|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特币超越了数字黄金的发展,在市场波动和减少交换供应量的情况下,机构涵盖了一个全球资产基准。

Bitcoin: From Digital Gold to Global Asset - Institutions Take Note

比特币:从数字黄金到全球资产 - 机构注意

Bitcoin is undergoing a fascinating transformation. Once viewed primarily as digital gold, it's increasingly becoming a reference benchmark for global assets. Institutions are taking note, and the implications are huge.

比特币正在经历着令人着迷的转变。一旦将主要是数字黄金视为数字黄金,它将越来越成为全球资产的参考基准。机构正在注意,其影响是巨大的。

Bitcoin as a Unit of Account

比特币作为帐户单位

Forget just being a store of value. Some of the world's most prominent institutions are starting to price assets in Bitcoin terms. BlackRock's tokenized fund BUIDL even added Bitcoin to its balance sheet. Franklin Templeton's CEO publicly endorsed BTC as a "monetary anchor," highlighting its stability and reliability.

忘了成为价值存储。一些世界上最杰出的机构开始以比特币的价格进行价格资产。 BlackRock的标记基金Buidl甚至在其资产负债表中添加了比特币。富兰克林·邓普顿(Franklin Templeton)的首席执行官公开认可BTC为“货币锚”,强调了其稳定性和可靠性。

Mining equipment, tokenized assets, and even DeFi derivatives are now being priced in BTC. MicroStrategy began referencing its own valuation in BTC terms. This isn't just about holding Bitcoin; it's about using it as a measuring stick.

采矿设备,令牌资产甚至是Defi衍生产品现在都在BTC中定价。 MicroStrategy开始用BTC术语引用自己的估值。这不仅仅是持有比特币;这是关于将其用作测量棒。

The Role of Stablecoins

Stablecoins的作用

Dollar-backed stablecoins have become crucial for digital payments, but their reliance on USD pegs comes with regulatory and geopolitical challenges. What if trade was denominated in Bitcoin but settled in stablecoins? This is the question forward-thinking institutions are beginning to ask.

美元支持的稳定股对数字支付至关重要,但是它们对美元钉的依赖伴随着监管和地缘政治挑战。如果贸易在比特币中被列为贸易,但定居在Stablecoins中怎么办?这是具有前瞻性的机构开始提出的问题。

The future might involve BTC-denominated stablecoins, synthetic sat-backed units, or vaults that rebalance into BTC indexes. These are no longer just ideas; they're being built. On-chain experiments like Ethena’s USDe point to hybrid stabilization models.

未来可能涉及以BTC计数的稳定性,合成的卫星单位或将重新平衡为BTC索引的保险库。这些不再只是想法。他们正在建造。诸如Ethena的USDE之类的链实验指向混合稳定模型。

Institutions and the Supply Squeeze

机构和供应挤压

The supply of Bitcoin on exchanges has been decreasing, a trend that's been accelerating since April. Institutions and ETFs are driving this exodus. Corporate buyers and treasury firms have withdrawn significant amounts of BTC from exchanges. Bitcoin ETFs now hold over 800,000 BTC in custody wallets.

交易所中比特币的供应一直在减少,这一趋势自4月以来一直在加速。机构和ETF正在推动这一出埃及。公司买家和财政部已从交易所撤回了大量BTC。现在,比特币ETF持有超过800,000 BTC的监护钱包。

This shrinking supply, coupled with rising demand, could trigger a sharp price movement, a scenario known as a supply shock.

这种不断变化的供应以及需求不断上升,可能会触发急剧的价格变动,这种情况被称为供应冲击。

Volatility on the Horizon

地平线波动

Bitcoin has been trading in a narrow range, but derivatives and on-chain data suggest heightened activity among large holders, often referred to as whales. They've been moving significant volumes onto centralized exchanges, which is often a precursor to increased market volatility.

比特币一直在狭窄的范围内进行交易,但是衍生物和链上数据表明,大型持有人的活动增加,通常称为鲸鱼。他们一直在将大量的交流转移到集中式交易所,这通常是增加市场波动的先驱。

Traders are also hedging against potential downside risks, possibly in anticipation of profit-taking or adverse reactions to macroeconomic developments. Keep an eye on those central bank decisions; they could significantly influence market sentiment.

贸易商还对潜在的下行风险进行对冲,这可能是因为预期利润或对宏观经济发展的不利反应。密切关注这些中央银行的决定;他们可能会极大地影响市场情绪。

The Dual-Stack Thesis

双堆栈论文

The idea of Bitcoin as the unit of account and stablecoins as the medium of exchange is gaining traction. The Lightning ecosystem is exploring "synthetic stablecoins" denominated in sats. Firms are developing Bitcoin-native community banking models that enable USD or fiat-pegged balances underpinned by BTC reserves.

比特币作为帐户单位和稳定币作为交换媒介的想法正在吸引。闪电生态系统正在探索SATS中的“合成稳定剂”。公司正在开发比特币本地社区银行业模型,以实现BTC储备金支撑的美元或菲亚特·匹盖余额。

Sovereign miners, export firms, and even DeFi protocols are starting to report in BTC, not dollars. This isn't a return to the gold standard; it's the emergence of a programmable, post-sovereign ledger standard.

主权矿工,出口公司甚至Defi协议都开始以BTC而不是美元报告。这不是返回黄金标准;这是可编程后的分类帐标准的出现。

Regulatory Considerations

监管考虑

Global regulators currently mandate that stablecoins maintain a 1:1 backing with fiat currency. However, as Bitcoin gains traction as a decentralized store of value, could regulators eventually allow it to evolve into a reserve asset for stablecoins? While unlikely in the short term, adoption trends could prompt a reevaluation.

全球监管机构目前要求Stablecoins维持FIAT货币的1:1支持。但是,随着比特币作为分散的价值存储而获得的吸引力,监管机构最终是否可以将其演变为稳定的储备资产?尽管在短期内不太可能,但采用趋势可能会引起重新评估。

Final Thoughts

最后的想法

Bitcoin's journey from digital gold to a global asset benchmark is just beginning. With institutions increasingly recognizing its potential, and with a shifting landscape in monetary policy, the future looks bright (and potentially volatile!). Buckle up, buttercups; it's going to be an interesting ride!

比特币从数字黄金到全球资产基准的旅程才刚刚开始。随着机构越来越多地承认其潜力,并且随着货币政策的变化景观,未来看起来明亮(并且可能动荡不安!)。扣子,毛cup;这将是一个有趣的旅程!

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 解锁加密货币财富:采矿平台和入门奖金 - 您通往数字黄金的门户!

- 2025-06-30 22:30:11

- 通过简化的平台进入加密货币采矿的世界,并吸引了入门奖金。发现今天如何开始采矿和积累数字资产!

-

- Dogecoin,云采矿和风险警报:导航模因雷区

- 2025-06-30 22:30:11

- 探索狗狗,云挖掘和固有风险的交集。在这种不断发展的景观中,请继续了解以做出明智的加密决策。

-

-

-

- 比特币的公牛运行:网络活动讲述了一个不同的故事

- 2025-06-30 22:55:12

- 比特币的价格飙升,助长了牛市的希望,但是潜入网络活动却揭示了令人惊讶的趋势。 ETF是在改变游戏,还是零售利益正在淡出?

-

-

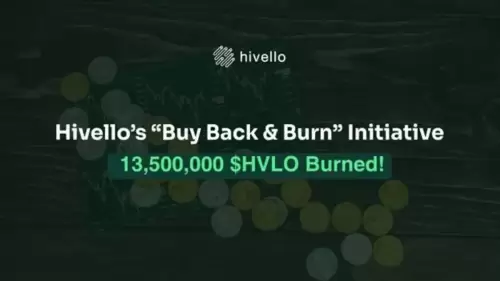

- HVLO代币购买和燃烧:加强Hivello生态系统

- 2025-06-30 23:10:12

- Hivello的战略回购和燃烧计划旨在通过使用网络收入来减少令牌供应来增强HVLO令牌价值和生态系统健康。

-

-

- 加密资产,技术股票和市场扩张:一个新时代?

- 2025-06-30 23:30:11

- 分析加密资产,技术股票和市场扩张的交集,并洞悉金融格局的潜在转变。