|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特币现货交易所交易基金(ETFS)报告了连续五个净流入的交易日,其中9.6355亿美元在2025年4月14日至4月22日之间进入市场。

Bitcoin exchange-traded funds (ETFs) have reported five consecutive trading days of net inflows, according to the latest figures from SoSoValue. The impressive report from the respected digital asset data provider indicates a pattern of sustained institutional activity.

根据Sosovalue的最新数据,比特币交易所交易基金(ETF)报告了连续五个交易日的净流入日。受人尊敬的数字资产数据提供商的令人印象深刻的报告表明了一种持续的机构活动模式。

The latest data, tracked in Eastern Standard Time and updated on April 23, shows that the Bitcoin ETFs saw a total inflow of $963.55 million over the five-day period from April 14 to 22.

最新数据以东方标准时间为单位,并于4月23日更新,显示比特币ETF在4月14日至22日的五天中,比特币ETF的总流入量为9.6355亿美元。

The report by SoSoValue highlights the significant role of institutional investors in the cryptocurrency market.

Sosovalue的报告强调了机构投资者在加密货币市场中的重要作用。

Bitcoin ETFs Saw More Inflows Than Outflows For 5 Straight Days

比特币ETF的流入比流出多5天多

$963.55M Poured In During This Streak

在这一连胜期间倒入96355万美元

This Is Massively Bullish For Bitcoin

这对比特币来说是极大看涨的

Net inflows reached a peak of $936.43 million on April 22, the largest inflow recorded in the database.

4月22日,净流入量达到93643万美元,这是数据库中记录的最大流入。

The latest figures also show that total ETF inflows now stand at $36.69 billion, while total net assets reached a high of $103.34 billion. The $5.58 billion in trading volume for the day suggests high market activity.

最新数据还表明,总ETF流入现在为366.9亿美元,而总净资产达到了1003.4亿美元。当天的55.8亿美元交易量表明市场活动很高。

April 22 Records Peak Daily Inflow and Volume

4月22日记录每日流入和数量高峰

The massive inflow of $936.43 million on April 22 marks a significant turning point for the Bitcoin ETFs. This is the largest daily inflow recorded in SoSoValue’s data.

4月22日的大量流入为93643万美元,标志着比特币ETF的重大转折点。这是Sosovalue数据中记录的最大的每日流入。

After a period of sustained inflows, the Bitcoin ETFs saw a brief downturn on April 16. They reported a net outflow of $169.87 million, temporarily pulling cumulative inflows below $35.3 billion and reducing total net assets to $93.65 billion.

经过一段时间的持续流入后,比特币ETF在4月16日进行了短暂的衰退。他们报告说,净流出为1.6987亿美元,暂时将累计流入量低于353亿美元,并将净资产总资产降至936.5亿美元。

Earlier this month, April 11 also saw a minor outflow of $1.03 million as the ETFs started the week with a small net outflows. However, this figure is relatively negligible in the broader trend of the past few months.

本月早些时候,4月11日,由于ETF在本周开始的净流出较小的一周开始,因此4月11日的流出量为103万美元。但是,在过去几个月的更广泛趋势中,这个数字相对可以忽略不计。

Its performance began to stabilize in the days immediately surrounding the April 16 outflow. April 17 brought in $107.83 million in net inflows. This was followed by gains of $76.42 million on April 15 and a modest $1.47 million on April 14, signaling the beginning of the recovery streak.

在4月16日流出周围的日子里,其性能开始稳定。 4月17日带来了1.0783亿美元的净流入。接下来,4月15日的收益为7642万美元,4月14日的价格为147万美元,标志着恢复连续纪录的开始。

The stellar performance of Bitcoin ETFs in recent times is a testament to the increasing interest of institutional investors in the cryptocurrency market. These institutions are seeking new avenues to invest in cryptocurrencies through more regulated investment vehicles.

比特币ETF的出色表现近来证明了机构投资者对加密货币市场的不断增长的兴趣。这些机构正在寻求新的途径,通过更受监管的投资工具对加密货币进行投资。

As the cryptocurrency market continues to evolve, it will be interesting to see how institutional investors' preferences and strategies shape the industry landscape further.

随着加密货币市场的不断发展,有趣的是,看到机构投资者的偏好和策略如何进一步塑造了行业的格局。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 比特币的售价超过$ 90K,以太坊和山寨币现很出色的收益

- 2025-04-25 17:55:13

- 全球加密货币市场继续反映出看涨的情绪,比特币保持稳定的立场高于93,000美元。

-

- 分析师说

- 2025-04-25 17:55:13

- 一位广泛关注的加密分析师说,比特币(BTC)可能在看跌逆转之前向上行进程。

-

-

- SUI区块链的本地令牌SUI本周飙升了62%以上

- 2025-04-25 17:50:13

- SUI区块链的原住民令牌SUI本周飙升了62%以上,这是由于猜测与Pokémon的潜在合作所推动。

-

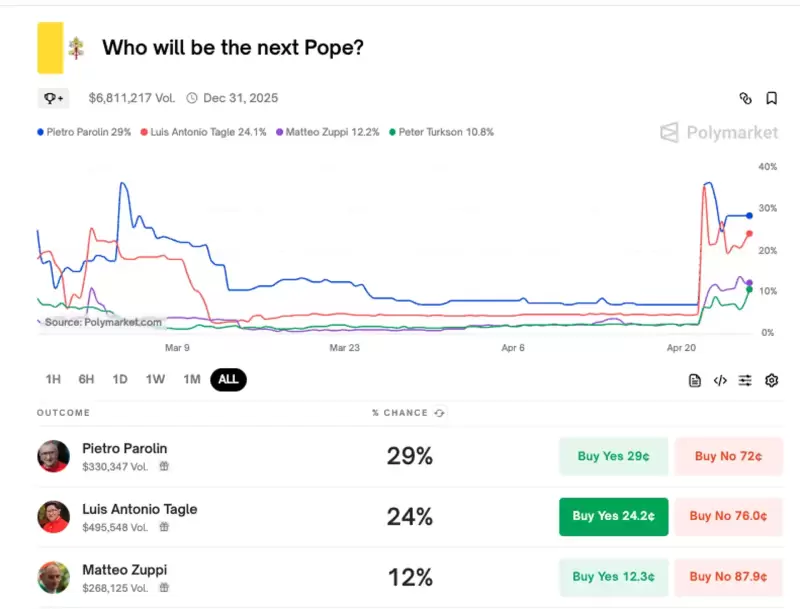

- 多聚市场捕获

- 2025-04-25 17:45:13

- 由于预计将在下个月举行的“结论”(教皇选举秘密会议)选举下一届教皇时,围绕教皇候选人主题的Meme Coins引起了人们的关注。

-

-

-

- DraftKings支付1000万美元以解决NFT证券集体诉讼

- 2025-04-25 17:40:13

- 流行的体育博彩和幻想体育公司Draftkings已同意达成1000万美元的和解,以解决集体诉讼

-