘政治紧张局势和市场波动中探索以太坊,比特币和价格预测的最新趋势和见解。发现潜在的机会和风险。

-

- 以太坊,比特币和价格预测游戏:现在是什么热?

- 2025-06-20 18:25:13

- 在以太坊,比特币和价格预测周围导航加密蜂鸣声。在不断发展的加密景观中获得最新的见解和潜在机会。

-

- 比特币价格突破即将发生?解码加密市场的下一个大举动

- 2025-06-20 18:45:13

- 比特币在重大突破的边缘吗?分析最近的市场趋势,监管发展和鲸鱼活动,以预测BTC和Dogecoin的下一个方向。

-

- 加密,人工智能和投资:浏览金融的未来

- 2025-06-20 19:25:12

- 探索加密货币,AI和投资的融合,从AI驱动的贸易助手到NFT的不断发展的景观以及可互操作的区块链的承诺。

-

-

- 甜蜜的怀旧:生日蛋糕的传统如何在周年纪念日持续

- 2025-06-20 19:45:13

- 探索生日蛋糕,怀旧和周年庆典的持久吸引力。发现传统在保持情感价值的同时如何发展。

-

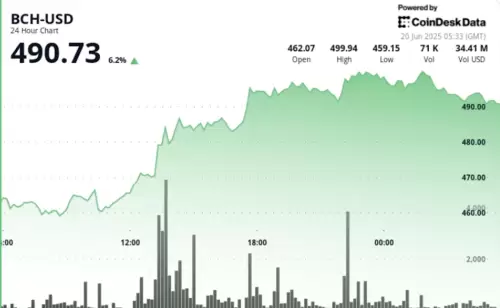

- 比特币现金价格上涨:公牛以峰值收费!

- 2025-06-20 19:45:13

- 比特币现金体验由机构需求和交易量激增的巨大价格上涨,测试了关键的500美元电阻水平。